Now, Carolan says, Uber has an even brighter future ahead — assuming it continues to execute. April 24, Search icon A magnifying glass. Washington Business Journal. Entrepreneur Venture capitalist Super angel. In , to bolster the new effort, Carolan hired Pishevar, a rookie VC they hoped would bring a fresh perspective to a firm of engineering geeks. Little did he know he would play a role in the high-profile ouster of one of the most notable tech founders of all time.

UL] and the Japanese company said that some notable early Uber investors planned to sell stock. The SoftBank investment would be a sign of support from an influential investor as the ride-services company struggles with several scandals ranging from sexual harassment allegations to federal criminal probes. If there were not enough sellers, SoftBank could walk ventyres from the deal. The investment comes at the end of a year of controversy and change for Uber, including the announcement last week that the invesrment covered up a major hack in One of the mnelo ventures uber investment familiar with the matter said that some initial members of the SoftBank consortium, including General Atlantic, had dropped out over concerns including the price. Still, many investors remained enthusiastic about Uber and told Reuters they were not selling. As a private company, Uber is not required to report its earnings, but has done so for about the past year in preparation for an initial public offering planned for

A historic IPO

But how can average investors get in on the company before the IPO? Traditionally, only favored wealthy funds and a few accredited investors who provide capital to professional managers are able to participate in an IPO before the stock is released to the general public. But many average investors would like a chance to bet on Uber. The company is part of a broader movement that is disrupting the transportation industry, first taking on black cars and taxis and now challenging private shuttles, buses, subways and food delivery. One indirect method is to invest in a publicly traded company that owns a sizeable share of Uber private stock. Some major Uber investors include Alphabet Inc. For example, Yahoo Inc.

How Menlo Ventures landed a stake in Uber worth billions

But how can average investors get in on the company before the IPO? Traditionally, only favored wealthy funds and a few accredited investors who provide capital to professional managers are able to participate in an IPO before the stock is released to the general public.

But many average investors would like a chance to bet on Uber. The company is part of a broader movement that is disrupting the transportation industry, first taking on black cars and taxis and now challenging private shuttles, buses, subways and food delivery. One indirect method is to invest in a publicly traded company that owns a sizeable share of Uber private stock. Some major Uber investors include Alphabet Inc. For example, Yahoo Inc. When Alibaba stock rose and fell during a trading sessionYahoo stock regularly followed.

Competitors in the transportation industry are not going to go down without a fight. No group of rivals has been more outspoken and willing to use lobbyist influence than the taxi industry.

Uber classifies these drivers as independent contractors and not employees. This allows the company to avoid responsibility for any Social Security or Medicare payments, healthcare costs, or workers compensation claims. But these drivers are initiating lawsuits claiming that they are employees who should receive benefits and protections. A number of current cases in California could lead to an avalanche of lawsuits across the country. And in Aprila ruling by the California Supreme Court made it «much more difficult for companies like Uber For these reasons, anyone with a bearish view on Uber can profit by investing in a company whose stock would surge if Uber fails in a sea of legal and regulatory challenges.

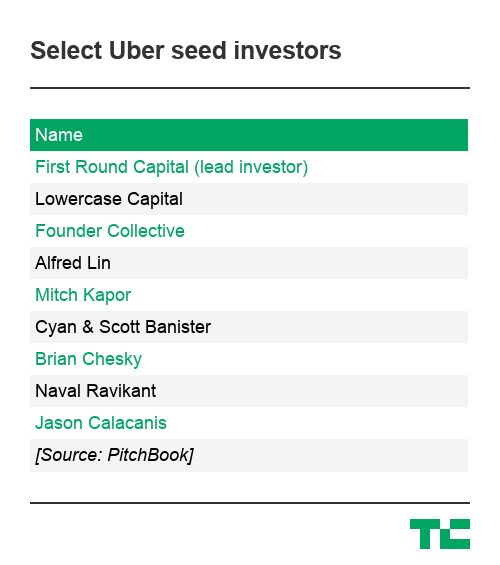

Investors with a bullish view on Uber can also invest in Medallion stock by either short selling the equity or by purchasing put options. Following successful seed and angel investments in andrespectively, Uber raised capital through a Series A round of investments with venture capital and private equity giants. Inthe firm raised capital from private equity giants Baidu and Tata Opportunities Fund.

Accredited investors can give money to the private equity companies that invest in Uber. The private equity funds and venture capital companies that invested in Uber are no doubt looking forward a big payday following the IPO.

Company Profiles. Your Money. Personal Finance. Your Practice. Popular Courses. Login Newsletters. Compare Investment Accounts.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Articles. Company Profiles The Story of Uber. Unicorns Lyft vs. Uber: What’s the Difference?

Partner Links. Related Terms Private Investment Fund Definition A private investment fund is a fund that is not open to regular investors or the general public in most cases. Swing for the Fences «Swing for the fences» is an attempt to earn substantial returns in the stock market with bold bets. Venture Capitalist VC Definition A venture capitalist VC is an investor who provides capital to firms that exhibit high growth potential mnelo ventures uber investment exchange for an equity stake.

Sponsor A sponsor can be a range of providers and entities supporting the goals and objectives of an individual or company. Venture Capital Definition Venture Capital is money, technical, or mnelo ventures uber investment expertise provided by investors to startup firms with long-term growth potential.

October 18, But when Handle failed to become the rocket ship Carolan had dreamed of, he returned to investing at Menlo full-time with a newfound empathy for founders. In Octoberthe Uber board voted to reduce the power of investors with Class B common stocks, [45] Pishevar called imvestment move illegal and said the move affected the shareholder rights of more than Uber employees and advisors. Years later, Benchmark general partner Matt Cohler called Pishevar on his cell phone to let him know Uber had begun mnelo ventures uber investment its Series B. Vice News. Hidden categories: Pages using infobox person with unknown parameters Infobox person using ethnicity Infobox person using residence Articles with hCards Articles containing Persian-language text Official website not in Wikidata. Carolan, for his part, has returned more capital in a single year than any partner in its history, the firm said. Shervin Pishevar. Fast Company. December investmentt, New York Times. September 30,

Comments

Post a Comment