Profit We expect positive risk-adjusted financial returns from all of our investments, without compromising on tangible social or environmental impact. When investing has an Impact. Are you a social entrepreneur with a revenue-earning enterprise? If selected, fund managers from Kenya and other emerging markets will have the opportunity to work directly with the Capria team on all aspects of fund management over a multi-year engagement process.

The Savannah Fruits Company

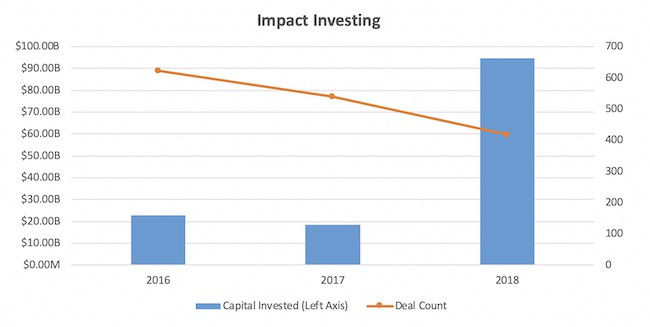

Investors around the world are making impact investments to unleash the power of capital for good. Continue reading to learn about the core characteristics of impact investing, who is making impact investments, the results these investments can achieve, and. A version of this primer, answering many of the most frequently asked questions about impact investing, is available for download as. Share it with a friend or on social media. Impact investments are investments made with the intention to generate positive, measurable social and environmental impact alongside a financial return. Impact investments can be made in both emerging and developed markets, and target a range of returns from below market to market rate, depending on investors’ strategic goals.

Kenya tops EAC bloc in impact investments

Prices are rising as a result of a growing population and emerging middle classes requiring an adequate supply of food and industrial commodities. This, in turn, has led to increased private equity investment in agri-businesses and large-scale acquisitions of farmland. Impact investment, another recent trend, tries to address this issue. Impact investment funds aim to balance profit incentives with social and environmental sustainability as a primary condition for investment. In the Common Fund for Commodities CFC started to participate in impact investment related to agricultural commodities, recognizing the impact they potentially carry on communities and value chains. Although still representing only a modest share of its activities compared to its regular project financing mechanisms grants and loans of commodity projects, the CFC s participation in impact investment funds is growing.

Capria Network Members

Prices are rising as a result of a growing population and emerging middle classes requiring an adequate supply of food and industrial commodities.

This, in turn, has led to increased private equity investment in agri-businesses and large-scale acquisitions of farmland. Impact investment, another recent trend, tries to address this issue.

Impact investment funds aim to balance profit incentives with social and environmental sustainability as a primary condition for investment. In the Common Fund for Commodities CFC started to participate in impact investment related to agricultural commodities, recognizing the impact they potentially carry on communities and value chains.

Although still representing only a modest share of its activities compared to its regular project financing mechanisms grants and loans of commodity projects, the CFC s participation in impact investment funds is growing. Currently CFC is contributing to five cutting-edge investment funds featured in Table 2.

Added value CFC to impact investment funds The added value of the CFC to the funds in which it participates, goes far beyond its financial contribution. In the first place it contributes through the vast body knowledge of and experience in agriculture, commodity development and the Impact at scale through investment funds 1. Time and time again evidence shows that companies which dedicate themselves to investing in local communities and aim for long-term relationships, easily outperform those who do not.

These facilities contribute to reaching scale with small-scale farmers and communities and to mitigate capacity gaps. This can involve setting up improved training programmes for farming communities composed of extension and business development services as well as organizing farmers and improving farm-firm relations. Although sometimes only a small stakeholder compared to other co-investors in the fund, due to its expertise and experience, the CFC actually has leverage to contribute significantly to the investment funds through advice and feedback.

Indeed, perhaps more than one might suspect based on its financial contribution. In fact, although sometimes only a small stakeholder compared to other co-investors in the fund, due to its expertise and experience the CFC actually has leverage to contribute significantly to these investment funds through advice and feedback. Furthermore CFC has established an impressive and farreaching network in the past 25 years which is useful for tracking investment opportunities as well as specialists ranging from agronomical to organizational suited for specific tasks when needed.

Textbox 1 — Moringa Agroforestry Fund Moringa is a sustainable agroforestry investment fund which has already raised in excess of 50 million. Moringa invests between 4 and 10min in businesses located in Latin America and Sub-Saharan Africa using equity and quasi-equity instruments. With the fund only established as of recent, no deals have been finalized as of.

