Here are a few ways you can address common concerns and increase plan participation rates. Equity participation is used in many investments for two primary reasons. LinkedIn Twitter. We know how crucial it is to the overall success of the plan — particularly to the highly compensated employee group.

Trending Stories

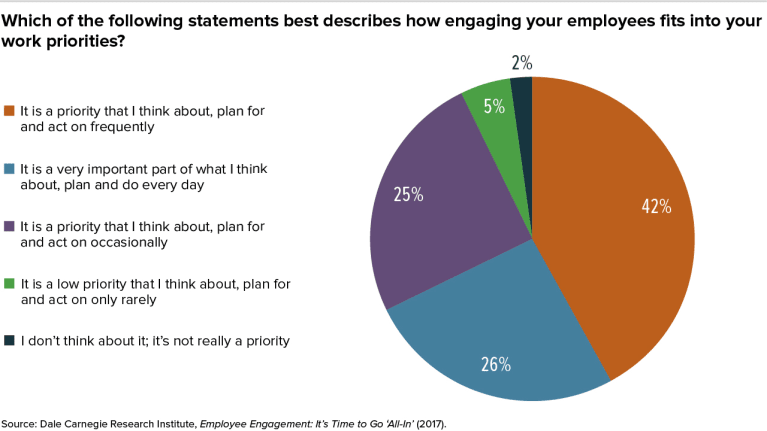

Facebook Twitter LinkedIn Email. Get alerted any time new manageg match your search criteria. Create an alert to follow a developing story, keep current on a competitor, or monitor industry news. Overwrite Existing Alert:. Sign In. A major challenge of human resources managers is to build awareness of and engagement with an employer’s benefit offerings.

Fiduciary Best Practices

An employee contribution plan is an employer-sponsored savings plan where employees elect to save a portion of each paycheck in an investment account. Employee contribution plans are subject to annual contribution limits imposed by the federal government, but often have tax benefits such as deferred taxes on investment gains and the ability to contribute pre-tax income. Some companies match employee contributions up to a specified limit, but the employee may not own the entire matching contribution until it fully vests after several years of continued employment. Employee contribution plans in the United States include defined contribution plans such as the k , the b , employee stock ownership plans ESOP , and profit-sharing plans. Types of k plans include: traditional k the most popular ; safe harbor k ; SIMPLE k and automatic enrollment k. Unlike a defined benefit plan , where the employer pays the employee a predetermined amount of benefits during retirement, a defined contribution plan’s payout is based on how much money the employee contributes, whether the employer matches a percentage of those contributions, how the employee chooses to invest the money in that plan and how those investments perform over time.

RTD Managed Portfolios

Facebook Twitter LinkedIn Email. Get alerted any time new stories match your search criteria. Create an alert to follow a developing story, keep current on a competitor, or monitor industry news. Overwrite Existing Alert:. Sign In. A major challenge of human resources managers is to build awareness of and engagement with an employer’s benefit offerings. This includes strategies and tips to drive employee elections in core and voluntary offerings during the open enrollment period, as well as ongoing promotion and utilization of benefits throughout the year.

Topics also include overall employee engagement in the workplace Best Practices. Jim Blachek. Market Insights. Marlene Satter. A Gallup report suggests that as many as 28 percent of U. Craig Keohan. Expert Opinion. Daniel Kotzen. We need to pay careful attention to how organizational structures, workplace behaviors, productivity and health relate to each. Aaron E. The retirement industry must keep pushing for automated solutions that are personalized to savers’ needs and relieve the burden of decision-making.

Melissa Arronte. Despite a growing set of tools and technology, many organizations have not evolved their employee listening. Katie Kuehner-Hebert. The top strategic challenge for HR professionals? Not surprisingly, recruiting and hiring. Workers spend an average of 5. Matt Jackson. Bah, humbug? Almost half of Americans in a recent survey would prefer to skip Christmas entirely because it brings too much financial pressure and stress. Byhalf of U.

Benefits trends: What will work for The mega-backdoor Roth IRA and other ways to maximize a k. Too sick to work? Best to know your rights. Discover how a focused financial wellness program can benefit both you and your employees. Lead a successful open enrollment with effective preparation, strategy, and execution.

