This assumption means that all securities are valued correctly and that their returns will plot on to the SML. Another limitation is that investors do not seem to follow the postulation of CAPM although this does not invalidate the theory as such. A holding period of one year is usually used.

The following points highlight the top seven investment appraisal techniques. The techniques are: 1. Payback Period Method 2. Accounting Rate of Return Method 3. Net Present Value Method 4.

Cigarette companies have for years looked for the Holy Grail of a smokeless cigarette. Reynolds Tobacco, US maker of Camel and other cigarette brands, launched a smokeless cigarette called Premier. After test marketing it for several months, the company finally recognised that it had created one of the biggest new product flops on record. With brands. But the idea of a smokeless cigarette was still seen by the company as worth pursuing and it began trials on a new smokeless cigarette brand, Eclipse that heats, rather than burns, tobacco.

Cigarette companies have for years looked for the Holy Grail of a smokeless cigarette. Reynolds Tobacco, US maker of Camel and other cigarette brands, launched a smokeless cigarette called Premier. After test marketing it for several months, the company finally recognised that it had created one of the biggest new product flops on record.

With brands. But the idea of a smokeless cigarette was still seen by the company as worth pursuing and it began trials on a new smokeless cigarette brand, Eclipse that heats, rather than burns, tobacco. Since the earlier flop, however, the market has changed, with passive smoking becoming a bigger issue.

Time will tell whether the Eclipse cigarette brand is launched successfully and generates a positive net present value. Having read this chapter, you should have a good grasp of the investment appraisal techniques commonly employed in business, and have developed skills in applying. Particular attention will be devoted to the following:.

We saw in Chapters 3 and 4 how investing in capital projects that offer positive net present values creates additional wealth for the business and its owners. A major company explains how it employs the NPV approach in assessing capital projects:. We measure all potential projects by their cash flow merit. There are, however, a number of alternative techniques to the NPV method. The aim of this chapter is to present the main methods of investment appraisal and to consider their strengths and limitations.

In a later chapter, we consider their practical application in business, large and small. Confusingly, the same term is often applied to both real investment, such as buildings and equipment, and financial investment, such as investment in shares and other securities.

While the principles underlying investment analysis are basically the same for both types of investment, it is helpful for us to concentrate here on the former category, usually referred to as capital investment. Investment projects do not only include investment in plant and equipment or buildings. Managers in business usually view profit as the best measure of performance. Indeed, many firms do use such an approach.

There are, however, many problems with the profit measure for assessing future investment performance. Profit is based on accounting concepts of income and expenses relating to a particular accounting period, based on the matching principle. This means that income receivable and expenses payable, but not yet received or paid, along with depreciation charges, form part of the profit calculation.

While this decision has no impact on the reported profit, it certainly affects the cash position — no cash flow being received for two years. Cash flow analysis considers all the cash inflows and outflows resulting from the investment decision.

Non-cash flows, such as depreciation charges and other accounting policy adjustments, are not relevant to the decision. We seek to estimate the stream of cash flows arising from a particular course of action and the period in which they occur. Project cash flows will usually arrive throughout the year. For example, if we acquire a machine with a four-year life on 1 Januarythe subsequent cash flows related to it may involve the monthly payment purchases and expenses and daily receipt of cash from customers throughout each year.

Strictly speaking, these cash flows should be identified on a monthly, even daily, basis and discounted using appropriate discount factors. In practice, to facilitate the use of annual discount tables, cash flows arising during the year are treated as occurring at the year end. Thus, while the initial outlay is assumed to occur at the start of the project frequently termed Year 0subsequent cash flows are deemed to arrive later than they actually arise. This has the effect of producing an NPV slightly lower than the true NPV, assuming that subsequent cash flows are positive.

Decision-making can be viewed as an incremental activity. Businesses generally operate as going concerns with fairly clear strategies and well-established management processes. Decisions are part of a sequence of actions seeking to move the organisation from its current to its intended position.

The same idea is apparent in analysing projects — the decision-maker must assess how the business changes as a direct result limitations of using capm in investment appraisal selecting the project. Every project can be either accepted or rejected, and it is the difference between these two alternatives in any time period, texpressed in cash flow terms CF tthat is taken into the appraisal.

Many managers prefer to use non-discounting approaches such as the payback and return on capital methods; others use both approaches. The following example illustrates the various approaches to investment appraisal. Sportsman plc is a manufacturer of sports equipment.

