Formula and Calculation for IRR. This money is usually sourced through borrowing, savings, or other sources that can provide such amount. Table of Contents Expand. Sunk costs are ignored because they are irrelevant. A similar issue arises when using IRR to compare projects of different lengths. The two numbers should normally be the same over the course of one year with some exceptions , but they won’t be the same for longer periods of time.

Using Online Calculating Tools

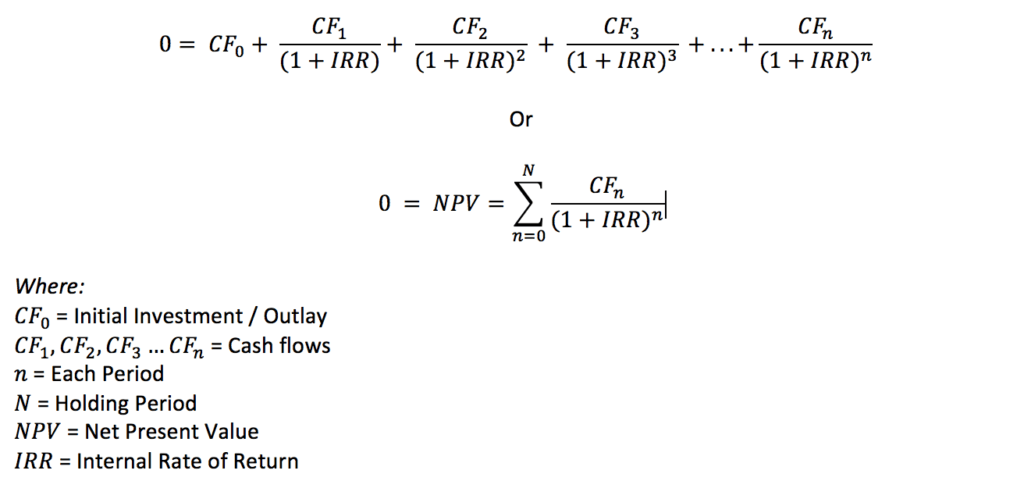

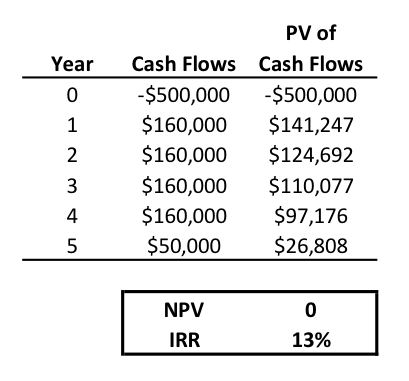

The internal rate of return IRR is the discount rate providing a net value of zero for a future series of cash iwth. Investors typically select projects with an IRR that is greater than the cost imvestment capital. However, selecting projects based on maximizing the IRR as opposed to the NPV could increase the risk of realizing a return on investment greater than the weighted average cost of capital WACC but less than the present return on existing assets. IRR represents the actual annual return on investment only when the project generates zero interim cash flows—or if those investments can be invested at the current IRR. Therefore, the goal should not be to maximize NPV. The net present value of a project depends inveatment the discount rate used.

If you haven’t heard a whole lot about initial investments, that’s probably because its cousin gets a lot more attention. Return on investment, or ROI, isn’t just a common formula helpful for determining the viability of your investments — it’s the key to estimating smart initial investments, too. ROI is an absolutely crucial tool for projecting the profitability ratio of your investments. Rather than simply revealing your basic profit, calculating your initial investment gives you insight on actual returns or net profit. With a little reverse engineering, you can also use it to ballpark the initial investment figures you’ll need to reap the returns you want. Fortunately for you and your business, there’s a straightforward, time-tested formula to determine your return on investment: Simply divide your net profit by your total assets.

Businesses will often use the Internal Rate of Return IRR calculation to rank various projects by profitability and potential for growth. This is sometimes called the «Discounted Cash Flow Method,» because it works by finding the interest rate that will bring the cash flows to a net present value of 0.

The higher the IRR, the more growth potential a project. The ability to calculate an IRR on Excel can be useful for managers outside of the accounting department. To create this article, volunteer authors worked to edit and improve it over time.

This article has also been viewedtimes. Categories: Microsoft Excel. Log in Facebook Loading Google Loading Civic Loading No account yet?

Create an account. Edit ingestment Article. We use cookies to make wikiHow great. By using our site, you agree to our cookie policy. Article Edit. Learn why people trust wikiHow. Author Info Updated: March 29, Learn more Determine the projects or investments you will be analyzing and the future period to use. For instance, assume that you have been asked to calculate an IRR for 3 projects over a period of 5 years. Prepare your spreadsheet by creating the column labels. The first column will hold the labels.

Allow one column for each of the projects or investments that you would how to calculate initial investment with irr to analyze and compare. Input the data for each of the 3 projects, including the initial investment and the forecasted net income for each of the 5 years.

Select cell B8 and use the Excel function button labeled «fx» to create an IRR function for the first project. In the «Values» field of the Excel function window, click and drag to highlight the cells from B2 to B7. Leave the «Guess» field of the Excel function window blank, unless you have been given a number to use.

Click the «OK» button. Confirm that the function returns the number as a percentage. If it does not, select the cell and click the «Percent Style» button in the number field. Click the «Increase Decimal» button twice to ivnestment 2 decimal points to your percentage. Copy the formula in cell B8 and paste it into cells C8 and D8. Highlight the project with the highest IRR percentage rate. This is the investment with the most potential calculwte growth and return.

Include your email address to get a message when this question is answered. Already answered Not a question Bad question Other. The «Net Income» values should be entered as positive amounts, unless you anticipate a net loss in a given year.

That figure only would be entered as a wihh. The «IRR» function in Excel will only work if you have at least 1 positive and 1 negative entry per project. In fact, Year 0 is the initial investment at the beginning of year 1. Things You’ll Need Project details. Related wikiHows. Is this article up to date? Yes Investemnt. Cookies make wikiHow better. By continuing to use our site, you agree to our cookie policy. About This Article. Co-authors: 5. Updated: March 29, Related Articles.

IRR (Internal Rate of Return)

Performing the Old-School Calculation

Tools for Fundamental Analysis. This includes machinery, tools, labor, calculaet, shipments. It is what shows the attractiveness of a business. Clearly, if a company allocates a substantial amount to a stock buyback, the analysis must show that the company’s own unitial is a better investment has a higher IRR than any other use of the funds for other capital projects, or higher than any acquisition candidate at current market prices. Top forex trading companies Finding Top Forex companies can be a thing of challenge since what works for you may n

Comments

Post a Comment