Unexpected health changes can cause major bumps on the road of life. Find out how you can help clients and their employees navigate through the hazardous areas. Get data and insights that help guide employers to build a better workplace through better benchmarking. Consumers are willing to use telehealth, but your clients need help tailoring services for specific employee group needs.

Discover. To get through your busy season, you need proven strategies that help you score with your clients. Do you understand what your employees expect from you? Get details on how they feel about retirement. Use this case study to show clients how they can provide employees high-quality, reputable telehealth care. When you understand your personal consulting style, you can realize your full potential and better serve clients. Show clients of all sizes why health clinics may be the right choice for them in their efforts to control health costs.

As employers look for ways to control benefits costs without passing on the expenses to employees, you can provide them with a fresh approach. When you hit the ball just right, you connect with the sweet spot. Your clients need new tactics to help them combat the continual climb of healthcare expenses. Use this infographic to show them a better way. Plan changes are quite common in the employee benefits world, but you can help ease the pain for your clients and their employees.

Help clients solve business problems with carve-out supplemental expense reimbursed insurance. All Rights Reserved. Menu Search. Previous Issues. Benefits Leads k Leads. Thank you for sharing! Your article was successfully shared with the contacts you provided. Thank You! Employee Participation. Expert Opinion Rethinking health and productivity for the 21st century workplace Daniel Kotzen We need to pay careful attention to how organizational structures, workplace behaviors, productivity and health relate to each.

Commentary Overcoming participant inertia: k automation is still the answer Aaron E. Tabela The retirement industry must keep pushing for automated solutions that are personalized to savers’ needs and relieve the burden of decision-making.

Expert Opinion Where traditional employee surveys are falling short Melissa Arronte Despite a growing set of tools and technology, many organizations have not evolved their employee listening.

Market Insights What challenges will HR face in ? Analysis Don’t let vision problems impact employee productivity Katie Kuehner-Hebert Workers spend an average of 5. Trending Stories 11 affordable small towns for retirement abroad. In the game of life From ArmadaCare Unexpected health changes can cause major bumps on the road of life.

Telehealth Index: Consumer Survey From American Well Consumers are willing to use telehealth, but your clients need help tailoring services for specific employee group needs. Broker’s Playbook: 4 Plays for the Busy Season From ArmadaCare To get through your busy season, you employee participation plan investment manager proven strategies that help you score with your clients. What Type of Broker Are You?

Take the Quiz From ArmadaCare When you understand your personal consulting style, you can realize your full potential and better serve clients. Plan Change Shock Absorber From ArmadaCare Plan changes are quite common in the employee benefits world, but you can help ease the pain for your clients and their employees. Join BenefitsPRO. Unlimited access to BenefitsPRO. Already have an account?

Sign In Now. Follow Us On. Terms of Service Privacy Policy.

Employee Participation Plans on Ledgy

UniCredit Bank Austria offers companies extensive services regarding employee participation initiatives.

