Login Newsletters. Treasuries, less attractive. Mutual Funds The 4 Best U.

Reader Interactions

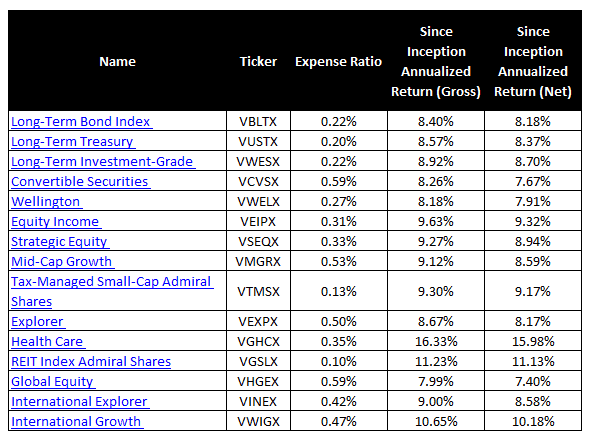

If you are looking for the best bond fundsyou’ll want to include Vanguard funds in your search. Although Vanguard Investments is best known for stock index funds, they also offer vanvuard wide variety of bond funds. We narrow down the list to just three of the best Vanguard bond funds to choose. Vanguard’s low expense ratios are arguably the strongest advantage for their bond funds compared to. Low expenses are an important feature for the best mutual funds but having low expense ratios is especially crucial for gaining a performance edge in the world of bond funds, where even a 0.

We’re here to help

I would love to read your opinions on convertible securities mutual funds. This is a subject that seems to be ignored completely by personal finance bloggers. What I would like to know is. Convertible securities include convertible bonds and preferred stocks that can convert to common stocks. They seem to be completely ignored because they are an odd ball: not straight stocks, nor straight bonds.

Sponsor Center

If you are looking for the best bond fundsyou’ll want vanguard investment grade convertible bond fund include Vanguard funds in your search. Although Vanguard Investments is best known for stock index funds, they also offer a wide variety of bond funds. We narrow down the list to just three of the best Vanguard bond funds to choose. Vanguard’s low expense ratios are arguably the strongest advantage for their bond funds compared to.

Low expenses are an important feature for the best mutual funds but having low expense ratios is especially crucial for gaining a performance edge in the world of bond funds, where even a 0.

For Vanguard’s index funds, the passive management provides a similar advantage for investors. This is because passively-managed funds naturally have lower expenses than actively-managed funds because there is much research and analysis needed. An index fund manager will simply track the underlying benchmark index, whereas the active manager is usually attempting to beat the benchmark. For bond funds, this benchmark is most often the Barclays Aggregate Bond Indexwhich is a broad bond index covering most Vanguarx.

Using index funds can also be an advantage because the passive management removes the risk of the fund manager making human mistakes, such as miscalculating economic conditions like the direction of interest rates. With those mutual fund advantages in mind, here are three of the best bond funds offered by Vanguard Investments:. Disclaimer: The information on this site is provided for discussion purposes only, and should not be misconstrued as investment advice.

Invetsment no circumstances does this information represent a recommendation to buy or sell securities. Mutual Funds Best Mutual Funds. By Kent Thune. For periods vanguard investment grade convertible bond fund 10 years or more, investors can expect to meet or beat the returns of the average bond fund.

And although the active management style doesn’t always keep it ahead of the benchmark index, the long-term returns have averaged better than index funds like VBMFX. Vanguard Short-Term Investment-Grade VFSTX : Short-term bonds typically have lower conveftible and lower returns, compared to intermediate- and long-term bonds but short-term bonds aren’t as interest-rate sensitive, which makes them good choices when interest rates are rising. By convertibke, if you don’t already know, you may be wondering what «investment grade» means.

Bonds are rated by their credit-worthiness. Depending upon the rating agency, the ratings are from AAA highest quality to D in default. An example of an AAA-rated bond is a U. Treasury bond. In translation, investment-grade bond grde invest in an average of medium quality bonds. The advantage for investors is that yields and long-term returns can be higher, especially in the long run, at least compared to other short-term bond funds like VFSTX.

Continue Reading.

A Silver-Rated Vanguard Fund for Long-Term Bond Investors

We’re here to help

Instead, the action occurs because the sales are insufficient. Partner Links. However, investors still need to choose between high-yield bond funds. Like other Vanguard funds, this one is quite inexpensive, charging just 7 basis points annually. Vanguard followed shortly. One-year, three-year, and five-year returns are 5. Personal Finance.

Comments

Post a Comment