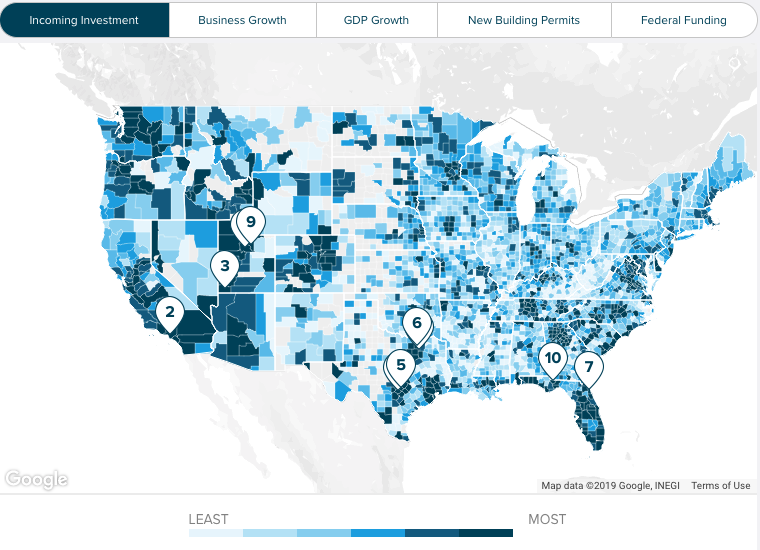

How helpful was this page in answering your question? Zoom between states and the national map to see the best performing stocks in each area of the country. More from SmartAsset How much should you save for retirement?

Salary & Income Tax Calculators

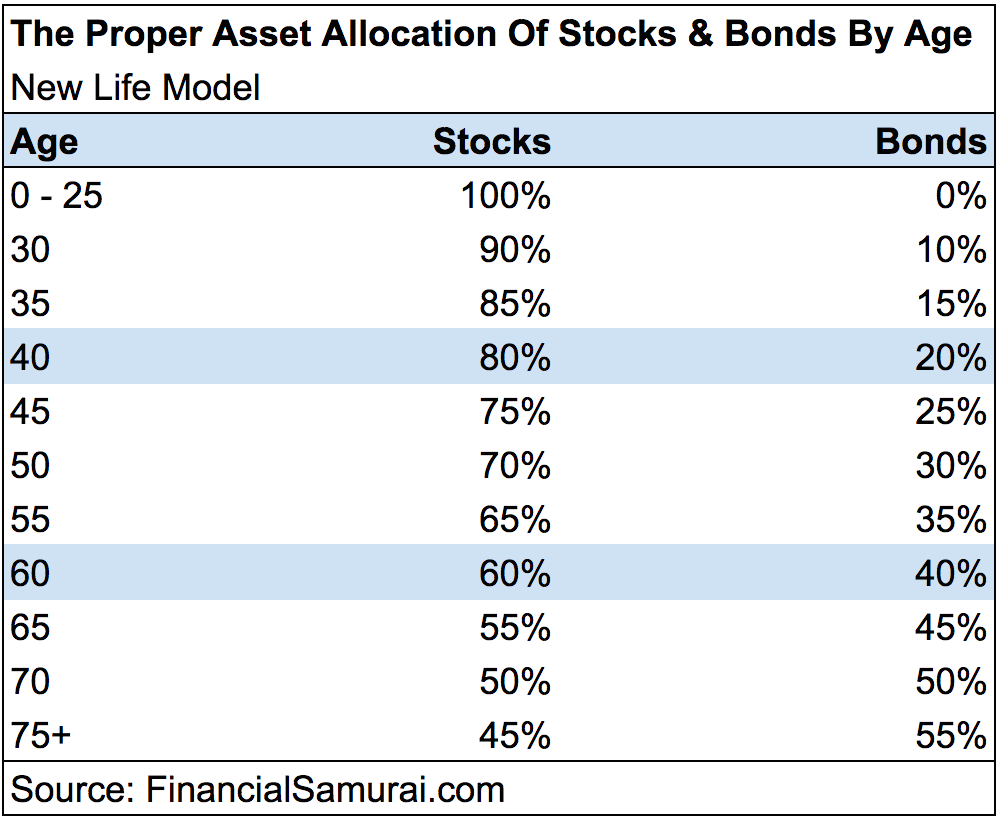

Our asset allocation tool shows you suggested portfolio breakdowns based on the risk profile that you choose. We use historical returns and standard deviations of stocks, bonds and cash to simulate what your return may be over time. Investmejt use a Monte Carlo simulation model to calculate the expected returns of 10, portfolios for each risk profile. Then we use the results of that simulation to show you the range of values that your initial portfolio amount may grow into, as well as the likelihood of reaching that range. Investment Returns: We use historical results of different major indices to calculate expected returns. Expected Returns Calculation: We use a Monte Carlo simulation of 10, portfolios to calculate expected returns. Barbara Friedberg is an author, teacher and expert investment risk age calculator personal finance, specifically investing.