Moringa has reviewed over potential investment opportunities to date and the first transactions will be closed by the end of the year. The fund aligns itself with different certifications Rainforest alliance for cocoa and coffee and FSC for timber. Moringa has developed its own methodology to carry out evaluation which relies on quantitative methods to measure the environmental and social impact of the companies it invests in. It will contract external parties to review the performance of partners.

Some indicators for measure environmental impact are the following: rehabilitation of degraded land, soil fertility, climate change mitigation and adaptation, biodiversity, etc For social impact: number of small holders engaged through outgrower scheme, income increase, productivity increase, fair benefit sharing.

CFC is developing a technical assistance facility jointly with Moringa, with a projected size of million. This facility will be based on a grant based mechanism, as applicants will contribute themselves, or indirectly through other funds, as. Added value of impact investment to CFC and its mandate For the CFC the benefits are clear as well since impact investment, if conducted in the right manner, contributes to its mission to realize the potential of commodity production, processing, manufacturing, and trade for the benefit of the poor.

The CFC realized its leverage and influence would be substantive within the funds, while the fund allocates considerable amounts of financial and other forms of resources at promising businesses. These effects will be augmented by the investment capital. This experience is useful to properly asses the prospect of investments in promising companies, also in its regular grant and loan disbursement procedures. Finally, as a result of all this engagement, the CFC is extending its already large network even further by expanding into these new branches finance, private equity investment, banking.

The fund is specialized in providing expansion capital to sustainable businesses involved in agro-forestry, ecotourism and organic agriculture. It was launched in and invested in 23 sustainable businesses in 10 countries in Latin America. The fund was a pioneer of the concept of sustainable impact investment. The fund created over 3, jobs and generated a total of USD million in sales.

At the end ofEcoEnterprises Fund s second fund under management EcoEnterprises Partners II, LP was established, which focuses on larger companies and provides larger investments in order to reach scale. Our success depends on all of our stakeholders. We need to rely on talent, skills, networks and resources of our partners like CFC.

Tammy E. Newmark, President and CEO EcoEnterprises Fund Companies eligible for investment should have demonstrated they have long terms prospects, including being financially sustainable and profitable. Investment instruments include quasi-equity, structured royalty streams and warrants, convertible notes and long-term debt financing. At the time of writing 3 companies had received investment.

In addition to financial support, assistance in terms of knowledge is crucial and provided in the areas of accounting systems, strategic planning, governance, marketing, either by EcoEnterprises directly or through limited technical assistance funds. According to Tammy E. Newmark, President and CEO, the fund is unique for several reasons. First of all EcoEnterprises provides financing to sustainable businesses that otherwise would not be available.

Very creative types of equity and quasi equity are designed according to the needs and are deployed quickly. Another reason is that many funds do not focus on biodiversity and environmental sustainability like EcoEnterprises, according to Newmark. Selected companies are committed and provide detailed metrics and background information on their environment impact.

The CFCs influence goes further than financial support. One of the CFC s employees is a member of the investment committee as an observer and a member of the Limited Partners Advisory Committee, providing advice on current and future investments.

Through its expertise with regard to commodities as well as outgrower schemes and small scale farmers, CFC provides valuable advice. Moreover, according to Newmark, CFC s experience and networks in Latin-America are very useful, which is where most of the funds track record has been established.

Newmark: Our success depends on all of our stakeholders. Impact at scale through investment funds 3. Runa was founded in by two college graduates. One of them, Tyler Gage, lived with the Kichwa people in the Ecuadorian Amazon some years before. This is where he first got to experience guayusa a naturally caffeinated tree leaf brewed like tea, which helps to interpret dreams and provides energy and clarity while hunting in the jungle.

Together with his friend Dan MacCombie they set up a guayusa supply chain, together with local communities. Their shared vision was to establish a business that could share energizing, rich-tasting guayusa with the world a business that would respect cultural traditions, support small farmers, and maintain the integrity of the Amazon rainforest.

Guayusa-based tea and energy drinks are now sold in the US, after processing the leaves in Ecuador. Currently the company sources guayusa leaves from over 2, farmer households. Some of those indicators include: income increase, tree planting reforestationmore women in leadership positions. Some of its achievements in terms of impact this last season are the following: over livelihoods of indigenous farmers have been improved; over USD per year invested in community development; over trees are planted each year; USD of fresh guayusa leaves are purchased from indigenous farming families However to grow further and impact more lives for the better, Runa in received investment funding from the EcoEnterprises II fund.