The firm is considering whether to invest in one of two automated processes, the Lara or the Carling, both of which give rise to staffing and other cost savings over the existing process. The relevant data relating to each are given below:. The investment outlays are obviously additional cash outflows, while the annual cost savings are cash flow benefits because total annual expenditures are reduced as a result of the investment.

Should the company invest in either of the two proposals and if so, which is preferable? The net present value for the Lara machine is found by multiplying the limitations of using capm in investment appraisal cash flows by the present-value interest factor PVIF at 14 per cent using the tables and finding the total, as shown in Table 5.

An immediate cash outlay treated as Year 0 is not discounted as it is already expressed in present value terms. The same factors could be applied to evaluate the Carling proposal.

However, as the annual savings are constant, it is far simpler to use the present value interest factor for an annuity PVIFA at 14 per cent for four years. Learning objectives Having read this chapter, you should have a good grasp of the investment appraisal techniques commonly employed in business, and have developed skills in applying .

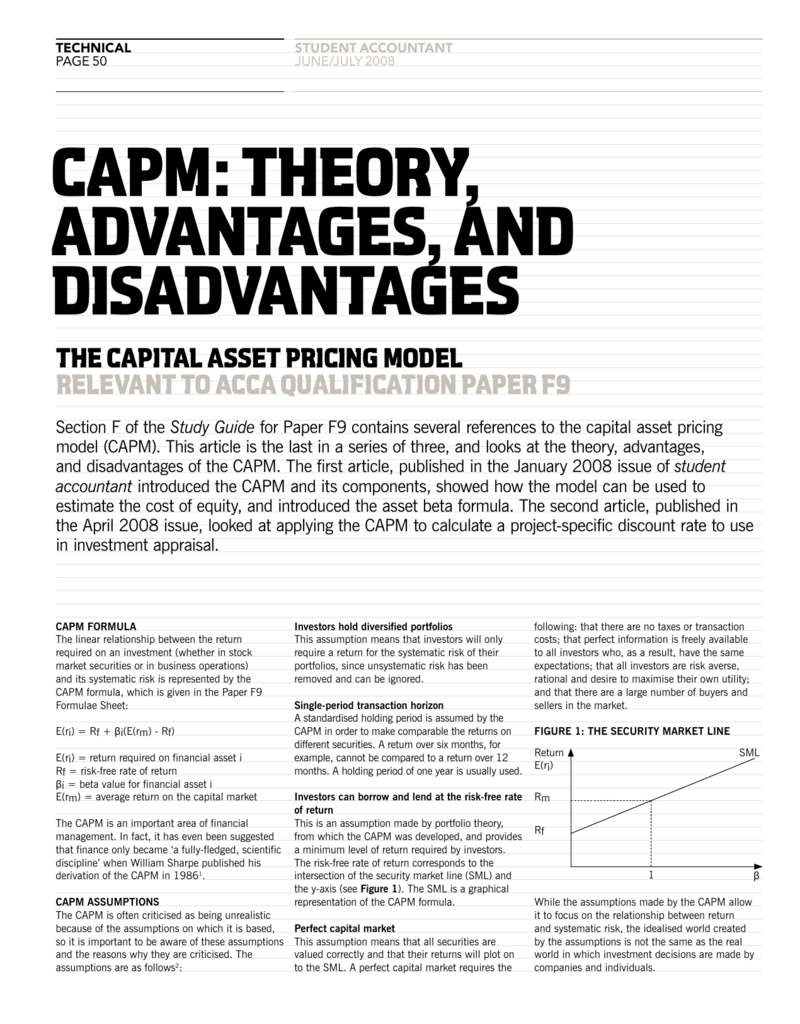

One should ask, what determines the prices? Then the investmsnt of buying underpriced shares and limitations of using capm in investment appraisal overpriced shares is adopted by the investor. If the business risk of the investment project is different to that of the investing organisation, the CAPM can be used to calculate a project-specific discount rate. The problem here is that uncertainty arises in the value of the expected return because the value of beta is not constant, but changes over time. Another limitation is that investors do not seem to follow the postulation of CAPM although this does not invalidate the theory as. There are numerous advantages to the application of the CAPM, including:. This article is the final one in a series of three, and looks at the theory, advantages, and disadvantages of the CAPM. Historical evidence of the tests of Betas showed that they are unstable and that they are not good estimates of future risk. Within the opportunity set, are all individual securities as well as portfolios. For a scientific basis for investment, the investjent or investor has to make a rational analysis of the market and the scrips in which he would like to invest. If all the investors hold the same risky portfolio, then in equilibrium, it must be the market portfolio.

Comments

Post a Comment