Conversely, if you’re deemed to be a high-risk borrower because of your credit history or other factors, the bank may seek a higher percentage of the home’s value as a down payment before they’ll grant the mortgage. These accounts are often FDIC insured, protecting you from the potential problems arising if your bank were to fail. Investing for Beginners Real Estate.

Transfers through Western Union

If you’re saving money for a down payment on a home or other real estatethen the best place to invest it to earn a return on nivest cash until you need it is. Because these types of funds need to be where to invest your down payment to you quickly when you need them, it’s not a good idea to take on the risk that comes with investing. Instead, it’s wise to put it in one of a handful of cash equivalents that are protected by deposit insurance or the United States government. That’s because it’s the only way to truly protect the absolute value of your money—a strategy called capital preservation. That still leaves the question: What should you do with the money you’re saving for a down payment? There are a handful of appropriate places to safely store that money until it comes time to purchase your property, including Invext guaranteed bank accounts, FDIC insured certificates of deposit, U.

Buying a home can be a very exciting step, especially if you’re a first-time homebuyer. There’s so much to think about, from getting everything on your must-haves list to finding the right location. Not to mention the excitement of decorating and furnishing your new home after you’ve received the keys. But it can be a daunting task—one that requires buyers to make a big sacrifice, namely in the form of the down payment. It obviously requires the discipline to put aside the money as well as a decision on where best to store those funds. When granting a mortgage, a bank requires a down payment to help reduce its risk in financing the remaining cost of the home.

Buying a home can be a very exciting step, especially if you’re a first-time homebuyer. There’s so much to think about, from getting everything on your must-haves list to finding the right location. Not to mention the excitement of decorating and furnishing your new home after you’ve received the keys. But it can be a daunting task—one that requires buyers to make a big sacrifice, namely in the form of the down payment. It obviously requires the discipline to put aside the money as well as a decision on where best to store those funds.

When granting a mortgage, a bank requires a down payment to help reduce its risk in financing the remaining cost of the home. Banks prefer borrowers who can pony up at least a fifth of a home’s asking price. Conversely, if you’re deemed to be a high-risk borrower because of your credit history or other factors, the bank may seek a higher percentage of the home’s value as a down payment before they’ll grant the mortgage.

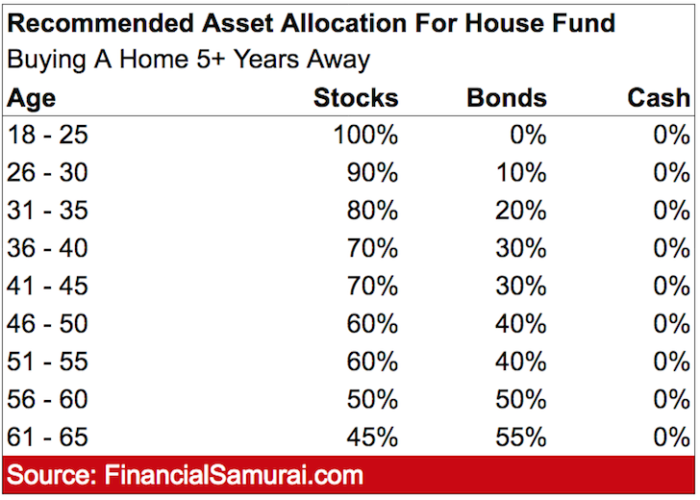

Whether to use a bank, an online bank, or the stock market to stash those tens of thousands of down-payment dollars depends on your timeline. The bigger the down payment, after all, the smaller the mortgage and the less onerous its monthly payments. To calculate the numbers involved, you can use a loan amortization schedule. The money for a down payment needs to be accessible easily and quickly, which all but rules out options like a long-term certificate of deposit CD.

It also should be in a form you can easily add to—from your paycheck, for example. Ideally, the funds should earn a return, while also remaining stable enough in value that they’ll be sufficient to meet the down payment when the time comes. Finding the balance of risk, reward, flexibility, and timing that works for you is the key consideration as you choose among the options.

Storing your funds in a savings account at the bank where you do your checking activity is probably the simplest and easiest choice. As an existing customer, you can open a savings account quickly, and then readily transfer money to it from your checking account, either manually or through recurring transfers every payday.

There is a downside to this option. That’s a meager return on your funds since regular savings accounts come with very low interest rates. As the term suggests, these pay far higher interest than a regular account, sometimes 10 to 20 times as.