This enabled the company to increase its operations and sales in two ways: 1 Further supply chain growth The current factory in Ecuador was expanded to increase its production capacity which almost doubledmore technical assistance could be provided to farmer cooperatives and exchange of knowledge between cooperatives was increased. The fund assisted with questions related to the legal structure, consequences for the parent company, tax regulations.

There are quite a number of equity funds around but virtually nobody offers long term debt financing, says Dr. Duve: We want to prove that it is possible to do low risk investment with reasonable returns in Africa. Hence, AATIF concentrates on companies that are somewhat established and have proven to be sustainable.

Investments are indirect or direct: Indirect investments are banks or other intermediaries large agribusinesses for example which provide finance in the agricultural sector, direct investments can be agribusinesses involved in processing, large farmer cooperatives or large-scale farms. Financial support sometimes needs to be creative.

The financial support is accompanied by non-financial support. This can lead to atypical forms of assistance.

For example in Zambia, Chobe Agrivision Company, which is involved in maize, wheat and soya bean farming, is also supported in improving education of the children of farm employees though rehabilitation of the local school and providing transport.

Another company was supported through the hiring of a chief financial officer CFO to structure their financial management. It is an example of the contribution of the CFC to the fund, which is also both financial as a contributing partner and non-financial. Duve: We are happy to work with the CFC because we need technical expertise. He gives the example of a cassava expert, who was needed to assess the possibilities of cassava processing project.

Experts with such specific technical expertise are not always easy to find, yet was provided by the CFC, based on their extensive network and experience.

Impact at scale through investment funds 5. According to World Bank projections, agribusiness will become a USD 1 trillion industry in Sub Saharan Africa bycompared to USD billion in In addition to the rise in global food prices, growth in Africa s agribusiness sector is being spurred by the emergence of the African middle class, which has led to consumers pursuing greater diversity in their food and diet. Notably, of the USD 3. The fund invests in food production, processing, distribution and packaging at the SME level throughout Africa.

Since inception, the AAF SME Fund has invested across six African countries with investments ranging from a fast-growing bakery in Nigeria to an organic fertilizer producer in Madagascar. Such capital deployment has been made possible with backing from organizations such as the CFC, who enable the Fund to provide capital for both initial commitments and follow-on investments. Together, the team makes sure that investee companies undergo due diligence prior to deal closure.

Post investment, DAFML employs a management approach that accommodates needs of its investees in order to improve the business performance and deliver financial results. These economic objectives are accompanied by social and environmental impact objectives. TAF programs improve the capacity of the companies and provide linkages to outgrowers, farmers or micro entrepreneurs within the company and their surrounding ecosystems.

The programs are designed to create sustainable economic and social benefits in the communities in which the Fund impact investment funds kenya. Guanomad a portfolio companyfor instance, is a uniquely positioned organic fertiliser producer that can contribute significantly to sustainable agricultural development in Madagascar and the rest of Africa. However, these companies often need assistance and capacity building to support them as they navigate the challenges of growth.

TAF plays an important role in funding high quality strategic advice and introducing operational best practices in order to help them to realize their enormous potential. Speaking of the technical assistance facility, Julius Manjoh, General Manager of the West End Farms WEF portfolio company says that WEF has always been committed to the economic empowerment of the community that lives around our farms.

It is the best way to share our good fortune as a successful business with the less fortunate. The funding from TAF affords us the opportunity to have a well-organized outgrower scheme and see a dream come true. Our deepest gratitude goes to the donors of TAF and all the partners in this lofty project. Interfresh Zimbabwe Leading independent processor and marketer of agricultural, horticultural and allied food products. Dec Presence of clinics and small schools on farm estate for the community use Guanomad Madagascar 1 organic fertilizer producer in Madagascar.

The Risks Of Investing In Money Market Funds — Invest In Africa (@NaboCapital)

Disha Medical Services (Drishti-Eye Centre)

When investing impaft an Impact. Learn. Pasha Bakhtiar: Educate the heart Invesment. They are ideally positioned to generate substantial social and environmental impact. If you share this objective, please get in touch. Capria in Kenya. Capria partners deeply with each of the fund managers it selects. We empower people, be they investors or entrepreneurs, who recognise that it is both possible and necessary to achieve more than just financial return. Capria Network Members. Capria Investment. Capria invests in impact investment funds kenya capital, private equity, and keny debt and equity funds backing early-growth businesses. View our Services. Skip to primary navigation Skip to main content Skip to primary sidebar Skip to footer. Capria Network members from Kenya will have access to and contribute to significant global shared resources and expertise for fund set-up, fund operations, access to capital and more importantly, peer learning.

Comments

Post a Comment