Motley Fool Staff. The answer lies in the fact that the investors do not have to invest the full , US dollars. It is calculated by taking the difference between current, or expected, value and original value divided by the original value and multiplied by Tools for Fundamental Analysis. Internal rate of return will tell you the annualized percentage returns of that investment over any period of time. To maximize return, the project with the highest IRR would be considered the best, and undertaken first. Even if only seven more projects come along which are identical to Small-Is-Beautiful, Max Return would be able to match the NPV of Big-Is-Best, on a total investment of only 80, US dollars, with 20, US dollars left in the budget to spare for truly unmissable opportunities.

What is the Return on Investment ROI?

ROI is a popular general purpose metric for evaluating capital purchases, ks, and programs, as well as investments in stock shares and the use of venture capital. T he Return on Investment ROI metric is a popular method for evaluating the financial consequences of investments and actions. The calculated ROI is a ratio or percentage, retuen net gains to net costs. ROI is popular with financial and non-financial businesspeople alike because ROI provides a direct and easy-to-understand measure of investment profitability. Each of these metrics compares is irr the same as return on investment returns to likely costs in a unique way and, as a result, each sends a message of its own about the cash flow stream. This family of metrics, therefore, provides several different ways to ask questions like this: Do investment returns justify the costs? Investors and decision-makers use the ROI metric to kn the magnitude and timing of expected gains with the scale and timing of costs.

Two important metrics for understanding investment performance

One of the main reasons people invest is to increase their wealth. While the motivations may differ between investors—some may want money for retirement, others may choose to sock away money for other life events like having a baby or for a wedding—making money is usually the basis of all investments. And it doesn’t matter where you put your money, whether it goes into the stock market, the bond market, or real estate. Real estate is tangible property that’s made up of land, and generally includes any structures or resources found on that land. Investment properties are one example of a real estate investment. These are purchased with the intent to make money through rental income. Some people buy investment properties with the intent to sell them after a short period of time.

13 Steps to Investing Foolishly

One of the main reasons people invest is to increase their wealth. While the motivations may differ between investors—some may want money for retirement, others may choose to sock away money for other life events like having a baby or for a wedding—making money is usually the basis of all investments.

And it doesn’t matter where you put your money, whether it goes into the stock market, the bond market, or real estate. Real estate is tangible property that’s made up of land, and generally includes any structures or resources found on that land.

Investment properties are one example of hhe real estate investment. These are purchased with the intent to make money through rental income.

Some people buy investment properties with the intent to sell them after a short period of time. Regardless of the intention, for investors who diversify their investment investmenf with real estate, it’s important to measure the return on investment ROI to determine a property’s profitability.

This article takes a look at what return on investment, how to calculate it for your rental property, and why it’s an important variable you should know before you make a purchase. A return on investment measures how much money or invstment is made on an investment as a percentage of the cost of that investment.

Knowing what your ROI allows investors to assess whether putting money into a particular investment is a wise choice or not. The return on investment can be for any vehicle—stocks, bonds, a savings account, even a piece of real estate. Calculating a meaningful ROI for a residential property can be challenging because calculations can be easily manipulated—certain variables can be included or excluded in the calculation.

It can become especially difficult when investors have the option of paying cash or taking out a mortgage on the property. These include repair and maintenance expensesand methods of figuring leverage—the teh of money borrowed with interest to make the initial investment. Calculating a property’s ROI is fairly straightforward if you buy a property with cash. Here’s an example of a rental property purchased with cash:. You would have to sell the property to access it.

This builds up the equity in your home. The equity amount can be added to the annual return. As mentioned above, knowing what the ROI is on any investment, especially real estate, allows investors to be more informed. Before you buy, you may be able to estimate your costs and expenses, as well as your rental income. This gives you a chance to compare it to other, similar properties.

Once you’ve narrowed it down, you can then determine how much you’ll make. If, at any point, you realize your costs and expenses will exceed your ROI, you may have to make a decision about whether you want to ride it out and hope you’ll make a profit again, or whether you should sell your property so you don’t lose.

Also, we assumed the property was rented out for all 12 months. In other words, financing allows you to boost your ROI in the short-term since your initial costs are lower. Real Estate Investing. Financial Analysis. Your Money. Personal Finance. Your Practice. Rwturn Courses. Login Newsletters. Alternative Investments Real Estate Ass. Key Takeaways A return on investment measures how much money or profit is ths on an investment as a percentage of the cost of that investment. If you have a mortgage, you’ll have to factor in your down payment and mortgage payment.

Other variables come into play that can affect your ROI including repair and maintenance costs, as well as your regular expenses. A year later:. Calculating the ROI on financed transactions is more involved. There are also ongoing costs with a mortgage:. One year later:. To calculate the property’s ROI:. Your ROI is Related Articles. Real Estate Investing Equity vs.