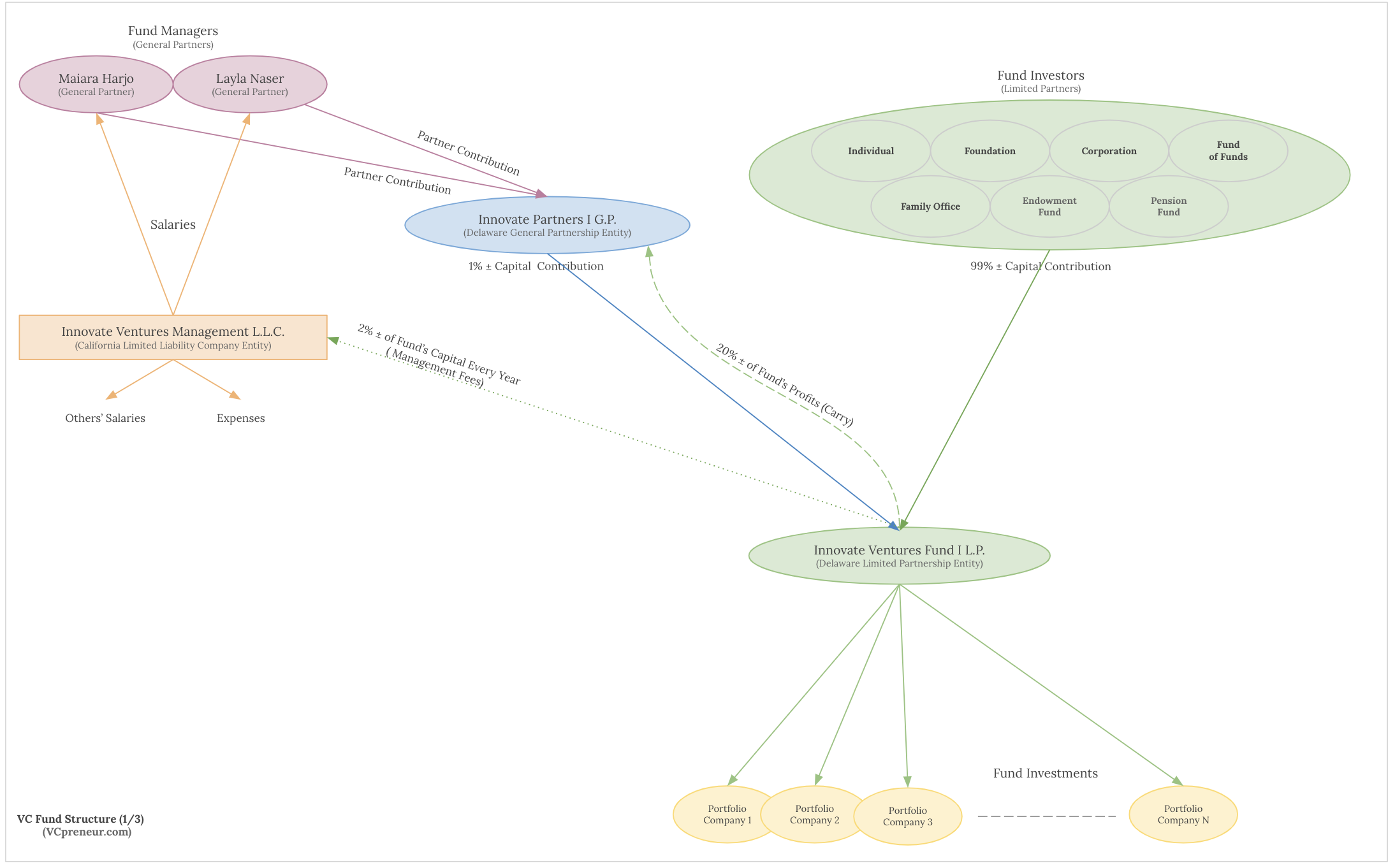

What Is Equity Participation? Phantom Stock Plan Definition A phantom stock plan is an employee benefit plan that gives select employees many benefits of stock ownership without giving them any company stock. Companies can use employee participation plan investment manager types of equity to create an equity participation program, such as options, reserve, phantoms stock, preferred stock, or common stock. Furthermore, companies that use personalized statements to inform employees about their k plan have an average six percent higher participation rate compared with those that don’t. This includes enrollment materials and other forms of communications. To often generic material and we just hope they get the message. As with executives who receive equity, the intent is to encourage employees to contribute their best efforts toward the long-term growth and prosperity of the organization. Login Newsletters. We have an established and comprehensive benchmarking process that monitors and evaluates every component of your plan so that you continue to meet your fiduciary obligations and your employees can prepare for a better retirement. Discover Plan Live. Home Insurance. The survey also shows that employers that communicate at least quarterly on such issues as the principles of the time value of money have a four percent higher employee participation rate than companies that communicate this information less frequently. Stock Appreciation Right SAR Definition A stock appreciation right, or SAR, is a bonus given to an employee that is equivalent to the appreciation of company stock over a specified period. Residents of a municipality might also be offered equity stakes in the development or employee participation plan investment manager of their hometown.

Comments

Post a Comment