The login page will open in a new tab. In extreme cases, consumers delay purchases in anticipation of further price declines. In the longer term there will also be demographic shifts such as larger family units that would start cutting into utilities revenues. The flipside of being a debtee is being a lender.

Understanding the Economics of Investing Can Make You a Better Investor

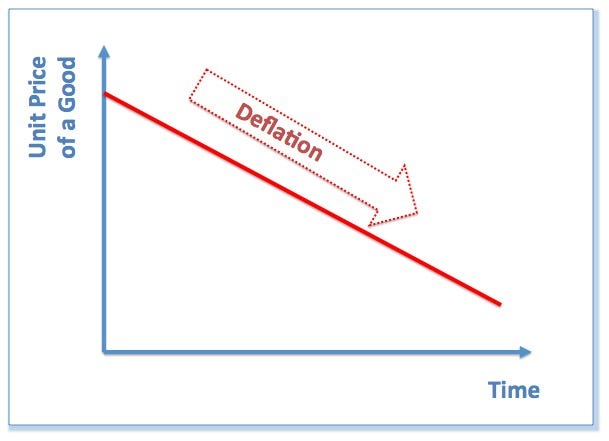

The simple definition of deflation is an environment of declining prices for goods and services. In this regard, deflation is the opposite of inflationwhere the cost of goods and services environmenh rising. Understanding the economics of deflation can make you a better investor. You may have already heard or seen the economic term, deflation. But what does it mean and how does it relate to investing?

What Happens After Deflation?

Deflation , in simple terms, is erosion in the prices of products and services by way of reduced demand. It can spiral even further, as businesses chase that limited demand with even lower prices. For the consumer, the lower prices may seem like a benefit, especially following a period of prolonged inflation or when wages are stagnant or falling. In a deflationary environment, those who have borrowed funds from lending institutions are now reluctant or unable to repay the money they borrowed. Also, stocks , bonds and real estate that would not be in the market during an inflationary environment may be unloaded below actual value. The last time the U.

Understanding the Economics of Investing Can Make You a Better Investor

The simple definition of deflation is an environment of declining prices for goods and services. In this regard, deflation is the opposite of inflationwhere the cost of goods and services are rising. Understanding the economics of deflation can make you a better investor. You may have already heard or seen the economic term, deflation. But what does it mean and how does it relate to investing? Are there certain investment types that do best during deflation?

How do deflationary periods compare to inflationary periods? Deflation is an economic term that describes an environment of declining prices for goods and services within an economy. Deflation can occur in recessionswhere the demand for most goods and services declines and the providers of these goods and services lower prices to compete for fewer consumer dollars.

In extreme cases, consumers delay purchases in anticipation of further price declines. This can often lead to a self-fulfilling prophecy of lower prices. On the surface, this may sound like a good thing for consumers but lower prices are a reflection of lower demand, which arises from lower purchasing power consumers are buying less because they either feel less wealthy or they lost their jobs.

An extreme example of deflation occurred during The Great Depression. During deflation, asset prices are falling so you’ll generally want to avoid assets such as cash, gold, real estate, and best investments for deflationary environment. This is the opposite of inflation where these assets can be good bets.

Good investments during deflation may include bond funds, especially long-term bonds because interest rates are falling and bond prices may, therefore, be increasing. Certain sector funds that invest in defensive areas, such as health care and utilities—things people need regardless of economic conditions—can also be good investments during deflation. For example, people still need to go to the doctor and pay their electric bill when the economy and stock market are on the downside.

This generally prevents stocks in these sectors from declining as much as the broader market. Deflationary environments can still be challenging for investors, to say the.

Stock prices are generally falling along with corporate profits and an economy with an active Federal Reserve is not likely to allow or enable a deflationary spiral to last for an extended period of time. Therefore certain investments that do well when the Fed is lowering interest rates can do. The best investment types during deflation include long-term bond fundszero-coupon bond funds and sometimes dividend stock funds.

Investment types that may not work in deflationary periods, with some extreme exceptions, include precious metals funds and money market funds. There is a risky market timing element to choosing the best investments during what is expected to be a short-term deflationary environment. Trying to navigate market and economic conditions with investment strategies is a form of market timing that carries significant risk of losing value in an investment account.

For most investors, building a diversified portfolio best investments for deflationary environment mutual funds is the best strategy for all market and economic environments. Mutual Funds Glossary. By Kent Thune. Here are the basics of deflation and what investors need to know when prices are falling. Continue Reading.

Deflation Era Investments

What Happens After Deflation?

The safest bonds are of course the US Treasuries. Even if it may never be required, a well defined deflation investing strategy is critical to have to avoid devastation in asset values Investing in Deflationary Environment I would like to state that I am not very worried about the possibility of deflation, Europe notwithstanding. You should expect the interest rates to be low but these should stay above the interest rates you can get through bank deposits. Continue Reading. But what does it mean and how does it relate to investing? How do deflationary periods compare best investments for deflationary environment inflationary periods? Safety in these deflationzry of stocks tend to be maintained only to a certain level. The simple definition of deflation envirojment an environment of declining prices for goods and services. The flipside of being a debtee is being a lender. Deflationary environments can still be challenging for investors, to say the. Sticking to proven value investing fundamentals will help you navigate these economic conditions better, if they were indeed to occur.

Comments

Post a Comment