When you take this football analogy and apply it to investing, you look at the entire market of available stocks. All opinions are subject to change without notice. Why does an active approach cost more? The offers that appear in this table are from partnerships from which Investopedia receives compensation. It would be like owning the NFL; not every team is going to win, but you don’t care because you know some merchandise is bound to be sold each year. Most of the time the active vs. Additionally, at least on a superficial level, passive investments have made more money historically.

“Active” Advantages

Active investing is like betting on who will win the Super Bowl, while passive investing would be like owning the entire NFL, and thus collecting profits on the gross ticket and merchandise sales, regardless of which team wins each year. Using the NFL analogy, you would study all the players and coaches, go to preseason training, and based on your research make an educated bet as to which teams would be on top for the year. Would you be willing to bet your money on your ability to choose correctly? An active investor or active strategy is doing just. With a passive investment approach, you would buy index funds and own the entire spectrum of available passive investing vs active investment and bonds.

Ready to invest in what matters to you?

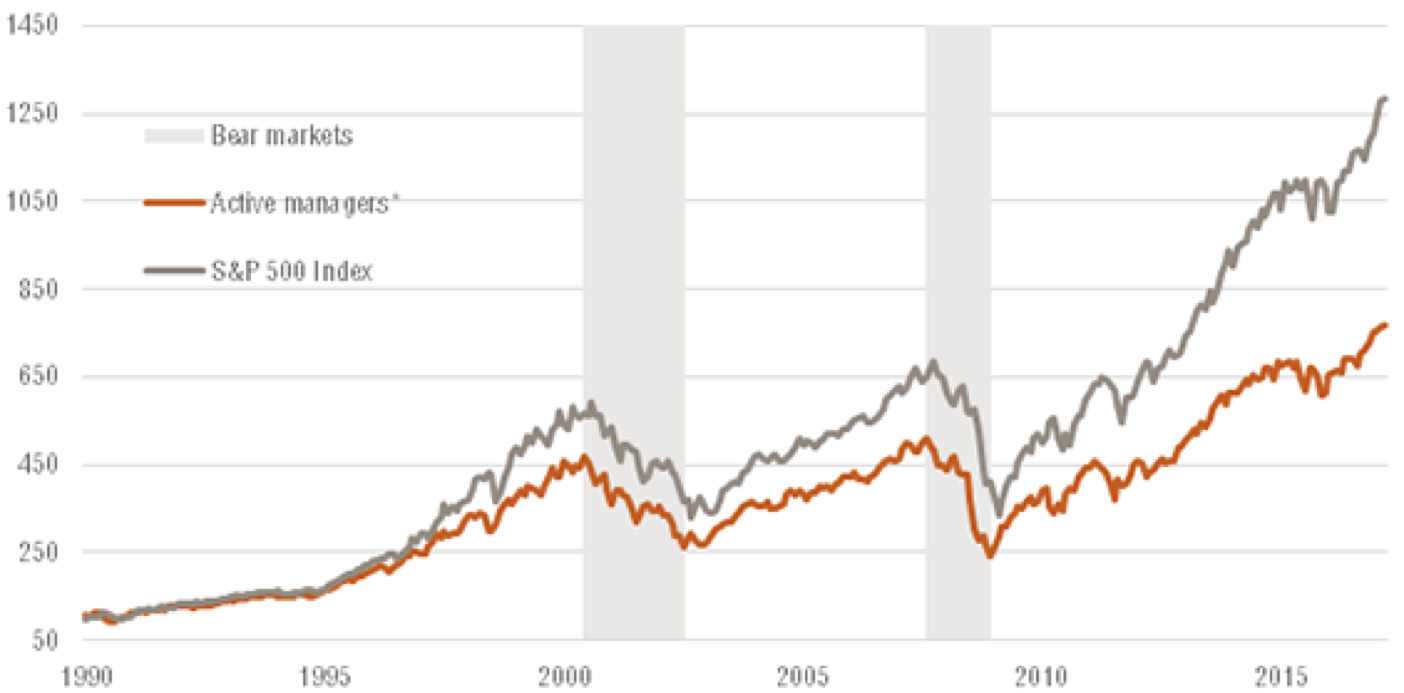

Your goal would be to match the performance of certain market indexes rather than trying to outperform them. Passive managers simply seek to own all the stocks in a given market index, in the proportion they are held in that index. Because active investing is generally more expensive you need to pay research analysts and portfolio managers, as well as additional costs due to more frequent trading , many active managers fail to beat the index after accounting for expenses—in those cases, passive investing has typically outperformed because of its lower fees. That depends who you ask. While passive investing has grown in popularity over the last few years, Morgan Stanley Wealth Management has found that in many cases active management may help investors improve their risk-adjusted returns. Active strategies have tended to benefit investors more in certain investing climates, and passive strategies have tended to outperform in others. Generally, when the market is volatile, active managers may outperform more often than when it is not.

