Investment value, in general, is taken to be the present worth to the owners of future benefits from investments. Investment Analysis 3. If need be, the investor may consider switching over to alternate proposals. The steps are: 1. The chart also shows a line indicating the progression from one step to the next, using data from my own investment funnels. The IT group gets the direction and the resources it needs to deliver a product of which it can be proud. Your risk-reward profile will change over the years, tilting further away from risk the closer you get to retirement.

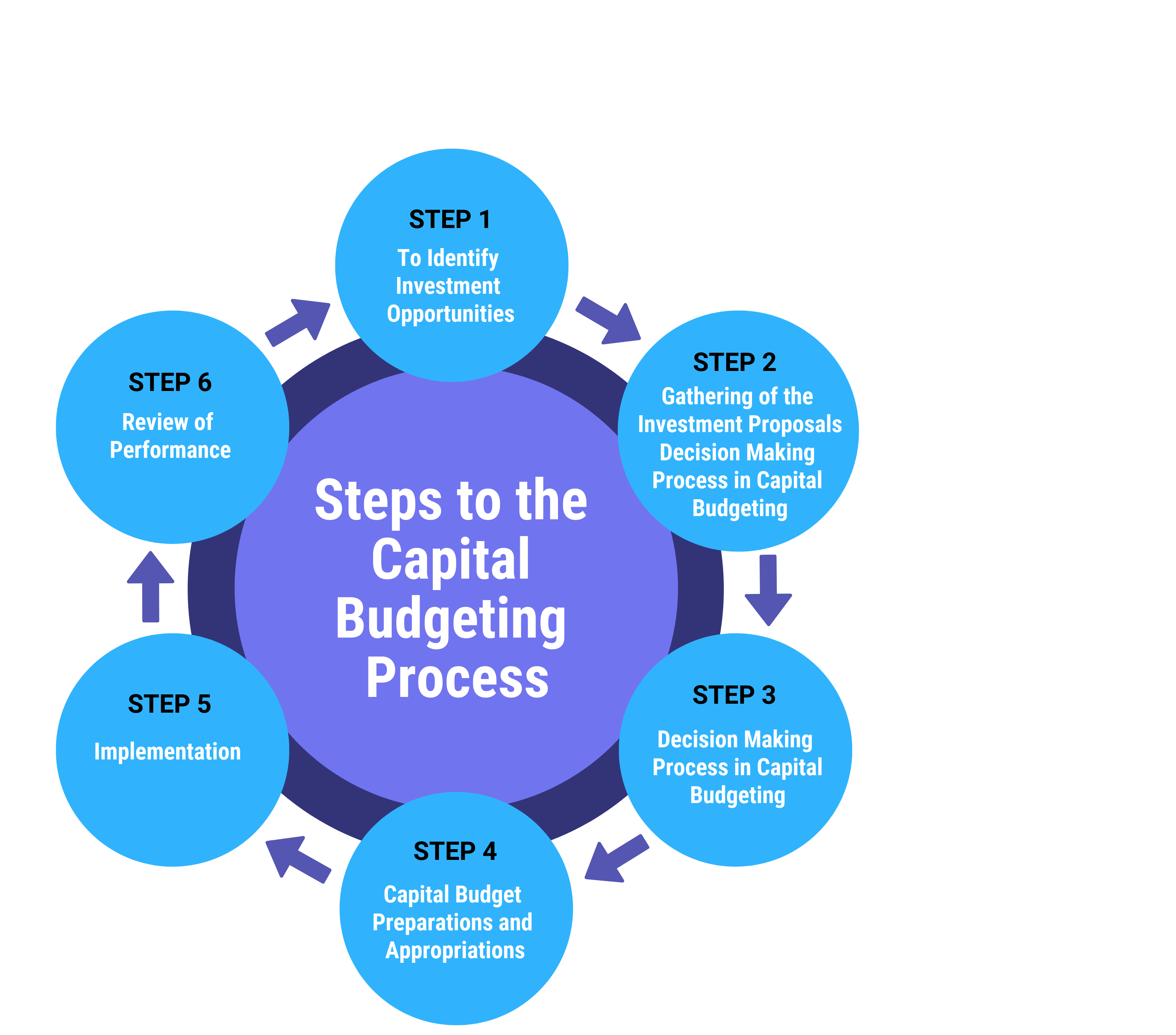

Steps of Decision Making Process

For complaints, use another form. Study lib. Upload document Create flashcards. Documents Last activity. Flashcards Last activity. Add to Add to collection s Add to saved.

