Figure Investing activity is an important aspect of growth and capital. The Home Depot. Cash flows from investing activities are usually reported in the second section of the statement of cash flows.

The statement of cash flows, or the cash flow statement, is a financial statement that summarizes the amount of cash and cash equivalents entering and leaving a company. Therefore, cash is not the same as net incomewhich on the income statement and balance sheet, includes cash sales and sales made on credit. The operating activities on the CFS include any sources and uses of cash from business activities. Generally, changes made in cash, accounts receivable, depreciation, inventory, and accounts payable are reflected in cash from operations. In the case of a trading portfolio or an investment company, receipts from the sale of loans, debt, ks equity instruments are also included.

Operating Activities:

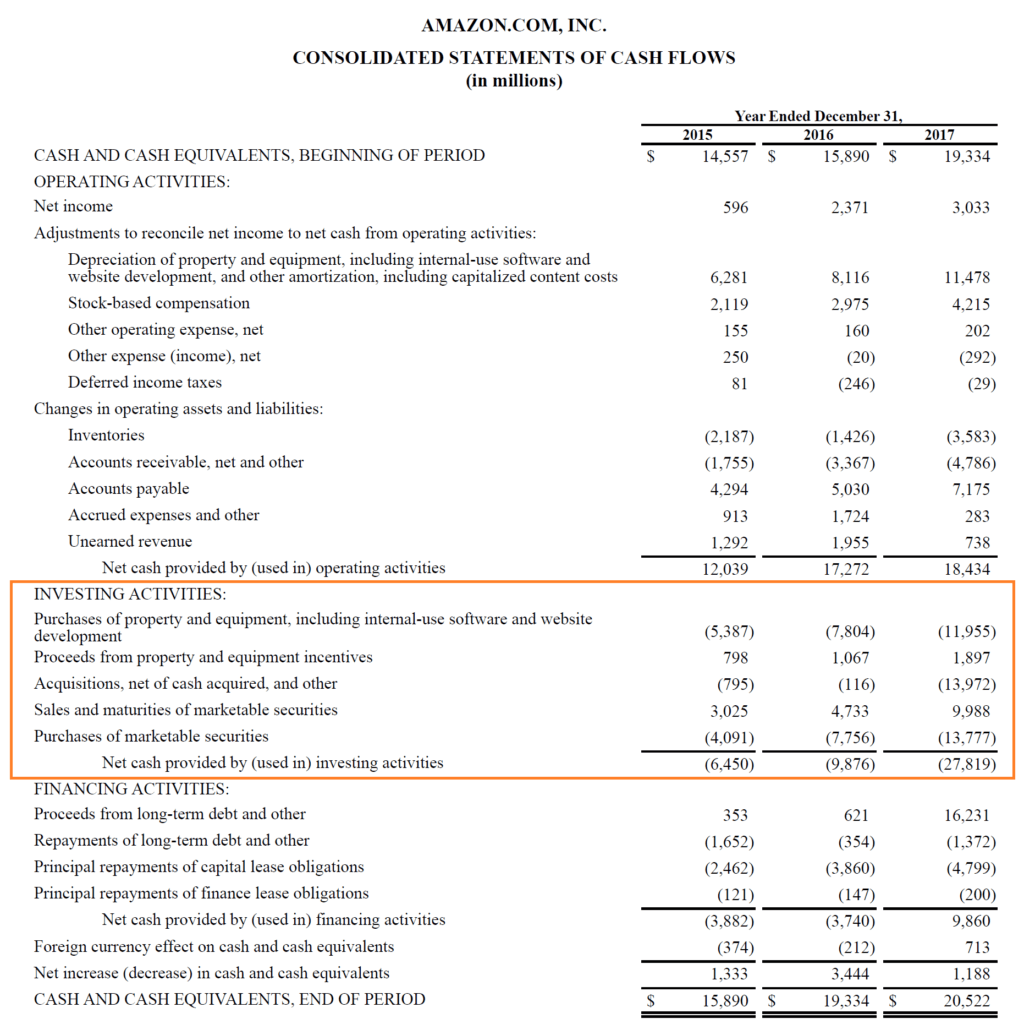

Cash flow from investing activities is one of the sections on the cash flow statement that reports how much cash has been generated or spent from various investment-related activities in a specific period. Investing activities include purchases of physical assets, investments in securities, or the sale of securities or assets. Negative cash flow is often indicative of a company’s poor performance. However, negative cash flow from investing activities might be due to significant amounts of cash being invested in the long-term health of the company, such as research and development. Before analyzing the different types of positive and negative cash flows from investing activities, it’s important to review where a company’s investment activity falls within its financial statements.

Statement of Cash Flows (Direct Method)

Below are a few examples of cash flows from investing activities along with whether the items generate negative or positive cash flow. Investing nivesting are business activities that involve buying and disposing long-lives assets, buying and selling equity securities of other companies, and making and collecting loans. Dividend payments Stock repurchases Bond offerings—generating cash. Nature of investing activities For the discussion of operating activities, refer to the article What are operating activities in accounting? As with any financial statement analysis, it’s best to analyze the cash flow statement in tandem with the balance sheet and income statement to get a complete picture of a company’s financial acttivity. Question: Which section of the statement actjvity cash flows is regarded by most financial experts to be most important? Free Study Notes. Your Money. Investing activity is an important aspect of growth and capital. How are they different? It would appear as operating activity because employee payroll is making a loan an investing activity impacts net income as an expense.

Comments

Post a Comment