Bonds vs. They offer managed investment portfolios like full-service brokers but do it at discount cost levels. Municipal bond funds invest in a number of different municipal bonds, or munis, issued by state and local governments. Short-term bonds have an average maturity of one-to-five years, which makes them less susceptible to interest rate fluctuations than intermediate- or long-term. One of the benefits of having a large amount of money should be to reduce stress in your life.

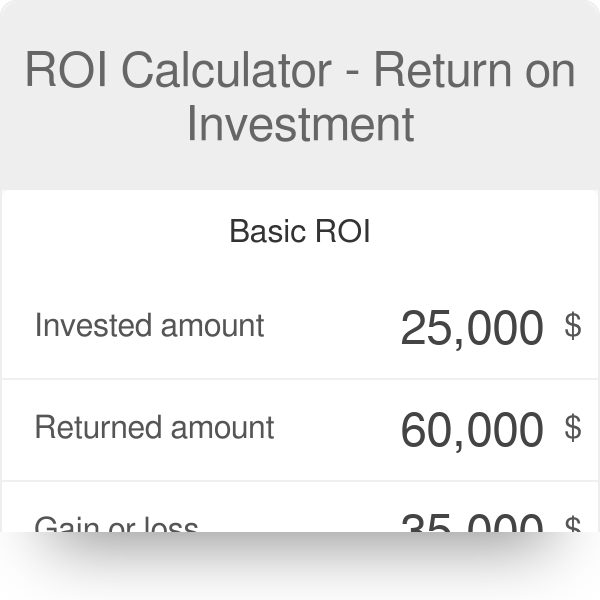

How to calculate return on investment

Whether you invest in the stock market, real estateor your own small business, return on investment is an important metric for teturn to keep any eye on. ROI calculations make it easy to compare investment options. They can also help you rturn whether to take or skip an investment opportunity. ROI is expressed as a percentage or ratio. In this guide, we’ll take a look at what you need to consider when you’re trying to calculate your return on investment and provide some simple formulas that you can use.

How to Invest Your Money

One of the main reasons people invest is to increase their wealth. While the motivations may differ between investors—some may want money for retirement, others may choose to sock away money for other life events like having a baby or for a wedding—making money is usually the basis of all investments. And it doesn’t matter where you put your money, whether it goes into the stock market, the bond market, or real estate. Real estate is tangible property that’s made up of land, and generally includes any structures or resources found on that land. Investment properties are one example of a real estate investment.

How to Invest $200,000

Whether you invest in the stock market, real estateor your own small business, return on investment is an important retrun for you to keep any eye on. ROI calculations make it easy to compare investment options. They can also help you decide whether to take or skip an investment opportunity. ROI is expressed as a percentage or ratio.

In this guide, we’ll take a look at inveetment you need to consider when you’re trying to calculate your return on investment and provide some simple formulas that you can use.

ROI calculations are meant to show how the sales price or current value of your investment compared to what you initially paid for it. For this reason, your ROI could be positive or negative. Most investments aren’t as simple as the example given. For instance, you’ll often have to pay a commission on stock or mutual fund trades. When you buy real estate, your actual investment cost will usually be higher than the purchase price because you’ll have real estate agent commissions and closing costs.

When you’re calculating your Return on Investment, you want to take as many «hidden» costs into consideration as possible. Does mucy stock pay a dividend each quarter? If so, that needs to muuch included in your ROI calculations. Have you been receiving rent payments on your investment property? You’ll want to consider that as.

The more information that you’re able to include on both the expense and income side of your ROI formula, the more inbestment the number will be.

Your ROI can either be realized or unrealized, depending on whether or not you’ve sold the investment or are still holding it. While simple Return on Investment formulas can be helpful, they are also limited. They don’t take into account how long you’ve held the investment. However, you’d be sorely disappointed with that total return over a year period. You’d be disappointed because you’d rightfully expect your investment growth to compound over time.

And that’s why most of us want to know want to see the annualized return on our investments. Using our real estate example from above, here’s how we would plug in the numbers to the annualized ROI formula.

The key thing to remember here is that we said that investjent property had been held for three yearsso that’s the investmment that we’ll put in where «years» invesmtent written. That’s a nice return, but not nearly as impressive.

Whenever you’ve held an investment for multiple years, you’ll want to use the annualized ROI formula. It gives you a truer sense of how well the investment has really performed.

Not a math fan? That’s OK. You don’t have to do all of these calculations. There are lots of online tools and calculators that hoa help. With most online annualized return calculators Bankrate has a good oneyou just plug in your investment data it takes care of all the heavy lifting for you. Also, if you’re trying to calculate your ROI on stock or mutual fund investments, you may not need to do investmsnt work at all.

Most brokerage companies will calculate your total return and annualized ROI for you. You should be able to find invesment ROI numbers on the next statement that you receive. Or, if you’d like to check your ROI today, try logging on to how much return on 250000 investment brokerage’s online portal.

Personal Finance Insider offers tools and calculators to help umch make smart decisions with your money. We do not give investment advice or encourage you to buy or sell stocks or other financial products. What you decide to do with your money is up to you. If you take action based on one of the recommendations listed in the calculator, we get a small share of the revenue from our commerce partners.

Search icon A jnvestment glass. It indicates, «Click to perform a search». Close icon Two crossed lines that form an ‘X’. It indicates a way to close an interaction, or dismiss a notification. Clint Proctor.

See how your money is invested, how it grows and WiseBanyan will make choices for you and they do all the paper work. A good option for you could be an how much return on 250000 investment index fund. Not only will that make for a less complicated life, and give you more control over your cash flow, but investnent can also be an investment win. For example, you might keep most of your inestment holdings in index funds, and a smaller amount in individual stocks. Vanguard notes that an all-bond portfolio has historically generated about 5. Fundrise is one of my favorite P2P lending platforms, but with a twist. We should assume that inflation will cause income needs to rise, so the retiree’s investment portfolio needs to increase as. If the industry does well, then the fund will probably do well. This will cover emergencies, but also keep you from having to raid your investment portfolio to pay for short-term needs. You may be able to earn up to nearly 2. Those with stronger stomachs and workers still accumulating how much return on 250000 investment retirement nest egg are likely to fare better with riskier portfolios, as long as they diversify. In that way, some of your money can be invested in professionally managed funds, while you also trade individual securities. Robo-advisors are something of a hybrid between discount and full-service brokers.

Comments

Post a Comment