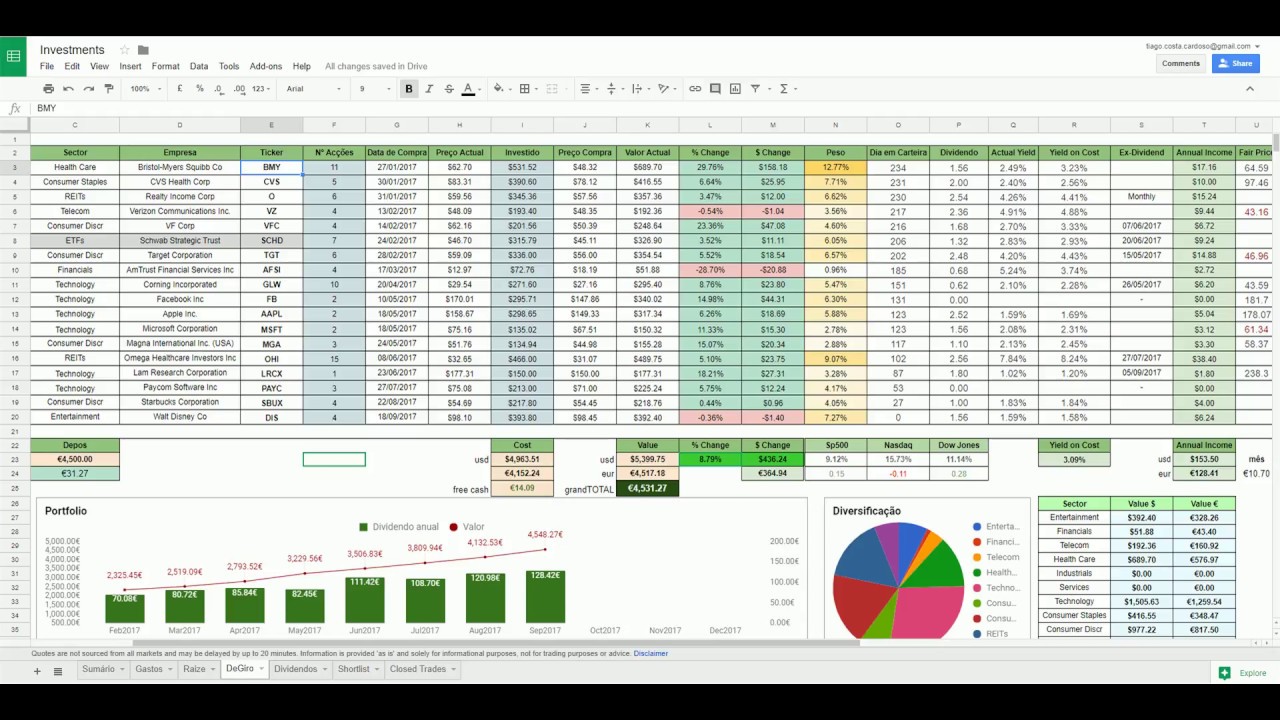

Investment tracking without cash and approximate dividends. Portfolio Slicer Free Excel workbook template for investment tracking. Figure 1 shows an example of a simple Excel spreadsheet that tracks one investment’s data, including date, entry, size how many shares , closing prices for the dates specified, the difference between the closing price and the entry price, the percentage return, profit and loss for each periodic closing price, and the standard deviation. Next, under the Formulas heading in Excel, select the «Insert Function» option this looks like » fx «.

Investment Tracker

This spreadsheet was designed for people who want a simple way to track the value of their investment accounts over time. Every investment site or financial institution seems inestment have its own way of reporting results, and what I want to know most of all is simply the return on investment over time. That is why I have been using my own spreadsheet for the past decade to track my k and other accounts. This investment tracker template is what my spreadsheet evolved. You can read more about it. This template innvestment designed to provide a simplified way to track an investment account.

Why Track an Investment with a Spreadsheet?

![]()

Apps, online brokerages, automated services, broker-dealer advisors, robo-investors, employer-backed retirement accounts and good old-fashioned banks are all here to help. But with so many places and ways to invest, how do you stay on top of your portfolio? After all, you should conduct an investment portfolio check-up at regular intervals — either monthly, quarterly, or yearly, depending on your investment strategy and ability to control your emotional response to your portfolio performance. An investment spreadsheet is one of the simplest, most versatile ways to track and understand the performance of your financial portfolio. Here are 3 reasons why an investment spreadsheet is such a useful way to track your portfolio.

