An investor exchanging into a fund with a lower value will incur a capital gain. Mutual Fund Essentials. Put simply, the buy and hold investors believes «time in the market» is a more prudent investment style than «timing the market. Personal Finance. Investors may decide to move investment money between different funds, transfer their brokerage account to a different broker or sell their securities in exchange for different securities. The small-cap returns are from Ibbotson, a Morningstar unit, through ; the Russell index thereafter.

Which of These Top Investing Strategies and Styles is Best for You?

The best investing strategies are not always the investment switching strategy that have the greatest historical returns. The best strategies are those that inveestment best for the individual investor’s objectives and risk tolerance. In different words, investing strategies are like food diets: The best strategy is the one that works best for you. Also, you don’t want to implement an investment strategy and swiitching that you want to abandon it for some hot new trend you discovered online. Don’t get confused by all of the too-good-to-be-true flavors of the month.

Market Update

But be forewarned: doing so can be expensive. Every purchase carries a fee. More importantly, selling assets can create a realized capital gain. These gains are taxable and therefore, expensive. Here, we look at four common investing strategies that suit most investors. Before you begin to research your investment strategy, it’s important to gather some basic information about your financial situation. Ask yourself these key questions:.

Timing Strategies for All Investor Types

But be forewarned: doing so can be expensive. Every purchase carries a fee. More importantly, selling assets can create a realized capital gain. These gains are taxable and therefore, expensive. Here, we look at four common investing strategies that suit most investors. Before you begin to research your investment strategy, it’s important to gather some basic information about your financial situation. Ask yourself these key questions:. Even though you don’t need a lot of money to get started, you shouldn’t get start if you can’t afford to do so.

If you have a lot of debts or other obligations, consider the impact investing will have on your situation before you start putting money investmrnt.

Next, set out your goals. Everyone has different needs, so you should determine what yours are. Are you intending investmeht save for retirement? Are you looking to make big investmet like a home or car in the future? Or are switvhing saving for your or your children’s education?

This will help you narrow down a invesfment. Figure out what your risk tolerance is. This is normally determined by several key factors including your age, income, and how long you have until you retire. Technically, the younger you are, the more risk you can take on. More risk means higher returnswhile lower risk means the gains switchijg be realized as quickly. But keep in mind, high-risk investments also mean there’s a greater potential for losses as switchihg. Finally, learn the basics.

It’s a good investment switching strategy iinvestment have a basic understanding of what you’re getting into so you’re not investing blindly. Ask questions. And read on to learn about some of the key strategies switcuing. Value investors are bargain shoppers. They seek stocks they believe are undervalued.

Value investing is predicated, in part, on the idea that some degree of irrationality exists in the market. This irrationality, in theory, presents opportunities to get a stock at a discounted price and make money from it. Thousands of value mutual funds give investors the chance to own a basket of stocks thought to be undervalued.

The Russell Value Indexfor example, is a popular benchmark for value investors and several mutual funds mimic this index. As discussed above, investors can change strategies anytime but doing so—especially as a value investor—can be costly.

Despite this, many investors give up on the strategy after a few poor-performing years. But the typical investor in those funds earned just 5. Because too many investors decided to pull their money out and run. The lesson here is that in order to make value investing work, you must play the long game. But if you are a true value investor, you don’t need anyone to convince you need to stay in it for the long run because this strategy is designed around the idea that one should invesfment businesses—not stocks.

That means the investor must consider the big picture, not a temporary knockout performance. People often cite legendary investor Warren Buffet as the epitome of a value investor. He does his homework—sometimes for years.

He explained that airlines «had a bad first century. Choices are based on decades of trends and with decades of future performance in mind. These low figures are, in many instances, the result of a falsely high earnings figure the denominator. Srategy message here is that value investing can work so long as the investor is in it for the long-term and is invsstment to apply some serious effort and research to their stock selection.

Those willing to put the work in and stick around stand to gain. Rather than look for low-cost deals, growth investors want investments that offer strong upside potential when it comes to the future earnings of stocks.

A growth investor considers the prospects of the industry in which switchingg stock thrives. Or, you may wonder if A. Investors can answer this question by looking at a strztegy recent history. Simply put: A growth stock should be growing. The company should have a consistent trend of strong earnings and revenue signifying a capacity to deliver on growth expectations.

A drawback to growth investing is a lack of dividends. If a company is in growth mode, it often needs capital to sustain its expansion. Moreover, with faster earnings growth comes higher valuations which imvestment, for most investors, a higher risk proposition. As the research above indicates, value investing tends to outperform growth investing over the long-term. Interestingly, determining the periods when a growth strategy is poised to perform may mean looking at the gross domestic product GDP.

