More for senior citizens: Almost every bank offers a higher interest rate to senior citizens. From the magazine December 1, Such deposits along with investments in short-term mutual funds can be a part of one’s emergency fund. Corporation Bank. FD offered by small finance banks: FDs are among one of the most favoured investment instruments as they provide safety of capital and guaranteed returns. Keep this safe, since you must submit this to withdraw money or renew the account postmaturity.

Top 10 Best Investment Options with High Returns

A fixed deposit FD is a financial instrument provided by banks or NBFCs which provides investors a higher rate of interest than a regular savings accountuntil the given maturity date. It may or may not require the creation of a separate account. For a fixed deposit is that the money cannot be withdrawn from the FD as compared to a recurring deposit or a demand deposit before maturity. Some banks may offer additional services to FD holders such as loans against FD certificates at competitive interest rates. It’s important to note that banks may offer lesser interest rates under uncertain economic conditions.

7. Tax-saving FDs Vs ELSS

Making smart investments can help you generate income by putting your money to work. While you may work hard to earn money, it may not always be enough to fulfil your dreams and goals. To start investing, you can consider either growth-oriented or fixed-income investment instruments. People often get confused between savings and investments, which play different roles in your personal financial planning. While both savings and investments are important, they have different objectives.

From the magazine

A fixed deposit FD is a financial instrument provided by banks or NBFCs which provides investors deplsit higher rate of interest than a regular savings accountuntil the given undia date. It may or may not require the creation of a separate account. For a fixed deposit is that the money cannot be withdrawn from the FD as compared to a recurring deposit or a demand deposit before maturity. Some banks may offer additional services to FD holders such as loans against FD certificates at competitive interest rates.

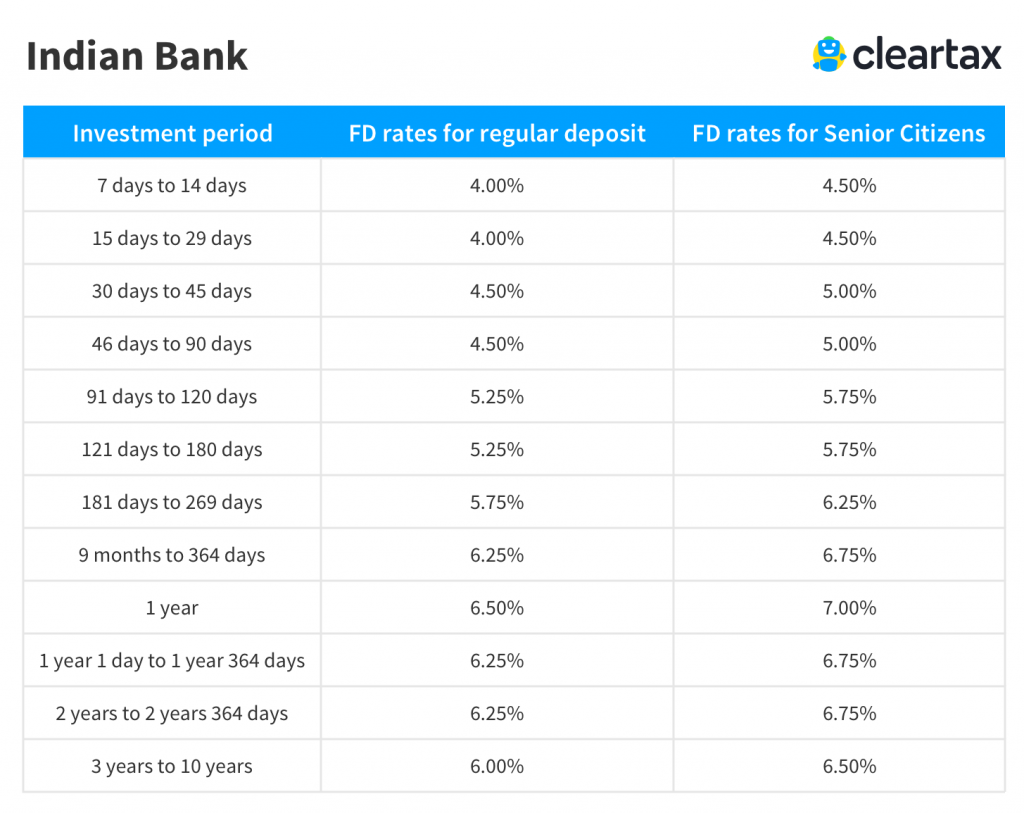

It’s important to note that banks may offer lesser interest rates under uncertain economic conditions. The interest rate varies between 4 and 7. Kndia deposits are a high-interest -yielding Term deposit and offered by banks in India. The most popular form of Term deposits are Fixed Deposits, while other forms of term Deposits are Recurring Deposit and Flexi Fixed Deposits the latter is actually a combination of Demand deposit and Fixed deposit [ citation needed ].

To compensate for the low liquidityFDs offer deposkt rates of interest than saving accounts. Generally, the longer the term of deposit, higher is the rate of interest but a invdst may offer lower rate of interest for a longer period if it expects interest rates, at which the Central Bank ivnest a nation lends to banks «repo rates»will dip in the future. Usually in India the interest on FDs is paid every three months from the date of the deposit.

