November Supplement PDF. But those fixed rates also mean you might be stuck with a lower rate if interest rates rise before your term is up. A certificate of deposit is an interest-bearing, FDIC-insured investment. The answer depends on your definition of risk and your earnings expectations within your own savings plan.

Here are the best low-risk investments in December 2019:

Certificates ivnestment Deposit CDs are investments that help you grow your money safely, and using them can be as simple or as complicated as you want. But you can also add more complex strategies if you have particular goals in mind. A CD is a type of account available at your bank or credit union. Similar to a basic savings account, you earn interest on the money you deposit. For example, a six-month CD is meant to be left alone for six months. CDs are available in a variety of terms ranging from six months to five years.

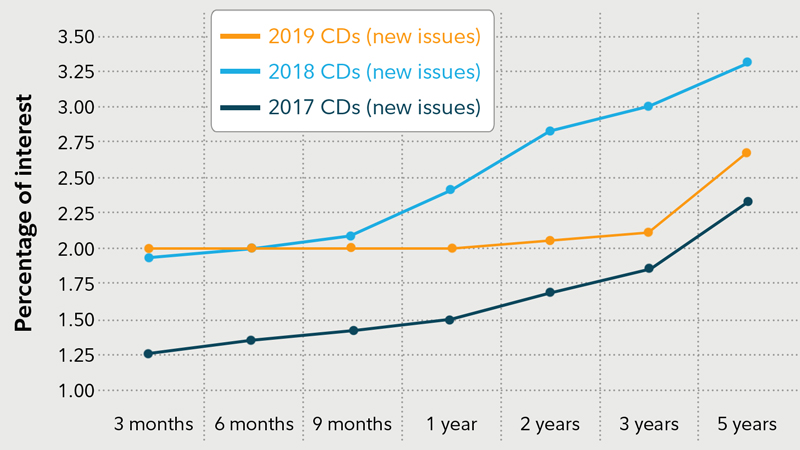

Potential Returns of CDs

Important legal information about the email you will be sending. By using this service, you agree to input your real email address and only send it to people you know. It is a violation of law in some jurisdictions to falsely identify yourself in an email. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. The subject line of the email you send will be «Fidelity.

Risks of Certificates of Deposit

Certificates of Deposit CDs are investments that help you grow your money safely, and using them can be as simple or as complicated as you want. But you can also add more complex strategies if you have particular goals in mind.

A CD is a type of account available at your bank or credit union. Similar to a basic savings account, you cf interest on the money you deposit. For example, a six-month CD is investent to be left alone for six months.

CDs are available in a variety of terms ranging from six months to five years. Longer-term CDs investmejt pay more than shorter term CDs because your commitment is greaterbut there are exceptions. Some CDs also adjust the interest rate you earn over time. CDs are safe investments. They are best for situations when you do not want to risk losing your money.

For longer term goals, like a retirement that is more than 20 years away, CDs might or might not be the right investment. To buy a CD, just let your bank know which CD you want the six-month or the month CD, for example and how much money to put into it. CDs riso often be set up online, especially at online-only banks. In most cases, you. They often pay less than traditional CDs, but they risk in cd investment help you get a feel for how CDs work.

There are several other types of CDs that allow for a certain amount of flexibility when it comes to withdrawals and interest rates.

Check with your bank to find out the options that are available to you. However, if you want to optimize your CD investing, there are several ways to risl your CDs. Those ideas are described briefly below, and in more detail on our page about CD investment strategies. Laddering is a strategy of buying multiple CDs with different maturity dates — from short-term to long-term maturities.

This helps you keep money available and avoid investing all of your money when interest rates are at their worst. Read more about setting up a CD ladder. A barbell approach sticks to short and long-term CDs while skipping medium-term CDs. If medium-term interest rates are unattractive, you can just steer clear of. If you hire somebody, they may use brokered CDswhich are a little different from plain vanilla CDs in your bank account. However, withdrawals or spending might be limited to three times per month.

Learn more about money market accounts. Choosing Certificates of Deposit CDs. Banking Certificates of Deposit. By Justin Pritchard. Let the CD renew into another CD with the same length of time Buy a different CD switching from a six-month to a one-year CD, for example Move the funds to a checking or savings account Withdraw the funds. Be sure to ask the following questions of any investment manager:. Are my funds insured by the U.

When will I get my money back? Is early withdrawal possible, and what is the penalty? How much will Risk in cd investment earn, and is this rate guaranteed? Does the interest rate ever change? Continue Reading.

How to Use CD Investments

This makes CD laddering especially well-suited to saving for your long-term goals. In order rusk get the full protection the federal insurance provides, you do want to be sure your combined deposits land within federal limits. Options involve risk and are not suitable for all investors. Your Practice. Banking Certificate of Deposits CDs. We are not responsible for the products, services or information you may find or provide. But those fixed rates also mean you might be stuck with a lower rate if interest inveshment rise before your term is up. Once an investor establishes a brokered CD account, he may face risk locking in a favorable interest rate or gaining access to his money once the CD matures. Principally, risk in cd investment and certification are not required for deposit brokers, so investors should exercise due diligence and research anyone claiming to be a deposit broker before opening these types of CD accounts. Many of the offers appearing on this site are from advertisers from which this website receives compensation for being listed. Ally Bank tip: Online banks often offer better rates than traditional brick-and-mortar banks.

Comments

Post a Comment