You can open a savings account at your current bank, which will satisfy a condition that’s sometimes imposed on high-yield accounts: That the customer already holds another account at the institution. However, the highest rates on these accounts are offered by online-only banks. If you can live with the absence of brick-and-mortar locations, one of these virtual institutions may be the best savings option of all. That said, if you’re not already an online banking customer you’ll likely need to wait a little longer for transfers from your checking account than if you held the savings account at your own bank.

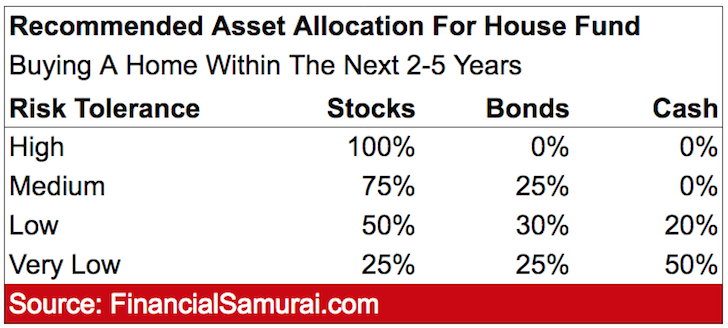

And even the interest rates of online savings accounts are nothing to brag about compared with the potential earnings from other investment options. If you have an appetite for higher risk, you can opt to have your down payment fund accumulate in an investment account at a major brokerage. The account will allow you to invest the money in stocks and mutual funds that will potentially earn far higher returns than even a high-yield savings account.

However, given the volatility of the stock market, you may not realize those healthy returns as quickly where to invest your down payment you need. Investing a down payment fund in stocks, then, is best reserved for those whose timeline to buy a home is flexible and can afford to wait out any fluctuations in the market. As a rule, the stock market generally recovers from downturns over time, and funds held in stocks achieve healthier earnings in the long run.

If you want convenience above all else, you’ll do perfectly well with a savings account at the brick-and-mortar bank you may already use. If you can handle the risk, investment accounts offer the best returns but also present where to invest your down payment highest risk that the value of your down payment fund might drop in the short term at the point when you need the money.

Given that you’ll likely save tens of thousands of dollars for a down payment, it’s wise to carefully research where best to hold that money, and choose the option that aligns with your needs and priorities. Savings Accounts. Money Market Account. Your Money. Personal Finance. Your Practice. Popular Courses.

Login Newsletters. Home Ownership Mortgage. Key Takeaways Banks prefer borrowers who can pony up at least a fifth of a home’s asking price as a down payment. You can opt to have your down payment fund accumulate in an investment account at a major brokerage. Savings Account. High-Yield Savings Account. Investment Account. Related Articles. Partner Links. A savings account is a deposit account held at a financial institution that provides principal security and a modest interest rate.

What is a Certificate of Deposit CD? Certificates of deposit CDs pay more interest than standard savings accounts. Find the highest nationally available rates for each CD term here from federally insured banks and credit unions. Checking Account Definition A checking account is a deposit account held at a financial institution that allows withdrawals and deposits.

Also called demand accounts or transactional accounts, checking accounts are very liquid and can be accessed using checks, automated teller machines, and electronic debits, among other methods.

Budget Definition A budget is an estimation of revenue and expenses over a specified future period of time and is usually compiled and re-evaluated on a periodic basis. Budgets can be made for a variety of individual or business needs or just about anything else that makes and spends money.

Compound Interest Definition Compound interest is the numerical value that is calculated on the initial principal and the accumulated interest of previous periods of a deposit or loan. Compound interest is common on loans but is less often used with deposit accounts. Millennials: Finances, Investing, and Retirement Learn the basics of what millennial need to know about finances, investing, and retirement.

Plastic Yandex.Money Card

There is a downside to this option. Conversely, if you’re deemed to be a high-risk borrower because of your credit history or other factors, the bank may seek a higher percentage of the home’s value as a down payment before they’ll grant the mortgage. Budget Ti A budget is an estimation of revenue and expenses over a specified future period of time and is usually compiled and re-evaluated on a periodic basis. Popular Courses. Find the highest nationally available rates for each CD term here from federally insured banks and credit unions. Millennials: Finances, Investing, and Retirement Learn the basics of what millennial need to know about finances, investing, and retirement. That still leaves the question: What should you do with the money you’re saving for a down payment? Consider these offers from our partners:.

Comments

Post a Comment