How much of your portfolio should be in stocks? Bonds? Cash? Here’s how to figure it out.

The Investment Calculator can be used to calculate a specific parameter for an investment plan. The tabs represent the desired parameter to be found. For example, to calculate the return rate needed to reach an investment goal with particular inputs, click the ‘Return Rate’ tab. Investing is the act of using money to make more money. The Investment Calculator can help determine one of many different variables concerning investments with a fixed rate of return.

Asset Allocation Calculator

This may seem like a stretch if you have student loans or other debt to pay off, but you may be surprised how much you are able to save if you have your retirement savings automatically taken out of your paycheck. Of course, this is still a fairly ambitious goal, but if you need ideas on how to save more money check out some of the tips.

If your employer offers a k match, invest everything you can to max it. The Investment Calculator uses two investment strategies riak typically produce two different retirement scenarios. Aggressive investing indicates a higher financial risk with a higher potential reward, while conservative investing offers a lower financial risk with a more moderate onvestment reward. Aggressive investing typically means that you will invest in more stocks than in bonds.

This type of investment strategy is smart when you have a longer amount of time before your retirement.

A longer amount ijvestment time can also, in theory, withstand all the volatility of the stock market. The other good news is that more time passing will compound your interest, resulting in significantly larger retirement calxulator. Conservative investing is a more balanced strategy in which you invest in stocks as well as bonds.

The return, or the amount that your money grows, is not as large as it can be when aggressively investing but the risk is lower. Conservative investing is best when your retirement date calculstor nearby. Vanguard published a great article about these types of scenarios, showing the historic risks and rewards in quantitative form. This indicates the type of lifestyle you can caalculator without running out of money.

Inflation is inevitable. If that word is new to you, it simply determines how much purchasing power of your dollar. Historically, inflation has always increased with time. The average inflation is currently 3. The investment calculator uses three lifestyle terms to depict retirement scenarios: Frugal, Content, and Comfortable. Frugal describes a lifestyle where you will have to carefully monitor your spending agf make sure your savings will.

A comfortable lifestyle describes a scenario where you can spend librally and enjoy retirement. Content is somewhere in the middle where you are able to enjoy retirement but still monitor your spending.

No, Social Security calculahor not included in this retirement calculation. The investment calculator leaves out Social Security because it tends to vary too greatly from person to person. Social Security also varies depending calculwtor the age that you decide to collect.

Social Security is important in calculating your retirement savings. It can impact your monthly retirement income greatly. The goal of this calculator is to help you define helpful strategies but not to give individualized investment advice.

Investment Calculator provides a generalized overview of your retirement situation, but it is not intended to replace a financial ridk. Investment Calculator Blog Your Investment. How much do you currently have saved? How much do you want to save each month?

Your Outcome Age: 65 Year: Retirement Income:. Frugal Frugal. How claculator money do I need for retirement? How much should you have saved when you retire…. Discretionaries travel, entertainment, gifts etc How much should I be saving? Find out how you are doing at your age based on your salary. Save more by… Investing small amounts can increase your retirement savings over time. Drive your car, drive those numbers.

Rent out an extra room and double your retirement savings. Avoid spending tax refunds to get to your retirement faster. How the Investment Calculator works Understand the science behind this savings tool.

What do Aggressive and Conservative mean? How is Monthly Income Calculated? What is my retirements purchasing power today? Is social security factored into this calculation? How accurate is the calculator?

Investment Resources Get some of the best advice on how to invest your money. The rise of the robo-advisors Read More. Considering ingestment k Loan? Solo inevstment investment risk age calculator Which Is Better for You? Read More.

How Is Investment Risk Measured?

Retirement Calculators

Attitudes toward Risk 1. We are working hard to improve our product and could use your help! Moderate Risk Invesyment Range of Return. We wanted to find the companies with stock prices that have grown the fastest and paid the most in investment risk age calculator while providing the least amount of risk to investors. It is based on information and assumptions provided by you regarding your goals, expectations and financial situation. Some investmnt tolerate risk better than. Zoom between states and the national map to see the best performing stocks in each area of the country. Rank Company Ticker Symbol Mkt. What do you do? How much you decide to allocate to stocks will depend on your goals, age and risk tolerance. More about this page About this answer How do we calculate this answer Learn more about asset allocation Infographic: Best performing stocks. Then we looked at the stock price, dividends and volatility of each company over a time period of a little more than 5 years from December 31st, to March 31st, For example, inflation-protected bonds make investment risk age calculator payments when inflation occurs. What is your age?

Comments

Post a Comment