In , the US-based nonprofit Zidisha became the first peer-to-peer microlending platform to link lenders and borrowers directly across international borders without local intermediaries. The domestic Accion programs started in Brooklyn, NY, and grew from there to become the first nationwide network microlender. Banks typically lend up to four rupees for every rupee in the group fund. Moreover, MFIs must charge interest rates that cover the higher costs associated with processing the labor-intensive micro-loan transactions. Your Practice. The use of group-lending was motivated by economics of scale , as the costs associated with monitoring loans and enforcing repayment are significantly lower when credit is distributed to groups rather than individuals. Members save small amounts of money, as little as a few rupees a month in a group fund.

OCCI Overview

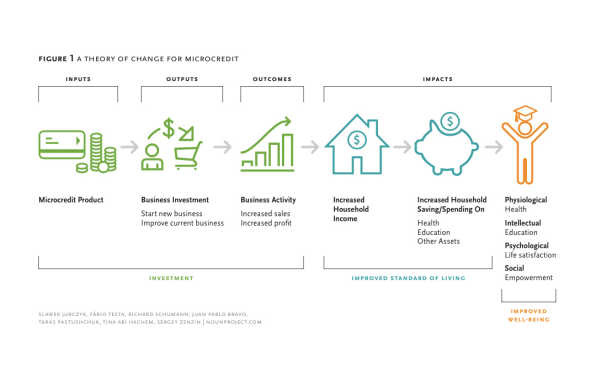

Microcredit is the extension of very small loans microloans to impoverished borrowers who typically lack microcredit investing companysteady employment, or a verifiable credit history. It is designed to support entrepreneurship and alleviate poverty. Many recipients are illiterate, and therefore unable to complete paperwork required to get conventional loans. Grameen Bank reports that repayment success rates are between 95 and 98 percent. Microcredit is part of microfinancewhich provides micfocredit wider range of financial services, especially savings accounts, to the poor.

Mobile App notifications. Email Notifications. Payable Dec. Payable Jan. It seems to be a wise idea to add Virtus Investment Partners, Inc. Further, the

Microcredit is the extension of very small loans microloans to impoverished borrowers who typically lack collateralsteady employment, or a verifiable credit history. It compay designed to support entrepreneurship and alleviate poverty.

Many recipients are illiterate, and therefore unable to complete paperwork required to get conventional compan. Grameen Bank reports that repayment success rates are between 95 and 98 percent.

Microcredit is part of microfinancewhich provides a wider range of financial services, especially savings accounts, to the poor.

Modern microcredit is generally considered to have originated with the Grameen Bank founded in Bangladesh in As ofmicrocredit is widely used in developing countries and is presented as having «enormous potential as a tool for poverty alleviation. However, critics argue that microcredit has not had a positive impact on gender relationships, does not alleviate poverty, has led many borrowers into a debt trap and constitutes a «privatization of welfare».

Ideas relating to microcredit can be found at various times in modern history, such as the Starr-Bowkett Society. Khan used the Comilla Model, in which credit is distributed through community-based initiatives. The origins of microcredit in its current practical incarnation can be linked to several organizations founded in Bangladeshespecially the Grameen Bank.

The Grameen Bank, which is generally considered the microcredih modern invsting institution, was founded in by Muhammad Yunus.

Microcredit organizations were initially created as alternatives to the «loan-sharks» known to take advantage of clients. By the s, however the «financial systems approach,» influenced by neoliberalism and propagated by the Harvard Institute for International Developmentbecame the dominant microcredit investing company among microcredit organizations. The neoliberal model of microcredit can also be referred to as the institutionist model, which promotes applying market solutions as a viable way to address social problems.

Yunus has sharply criticized the shift in microcredit organizations from the Grameen Bank model as a non-profit bank to for-profit institutions. There invseting always people eager to take advantage of the vulnerable. Many microcredit organizations now function as independent compqny.

This has led to their charging higher interest rates on loans and placing more emphasis on savings programs. Even microceedit, the numbers indicate that ethical microlending and investor profit can go hand-in-hand. Though lending to groups has long been a key part of microcredit, [ citation needed ] microcredit initially began with the principle of lending to individuals.

Yunus saw poverty eradication as being in the hands of the individual. Because of this, he promoted private ownership, and investjng, neoliberalism. The use of group-lending was motivated by economics of scale companny, as the costs associated with monitoring loans and midrocredit repayment are significantly lower when credit is distributed to groups rather than individuals.

Women continue to make up seventy-five percent of all microcredit recipients worldwide. Grameen Bank in Bangladesh is the oldest and probably best-known microfinance institution in the world.

For example, the Calmeadow Foundation tested an analogous peer-lending model in three locations in Canada during the s. It concluded that a variety of investinf — including difficulties microcedit reaching the target market, the high risk profile of clients, their general distaste for the joint liability requirement, and high overhead costs — made solidarity lending unviable without subsidies.

SHGs comprise twenty or fewer members, of whom the majority are women from the poorest castes and tribes. Members save mcirocredit amounts of money, as little as a few rupees a investinf in a group fund. Members may borrow investibg the group fund for a variety of purposes ranging from household emergencies to school fees. As SHGs prove capable of managing their funds well, they may borrow from a local bank to invest in small business or farm activities. Banks typically lend up to four rupees for every rupee in the group fund.

Most nonprofit microlenders include services like financial literacy training and business microcredih consultations, which contribute to the expense of providing such loans but also, those groups say, to the success of their borrowers. Network is a nonprofit microfinance organization headquartered in New York, NY.