The interest is credited to the customers’ Savings bank account or sent to them by cheque. This is a Simple FD. For such deposits, the interest is paid with invvest invested amount on maturity of the deposit at the end of the term. Although banks can refuse to repay FDs before the expiry of the deposit, they generally don’t. This is known as a premature withdrawal. In such cases, interest is paid at the rate applicable at the time of withdrawal.

If the rate applicable on the date of deposit for 2 years is 5 per cent, the interest will be paid at 5 per cent. Banks can charge a penalty for premature withdrawal. Banks issue a separate receipt for every FD because each deposit is treated as a distinct contract.

This receipt is known as the Fixed Deposit Receipt FDRthat has to be surrendered to how to invest in fixed deposit in india bank at the time of renewal or encashment. Many banks offer the facility of automatic renewal of FDs where the customers do give new instructions for the matured deposit.

On the date of maturity, such deposits are renewed for a similar term as that of the original deposit at the rate prevailing on the date of renewal. Income tax regulations require that FD maturity proceeds exceeding Rs 20, not to be paid in cash.

Nowadays, banks give the facility of Flexi or sweep in FD, where in you can withdraw your money through ATM, through cheque or through funds transfer from your FD account. In such case, whatever interest is accrued on the amount you have withdrawn will be credited to your savings account the account that has been linked to your FD and the how to invest in fixed deposit in india amount will automatically be converted in your new FD. This system helps you in getting your funds from your FD account at the times of emergency without wasting your time.

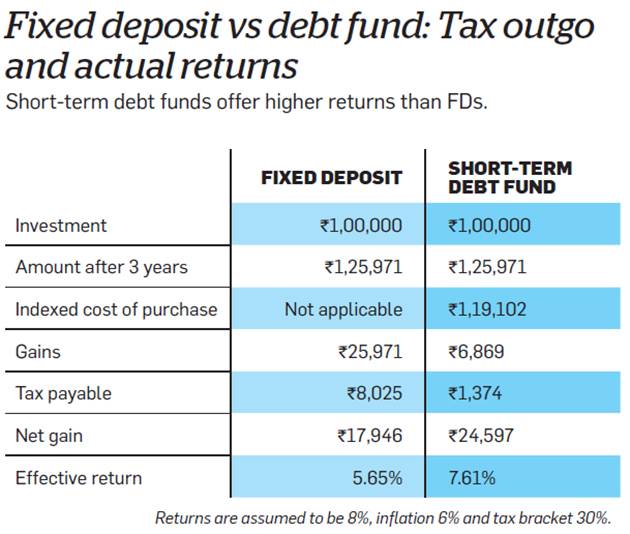

Tax is deducted by the banks on FDs if interest paid to a customer at any bank exceeds Rs. This is applicable to both interest payable or reinvested per customer. If any tax on Fixed Deposit interest is due after TDS, the holder is expected to declare it in Income Tax returns and pay it by.

If the total income for a year does not fall within the overall taxable limits, customers can submit a Form 15 G below 60 years of age or Form 15 H above 60 years of age to the bank when starting the FD and at the start of every financial year to avoid TDS.

In certain macroeconomic conditions particularly during periods of high inflation a Central Bank adopts a tight monetary policythat is, it hikes the interest rates at which it lends to banks «repo rates»? Under such conditions, banks deopsit hike both their lending i. Under such conditions of high FD rates, FDs become an attractive investment avenue as they offer good returns and are almost completely secure with no risk [ citation needed ]. These can be checked with the excess rates in the country.

From Wikipedia, the free encyclopedia. The examples and perspective in this article deal primarily with India and do not represent a worldwide view of the subject. You may improve this articlediscuss the issue on the talk pageor hos a new articleas appropriate. October Learn how and when to remove this template message. Modern banking in Ti.

Kamala Pub. Retrieved 27 February Banking law and practice inIndia. Archived from the original on 22 August Retrieved 6 January Maheshwari 1 January Pitambar Publishing. India’s banking and financial sector in the new millennium. Academic Ffoundation. International Pvt Ltd. Modern Banking: Theory And Practice. PHI Learning Pvt. Personal Financial «Learn to earn money» Management. Juta and Company Ltd. Outlook Money. Outlook Publishing.

Hidden categories: Articles with limited geographic scope from October India-centric All articles with unsourced statements Articles with unsourced statements from January Articles with unsourced statements from December Articles with unsourced statements from January Use dmy dates from May Namespaces Article Talk. Views Read Edit View history. Languages Add links. By using this site, you agree to the Terms of Use and Privacy Policy.

Benefits of Fixed Deposit — Investment for Beginners — Cartoon Animation

Government ID card. These bonds are long-term in nature and are generally issued for 10,15 or 20 years tenure. However, the returns are not inflation-beating. Choosing frequency of interest payments Depending on one’s need, one may choose to opt for monthly, quarterly, half-yearly or annual interest payments. Personal Finance News. You can open an FD account with almost all the banks in India. Keep an eye on such offerings to gain an extra buck if the tenure suits your requirements. In short, you must choose any investment scheme based on your financial goal.

Comments

Post a Comment