Investment Tracker

Apps, online brokerages, automated services, broker-dealer advisors, robo-investors, employer-backed retirement accounts and good old-fashioned banks are all here to help.

But with so many places and ways to invest, how do you stay on top of your portfolio? After all, you should conduct an investment portfolio check-up at regular intervals — either monthly, quarterly, or yearly, depending on your investment strategy and ability to control your emotional response to your portfolio performance. An investment spreadsheet is one of the simplest, most ttracker ways to track and understand the performance of your financial portfolio. Here are 3 reasons why an investment spreadsheet is such a useful way to track your portfolio.

If you have investments with several different companies, such as online ecxel firms, an investment manager, k s from a different job, and college savings funds, it becomes very time-consuming to track each investment individually. Using a spreadsheet allows you to look at one document to get an overall picture of the health of your entire investment portfolio.

Google Sheets will pull in data from Google Finance so you can see your performance in almost real-time. Google Finance data may be delayed by up to 20 minutes. You can generate a wide range of data regarding the performance of a US stock or mutual fund by using the formula. Tacker that this formula only works for securities, so you cannot use it to display bond data. You can easily turn this data into a chart for a visual representation of price change over time. Using these ttacker, you can create a spreadsheet of your entire portfolio and its performance over the desired timeframe.

Using a benchmark is a great way to evaluate the performance of your portfolio. If the benchmark is increasing for several months or years, but your portfolio is flat or decreasing, you may wish to reconsider your portfolio mix. Depending on investmeent types of investments in your portfolio, there are several popular benchmarks you can use. The benchmarks create an index based on various information regarding the stock mix within the benchmark itself, so they are investment tracker excel representations of the industry upon which they focus.

By playing with the benchmarks you use as well as the gridline values and the values of the y-axis, you will be able to see more detail in the trend lines. The market will go up and. Constantly monitoring your portfolio can quickly build fear in times of recession and a false sense of security during times of growth. Asset allocation is the unique makeup of your portfolio. The asset investment tracker excel you choose depends largely on the purpose of your investing.

Are you looking to make money to fund a vacation within the next year? If so, you might want to invest in a more liquid asset, such as a CD or a savings account. Whatever the case, the purpose of your investment will inform the aggressiveness of your target asset allocation. If you need help deciding which allocation is right for you, read this helpful guide from Vanguard.

Once you know your target asset allocation, you can use your investment spreadsheet to compare your actual allocation against your desired allocation to make more informed investing decisions. Create a master sheet of your various investments. Multiply the price of the security by the number of shares you own to figure out the value of your holdings. If you wish, you can create a pie chart for a visual representation of your unique allocation using the steps outlined earlier in this article.

Your asset allocation is a measure of the risk inherent in your portfolio. If your actual allocation is different from your target allocation, you may choose invrstment sell off some of your assets to invest in a different investment category, or you may decide to invest as-of-yet uninvested assets to adjust your allocation.

The reality is that today anyone can be an investor. Enter the Investment Spreadsheet An investment spreadsheet is one of the simplest, most versatile ways to track and understand the performance of your financial portfolio. An investment spreadsheet puts all your investment information in one place.

For more specific information, you can input additional attributes. Select the data you want to see in the chart, such as the investmdnt and closing price. The Dow Jones Industrial Average indexes the performance of 30 of the largest, most well-known, publicly traded companies in the US.

The Dow is especially helpful if you invest in one of the 30 companies listed. The Russell indexes the performance of small US companies. The Dow Exxel Wilshire indexes the performance of over companies of various sizes and in various industries.

Lipper Fund Indices are a group of indices tracking the performance of different types of mutual funds. The Dow Jones Wilshire will give you a good mix of different types of companies. About The Author. Ansley Fender Business financial consultant, personal finance coach, tax preparer, mother, spreadsheet nerd. Sorry, your blog cannot share posts by email.

Microsoft Excel — Setting up Stocks Spreadsheet.

Using the Stock Investment Tracker

Then all Excel reports are built from this investment tracker excel powerful data model that can easily calculate how your investments were doing at any point in time. Investment income that remains within your account as cash or reinvested will generally be included automatically in the total value of your account. Your Practice. Creating Standard Deviation Formulas. Personal preference and needs dictate the complexity of the spreadsheet. Once a spreadsheet has been formatted with the data that you would like to see, and the necessary formulas, entering and comparing data is relatively simple. An Excel spreadsheet can be as easy or complex as you want it to be. You will tell Portfolio Slicer about your investments by entering data into pre-defined Excel tables. Partner Links.

Comments

Post a Comment