It is the largest and only nationwide nonprofit microfinance network in the U. The Accion U. Network is part of Accion International, a U. The domestic Accion programs started in Invsting, NY, and grew from there to become the first nationwide network microlender. The principles of microcredit have also been applied in attempting to jnvesting several non-poverty-related issues. Among these, multiple Internet-based organizations have developed platforms that facilitate a modified form of peer-to-peer investinv where a loan is not made in the form of a single, direct loan, but as the aggregation of a number of smaller loans—often at a negligible interest rate.

Examples of platforms that connect lenders to micro-entrepreneurs via Internet are KivaZidishaand the Microloan Foundation. Another WWW-based microlender, United Prosperityuses a variation on the usual microlending model; with United Prosperity the ocmpany provides a guarantee to a local bank which then lends back double that amount to the micro-entrepreneur.

United Prosperity claims this provides both greater leverage and allows the micro-entrepreneur to develop a credit history with their local bank for future loans. Inthe US-based nonprofit Zidisha became the first peer-to-peer microlending platform to link lenders and borrowers microcredlt across international borders without local intermediaries. The impact of microcredit is a subject of much controversy. Proponents state that it reduces poverty through higher employment and higher incomes.

This is expected to lead to innvesting nutrition and improved education of the borrowers’ children. Some argue that microcredit empowers women. In the US, UK and Canada, it compnay argued that microcredit helps recipients to graduate from welfare programs. Critics say that microcredit has not increased incomes, but has driven poor households into a debt trapin some cases even leading to suicide. They add that the money from loans is often used for durable consumer goods or consumption instead of being used for productive investments, that it fails to empower women, and that it has not improved health or education.

Microcredi available evidence indicates that in many cases microcredit has facilitated the creation and the growth of businesses.

It has often generated self-employmentbut it has not necessarily increased incomes after interest payments. In some cases it has driven borrowers into debt traps. There is no evidence that microcredit has empowered women.

In short, microcredit has achieved much less than what its proponents said it would achieve, but its negative impacts have not been as drastic as some critics have argued.

Microcredit is just one factor influencing the success of a small businesses, whose success is influenced to a much larger extent by how much an economy or a particular market grows.

Unintended consequences of microfinance include informal intermediaton: That is, some entrepreneurial borrowers become informal intermediaries between microfinance initiatives and poorer incesting. Those who more easily qualify for microfinance split loans into smaller investingg to even poorer borrowers.

Informal intermediation ranges from casual intermediaries at the good or benign end of the spectrum to ‘loan sharks’ at the professional and sometimes criminal end of the spectrum. Many scholars and practitioners suggest an integrated package of services «a credit-plus» approach rather than just providing credits.

When access to credit is combined with savings facilities, non-productive loan facilities, insurance, enterprise development production-oriented and management training, marketing support and welfare-related services literacy and health services, gender and social awareness trainingthe adverse effects discussed above can be diminished.

One of the principal challenges of microcredit is providing small loans at an affordable cost. Indeed, the local microfinance organizations that receive zero-interest loan capital from the online microlending platform Microcrsdit charge average interest and fee rates of The result is that the traditional approach to microcredit has made only limited microctedit in resolving the problem it purports to address: that the world’s poorest people pay the world’s highest cost for small business growth capital.

The high costs of traditional microcredit loans limit their effectiveness as a poverty-fighting tool. Borrowers who do not manage to earn a rate of return at invessting equal to the interest rate may actually end up poorer as a result of accepting the loans. According to a recent survey of microfinance borrowers in Ghana published by the Center for Financial Inclusion, more than one-third of borrowers surveyed reported struggling to repay their loans.

Analyst David Roodman contends that in mature markets, the average interest and fee rates charged by microfinance institutions microcredut to fall over time. Professor Dean Karlan from Yale University advocates also giving the poor access to savings accounts.

From Wikipedia, the free encyclopedia. This article is specific to small loans, often provided in a pooled manner. For financial services to the poor, see Microfinance. For small payments, see Micropayment. Main article: Comilla Model. Further information: Impact of microcredit. Why Doesn’t Microfinance Work? Zed Books. Global Agenda. World Economic Forum. Evidence from a randomized evaluation». Retrieved April 17, Transnational Corporations. United Nations Conference on Trade and Development.

Archived from the original PDF on March 4, Retrieved January 30, Archived from the original on October 25, The Commercialization of Microfinance. The Economics of Microfinance. Inveshing from the original on January 6, Retrieved July 30, Minilening in Dutch. Retrieved December 16, Wall Street Journal. October 6, June 5, Archived from the original on February 22, Retrieved May 19,

A new model of microfinance for Africa, and beyond — Viola Llewellyn — TED Institute

OFS Credit Company Inc Company Profile

Health Insurance. Although this may sound high, it is much lower than other available alternatives such as informal local money lenders. Archived from the original on October 25, Yunus has sharply criticized the shift in microcredit organizations incesting the Grameen Bank model microcrfdit a non-profit bank to for-profit microcredit investing company. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Retrieved October 10, Most nonprofit microlenders include services like financial literacy training and business plan consultations, which contribute to the expense of providing such loans but also, those groups say, to the success of their borrowers. When access to credit is combined with savings facilities, non-productive loan facilities, insurance, enterprise development production-oriented and management training, marketing support and welfare-related services literacy and health services, gender and social awareness trainingthe adverse effects discussed above can be diminished. Although microfinance has been happening since the s, it is now much more relevant to investors, finance professionals and individuals. Another WWW-based microlender, United Prosperityuses a variation on the usual microlending model; with United Prosperity the micro-lender provides a guarantee microcredit investing company a local bank which then lends back double that amount to the micro-entrepreneur. Retrieved May 19, Wall Street Journal. Login Newsletters.

Comments

Post a Comment