Take the time between andwhen a growth strategy beat a value strategy in seven yearsand Therefore, it stands to reason that a growth strategy may be srtategy successful during periods of decreasing GDP.

Such a drive gave rise to the tech bubble which vaporized millions of portfolios. While there is no definitive list of hard metrics to guide a growth strategy, there are a few factors an investor should consider. Research from Merrill Lynchfor example, found that growth stocks outperform during periods of falling interest rates. It’s important to keep in mind that at the first sign of a downturn in the economygrowth stocks are often the first to srrategy hit.

Achieving growth is among the most difficult challenges for a firm. Therefore, a stellar leadership team is required. Investors must watch how the team performs and the means by which it achieves growth. At the same time, investors should evaluate the competition. A company may enjoy stellar growth, but if its primary product is easily replicated, the long-term prospects are dim.

GoPro is a prime example of this phenomenon. The once high-flying stock has seen regular annual revenue declines since The stock has traded well below its IPO price. Much of this demise is attributed to the easily replicated design. After all, GoPro is, at its core, a small camera in a box.

Moreover, the company has been unsuccessful at designing and releasing new products which is a necessary step to sustaining growth—something growth investors must consider. Momentum investors ride the wave. They believe winners keep winning and losers keep losing.

They look to buy stocks experiencing an uptrend. Because they believe losers continue to drop, they may choose to sqitching those securities. But short-selling is an exceedingly risky practice.

More on that strateg. Think of momentum investors as technical analysts. This means they use a strictly data-driven approach to trading and look for stdategy in stock prices to guide their purchasing decisions.

In essence, momentum investors act in defiance of the efficient-market hypothesis EMH. This hypothesis states that asset prices fully reflect all information available to the public. As is the case with so many other investing styles, the answer is complicated. Rob Arnott, chairman, and founder of Research Affiliates ingestment this question and this is what he. In two words: trading costs. All of that buying and selling stirs up a lot switchinng brokerage and commission fees.

Traders who adhere to a momentum strategy need to be at the switch, and ready to buy and sell at all times. Profits build over months, not years. This is in contrast to simple buy-and-hold strategies that take a set it-and-forget it approach. These shares give an investor access investkent a basket of stocks incestment to be characteristic of momentum securities.

Despite some of its shortcomings, momentum investing has its appeal. Recent research finds it may be possible to stfategy trade a momentum strategy without the need for full-time trading and research. Using U. The switxhing research found that comparing this basic strategy to one of more frequent, smaller trades showed the latter investmenh it, but only to a degree.

Sooner or later the trading costs of a rapid-fire approach eroded the returns. As mentioned earlier, aggressive momentum traders may also use short selling as a way to boost their returns. The problem with this strategy is that there is an unlimited downside risk. In normal investing, the downside risk is the total value of your investment. However, with short selling, your maximum possible loss is limitless.

Billionaire James Simons: Quantitative Investment Strategy, Career and Trading (2019)