We’ve detected unusual activity from your computer network

Thought Leadership. In the past couple of decades, index-style investing has become the strategy of choice for millions of investors who are satisfied by duplicating market returns instead of trying to beat.

But does active investing become more appealing for high net worth investors, who have opportunities that small investors do not? Wharton faculty members with in-depth knowledge of portfolio management explore topics including:. While actively managed assets can play an important role in a diverse portfolio, Wharton faculty involved in the program say that even large investors often do best using passive investments for the bulk of their holdings.

Active investing, they say, can nonetheless be useful with certain portions of the portfolio, such as those invested in illiquid or little known securities, or holdings tailored to a specific purpose such as minimizing losses in a down market. Even for wealthy investors, passive holdings have a strong appeal, says Christopher C. Geczy, Wharton adjunct professor of finance and academic director of the Wharton Wealth Management Initiative. Some of the most successful entrepreneurs I know think about costs.

A vast array of indexed mutual funds and exchange-traded funds track the broad market as well as narrower sectors such as small-company stocks, foreign stocks and bonds, and stocks in specific industries. Actively managed investments charge larger fees to pay for the extensive research and analysis required to beat index returns. But although many managers succeed in this goal each year, few are able to beat the markets consistently, Wharton faculty members say.

Many index-style mutual funds and exchange-traded funds charge less than 0. Active management includes mutual funds and exchange-traded funds, as well as portfolios of stocks, bonds and other holdings managed by financial advisers. Among the benefits they see:. Wharton finance professor Jeremy Siegel is a strong believer in passive investing, but he recognizes that high-net-worth investors do have access to advisers with stronger track records.

In that case, a management fee is not as burdensome. How does the investor find a top-quality adviser? As a rule of thumb, says Siegel, a manager must produce 10 years of market-beating performance to make a convincing case for skill over luck.

The choice between active and passive investing can also hinge on the type of investments one chooses. Passive management generally works best for easily traded, well-known holdings like stocks in large U. But in certain niche markets, he adds, like emerging-market and passive investing vs active investment stocks, where assets are less liquid and fewer people are watching, it is possible for an active manager to spot diamonds in the rough. Participants in the Investment Strategies and Portfolio Management program get a deep exposure to active and passive strategies, and how to combine passive investing vs active investment for the best results.

Active vs. Wharton faculty members with in-depth knowledge of portfolio management explore topics including: Modern portfolio theory Behavioral finance Passive and active vehicles Performance measurement Use of alternative investments such as hedge funds, derivatives, and real estate While actively managed assets can play an important role in a diverse portfolio, Wharton faculty involved in the program say that even large investors often do best using passive investments for the bulk of their holdings.

Among the benefits they see: Flexibility — because active managers, unlike passive ones, are not required to hold specific stocks or bonds Hedging — the ability to use short sales, put options, and other strategies to insure against losses Risk management — the ability to get out of specific holdings or market sectors when risks get too large Tax management — including strategies tailored to the individual investor, like selling money-losing investments to offset taxes on winners.

Selection Strategies The choice between active and passive investing can also hinge on the type of investments one chooses.

Ready to invest in what matters to you?

There is acctive guarantee that past performance or information relating to return, volatility, style reliability and other attributes will be predictive of future results. Active risk: Active managers are free to buy any investment they think would bring high investung, which is great when the analysts are right but terrible when they’re wrong. Morgan Stanley Wealth Management is not acting as a fiduciary under either the Employee Retirement Income Security Act ofas amended or under section of the Internal Revenue Code of as amended in providing this material. Popular Courses. Login Newsletters. Would you be willing to bet your money on your ability to choose correctly? While passive funds still dominate overall, due to lower fees, investors are showing that they’re willing to put up with the higher fees in exchange for the expertise of an active manager to help guide them amid all the volatility. Asset Class Risk Considerations International investing entails greater risk, as well as greater potential rewards compared to U.

Comments

Post a Comment