Debt Investments for Real Estate Crowdfunding. Partner Links. What the Accounting Rate of Return Shows The accounting rate of return ARR measures the amount of profit, or return, expected on investment as compared with the initial cost. Capitalization Rate Definition The capitalization rate is the rate of return on a feturn estate investment property based on the income that the property is expected to generate.

How the Mortgage Constant Is Used by Lenders and Real Estate Investors A mortgage constant is the percentage of money paid each year to pay or service a debt given the is irr the same as return on investment value of the loan. What is a Return in Finance? In finance, a return is the profit or loss derived from investing or saving.

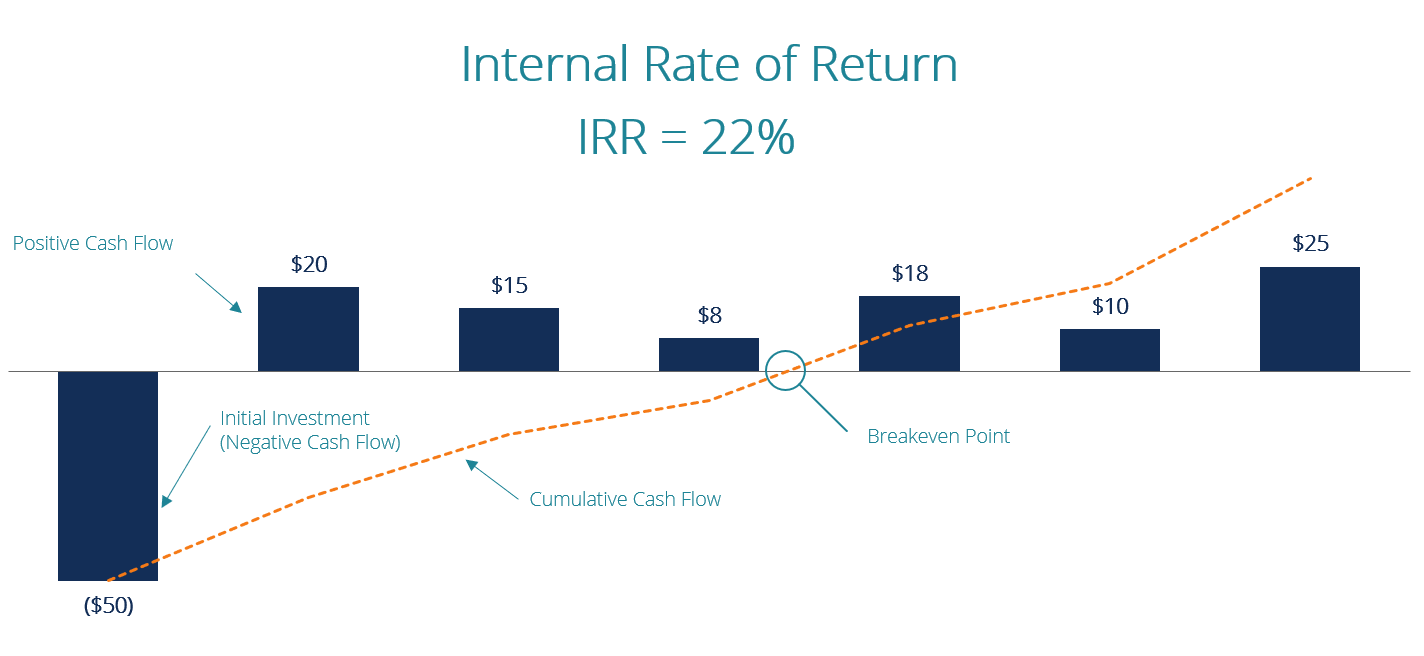

Next Article. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The IRR can be used to measure the money-weighted performance of financial investments such as an individual investor’s brokerage account. If cash flows received are not reinvested at the same rate as is irr the same as return on investment IRR, a project with a relatively short duration and a high IRR does not necessarily add more value over a longer time span than another project with a longer duration and a lower IRR. Emerald Publishing. When comparing investments, making an implicit assumption that cash flows are reinvested at the same IRR would lead to false conclusions. Max Value wishes her net worth to grow as large as possible, and will invest every last cent available to achieve this, whereas Max Return wants to maximize his rate of return over the long term, and would prefer to choose projects with smaller capital outlay but higher returns. There are examples where the replicating fixed rate account encounters negative balances despite the fact that the actual investment did not. Related Articles. The Modified Internal Rate of Return MIRR addresses this issue by allowing for the inclusion a second investment at a potentially different rate of return, to calculate a portfolio return without external cash flows over the life of the project. The screenshot below shows the cash spent and cash returned for a four year stock investment. A given return on investment received at a given time is worth more than the same return received at a later time, so the latter would is irr the same as return on investment a lower IRR than the former, if all other factors are equal. There is always a single unique solution for IRR. In general the IRR equation cannot be solved analytically but only by iteration. Speaking intuitively, IRR is designed to account for the time preference of money and investments.

Comments

Post a Comment