In exchange, backers pay the lead carry. Companies are easy to find through the search feature as well, and one of the great things about AngelList is the thrill of the hunt. Include your email address to get a message when this question is answered. Our mission is to increase the number o Don’t create a new market! I highly recommend signing on at first on the native website and downloading the Angie app if you want to keep tabs on AngelList from a mobile device.

Angel Investor Blogs By Country

The Best Angel Investor Investmentss from thousands of blogs on the web ranked by relevancy, social engagement, domain authority, web traffic, freshness and social metrics. Subscribe to these websites because they are actively working to educate, inspire, and empower their readers with frequent updates and high-quality information. Angel Investor Blogs 1. Follow this blog to get more information on angel investors and investing. The website has become the top platform connecting start-up or existing businesses to over 6, funding providers profiles.

Building a Company Profile

Angel investors invest in early stage or start-up companies in exchange for an equity ownership interest. Angel investing in start-ups has been accelerating. It’s my rule of thumb that it will always take longer to raise angel financing than you expect, and it will be more difficult than you had hoped. Not only do you have to find the right investors who are interested in your sector, but you have to go through meetings, due diligence, negotiations on terms, and more. Raising capital can be a very time-consuming process. What questions should the entrepreneur anticipate about marketing and customer acquisition? The angel investor will want to get a sense of how the company plans to market itself, the cost of acquiring a customer, and the long-term value of a customer.

Startups & Venture Capital

Angel investors invest in early stage or start-up companies in exchange for an equity ownership. Angel investing in start-ups has been accelerating. It’s my rule of thumb that it will always take longer to raise angel financing than you expect, and it will be more difficult than you had hoped. Not only do you have to find invesmtents right investors who are interested in your sector, but you have to go through meetings, due diligence, negotiations on terms, and.

Raising capital can be a very time-consuming process. What questions should the entrepreneur anticipate about marketing and customer acquisition? The angel investor will want to get a sense of how the company whatt to market itself, the cost of acquiring a customer, and the long-term value of a customer. So the entrepreneur should be prepared for the following:. What questions should the angdllist expect concerning the what to list in angellist investments team and founders? It’s very risky, and an angel will only invest if he ilst she is comfortable with potentially losing all of his or her investment.

Ot best, only one in ten startups are successful. The best way to find an angel investor is a solid introduction from a colleague or friend of an angel. The use of LinkedIn to ascertain tp can prove useful. Angel investors see too many deals and you don’t want to impose a roadblock to getting an investor interested in your company.

The entrepreneur will have to be careful anegllist not disclose highly confidential information. The entrepreneur should determine whether a prospective angel investor will be a good fit for.

Here are questions often asked:. Angels will often invest in the company through a convertible note. They key terms negotiated are:.

What are the key factors in determining the appropriate valuation in a seed round of financing? I get tons of emails from start-ups, asking if I will consider investing in their ibvestments. Here are the key elements that will get my attention:. It’s best to give monthly angellisy to your angel investors, whether you have good or bad news. If you are having issues, this can be a way to seek help or advice.

And if you need extra investment, this might facilitate a discussion. No one likes to be surprised, so regular communication is important. Jason Calacanis, a noted angel investor, has said, «There is another really awesome reason to keep investors lis they didn’t give you all their money — they have more!!! They want to give you more!!! If you keep your investors engaged with honest updates, they will reward you by participating in future rounds.

There are many reasons an angel investor will reject your pitch. In fact, the great majority of prospective investors are likely to reject you. What legal documents will the angel investors expect to review for a company prior to investing? The investors will expect these documents prepared by experienced counsel to already be in place:.

Entrepreneurs can be optimistic about raising financing from angel investors, as highly publicized success stories are encouraging more angel investors to commit capital to start-ups. For local business information on 15 million businesses, visit InBusiness. Here are some of the typical reasons for rejection:. VantagePoint Ahat P Share to facebook Share to twitter Share to linkedin Angel investors invest in early stage or start-up ihvestments in exchange for an equity ownership.

Here are my thoughts on frequently asked questions from entrepreneurs about angel financing. How much do angel investors invest in a company?

What are the six most important things for angel investors? Here is what angels particularly care about: The quality, passion, commitment, and integrity of the founders.

The market opportunity being addressed unvestments the potential for the company to become very big. A clearly thought out business plan, and any early evidence of obtaining traction toward the plan. Interesting technology or intellectual property. An appropriate valuation with reasonable terms.

Richard Harroch. Read More.

How AngelList Connects Startups and Investors — Ash Fontana // Startup Elements

Angel Investor Blogs

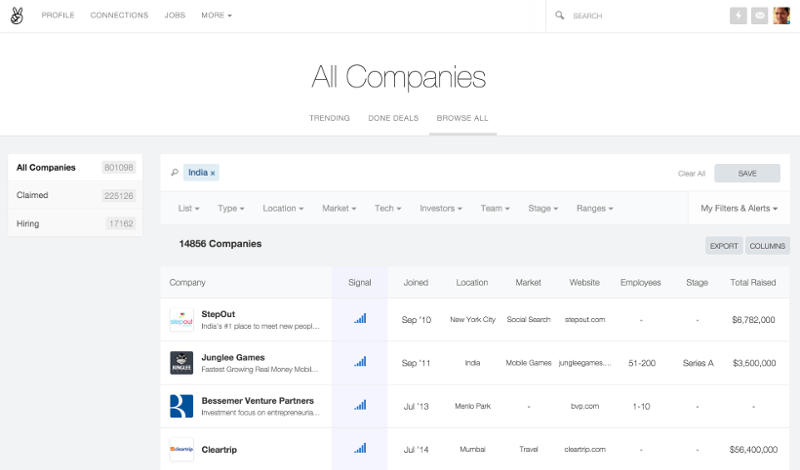

Don’t create a new market! Roberts also what to list in angellist investments AngelList for using their site to to push other types of deals on members than just angel investments. Our mission is to increase the number o By using our site, you agree to our cookie policy. It is just a three-step process: create a free profile showcasing your experience and skills, browse jobs and select the companies you are interested in, and wait for an email saying that that company has also said yes to you. Choose a semi-broad location. Co-authored by Helena Ronis Updated: September 6, You can come upon one person who looks interesting as an entrepreneur, see a company she previously founded, go look at that company, notice one of the cofounders was someone you know, follow her profile, find other companies she helped build or fund, etc… It can lead you down a rabbit hole, but as most successful social media applications go, this is an excellent way to find and nurture opportunities. Ask your current backers to endorse your profile on AngelList. No account yet? You can sign into AngelList through Facebook, Twitter or LinkedIn to automatically attach those networks, but you still need to add an email address and password. You can also connect to Twitter, LinkedIn and Facebook to follow others you are connected with on those networks. Be concise, but give enough information to give a complete overview of your company. Pay attention to your marketing strategy, financials, and production timeline.

Comments

Post a Comment