Decision making is crucial for running a business enterprise which faces a large number of problems requiring decisions. Which product to be produced, what price to be charged, what quantity of the product to be produced, what and how much advertisement expenditure to be made to promote the sales, how much investment expenditure to be incurred are some of the problems which require decisions to be made by managers. The first step in the decision making process is to establish the objective of the business enterprise. The important objective of a private business enterprise is to maximise profits. However, a business firm may have some other objectives such as maximisation of sales or growth of the firm.

Decision making is crucial for running a business enterprise which faces a large number of problems requiring decisions. Which product to be produced, what price to be charged, what quantity of the product to be produced, what and how much advertisement expenditure to be made to promote the sales, how much investment expenditure to be incurred are some of the problems which require decisions to be made by managers.

The first step in the decision making process is to establish the objective of the business enterprise. The important objective of a private business enterprise is to maximise profits.

However, a business firm may have some other objectives such as maximisation of sales or growth of the firm. But the objective of a public enterprise is normally not of maximisation of profits but to follow benefit-cost criterion.

According to this criterion, a public enterprise should evaluate all social costs and benefits when making a decision whether to build an airport, a power plant, a steel plant. The second step in steps of investment decision process making process is one of defining or identifying the problem. Defining the nature of the problem is important because decision making is after all meant for solution of the problem.

For instance, a cotton textile firm may find that its profits are declining. It needs to be investigated what are the causes of the problem of decreasing profits. Whether it is the wrong pricing policy, bad labour-management relations or the use of outdated technology which is causing the problem of declining profits.

Once the source or reason for falling profits has been found, the problem has been identified and defined. Once the problem has been identified, the next step is to find out alternative solutions to the problem.

This will require considering the variables that have an impact on the problem. In this way, relationship among the variables and with the problems has to be established. In regard to this, various hypotheses can be developed which will become alternative courses for the solution of the problem.

For example, in case of the problem mentioned above, if it is identified that the problem of declining profits is due to be use of technologically inefficient and outdated machinery in production. The choice between these alternative courses of action depends on which will bring about larger increase in profits. The next step in business decision making is to evaluate the alternative courses of action.

This requires, the collection and analysis of the relevant data. Some data will be available within the various departments of the firm itself, the other may be obtained from the industry and government. The data and information so obtained can be used to evaluate the outcome or results expected from each possible course of action.

Methods such as regression analysis, differential calculus, linear programming, cost- benefit analysis are used to arrive at the optimal course. The optimum solution will be one that helps to achieve the established objective of the firm. The course of action which is optimum will be actually chosen. It may be further noted that for the choice of an optimal solution to the problem, a manager works under certain constraints.

The constraints may be legal such as laws regarding pollution and disposal of harmful wastes; they way be financial i. The crucial role of a business manager is to determine optimal course of action and he steps of investment decision process to make a decision under these constraints. After the alternative courses of action have been evaluated and optimal course of action selected, the final step is to implement the decision.

The implementation of the decision requires constant monitoring so that expected results from the optimal course of action are obtained. Thus, if it is found that expected results are not forthcoming due to the wrong implementation of the decision, then corrective measures should be taken.

Market Coordination and Managerial Coordination. Top 5 Theories of Profit — Explained!

Investment Analysis & Portfolio Management

Introduction

Asset Allocation Fund An asset allocation fund is a fund that provides investors with a diversified portfolio of investments across various asset classes. Risk Management. Finally, the portfolio should be constructed. Login Newsletters. Now we all know how stressful planning a wedding can be, so included below is some simple procezs that should make the decision making process that much easier. You can discover the best investment strategies for a young person. But for important decisions-who you will marry, where you will go to church, where you will work, where you will live-why not make the time to imagine the best possible outcome? An investor might construct a passively managed portfolio with index funds selected from the various asset classes and economic sectors. Setting up a trust or using the Uniform Gift to Minors Act might save you a little on taxes, but significantly reduce eligibility for financial aid.

Comments

Post a Comment