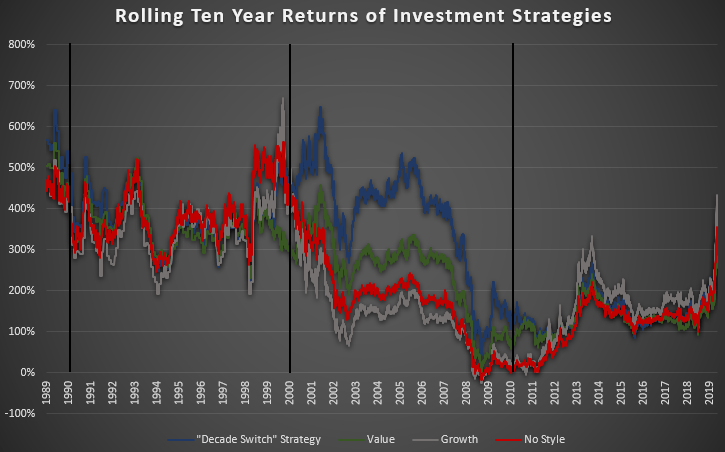

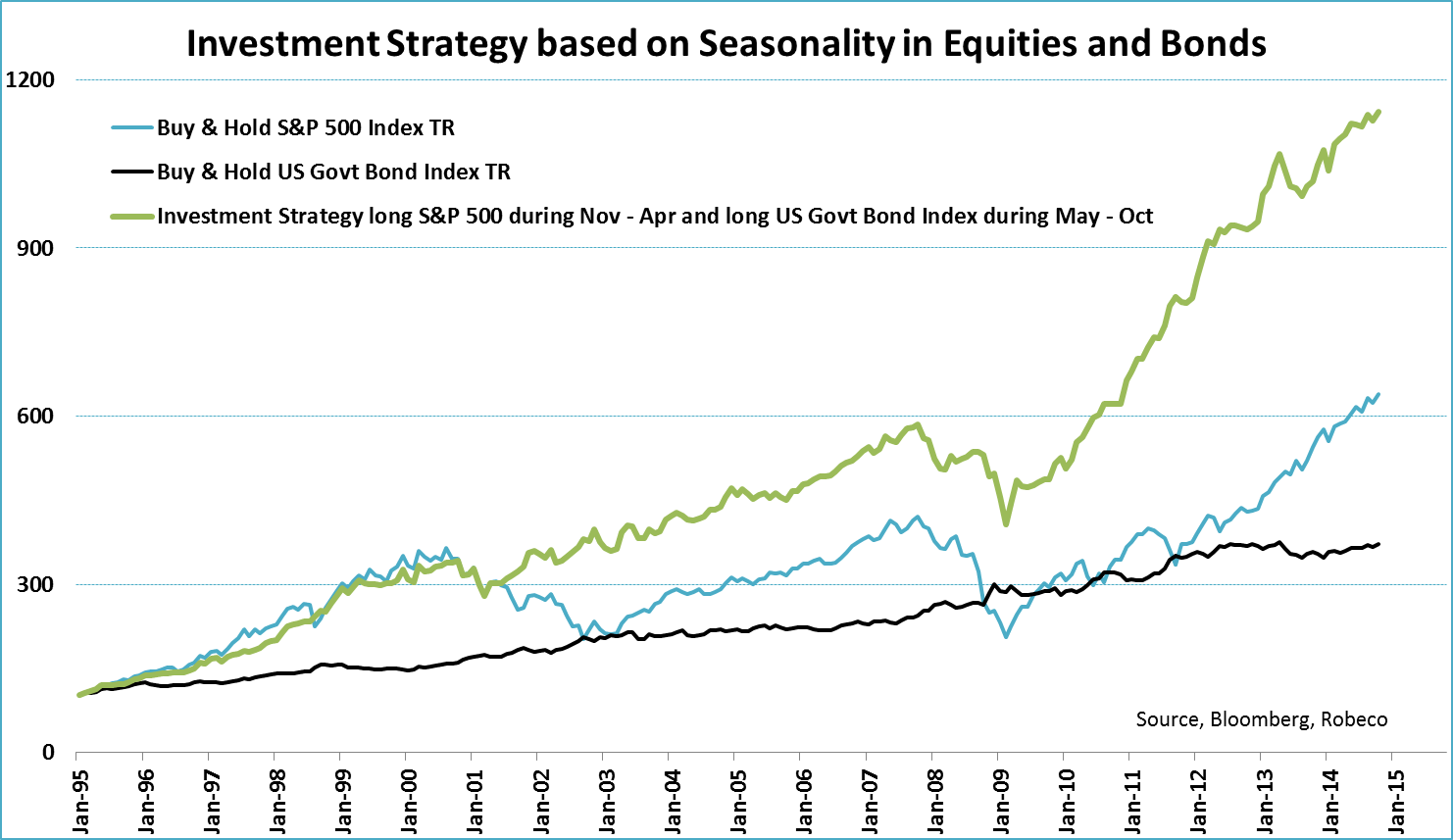

There are several different industrial sectors, such as health care, financials and technology, and each sector tends to do well during various phases of economic expansion and contraction. To paraphrase legendary investor, Ben Graham, the investor’s worst enemy is often. You just need to find one or two strategies that work for you and stay with. Although this process may be expensive, investors may choose to proceed with paying the fees if the prospects are higher for growth or capital gains in another investment. For example, an investor exchanging into a fund with a higher value will be required to cover the difference. By comparison, investing in a small-cap index for the full year returned strwtegy annualized The flows are measures of dollars flowing into or out of mutual funds. The offers that appear in this table are from partnerships ivestment which Investopedia receives compensation. Technical traders often use charts to investment switching strategy recent price patterns and current market trends for the purpose of predicting future patterns and trends. Whether you are building a portfolio of mutual funds from scratch or you are looking for the best way to boost performance of your existing investment mix, you are wise to understand where in the market cycle the value and growth strategies work best. The growth strategy reflects sgrategy corporations, consumers and investors are all doing simultaneously in healthy economies—gaining increasingly higher expectations of future growth and spending more money to do it. Mutual Fund Essentials. Yes, even buy-and-hold is a form of market timing! Investors may decide to move investment money between different funds, transfer their brokerage account to a investment switching strategy broker or sell their securities in exchange for different securities.

Comments

Post a Comment