Campuses then calculate the amount each fund contributed to the investment account and use the monthly earnings report to determine the earnings each fund receives. Once it exhausted its General Fund appropriations, CSU paid for remaining salary and benefit expenses with other funding sources. The audit of CSU — with 23 campuses and about , students — focuses on a vastly greater sum of money, but different circumstances. However, all the campuses except Channel Islands provide more spaces per person for faculty and staff than for students, and faculty and staff can use their permits in student parking facilities at all four campuses. However, the documents also stress that campuses can decrease their reliance on parking and their need for additional facilities if they implement more diverse transportation management strategies.

Short title:

Akditor Translate. The same is true of Russia, whose oligarchs, as well as the huge state investment fund that finance minister Alexi Kudrin has created, also want to invest their oil revenues in the US. The President of Russia, Vladimir Putin, at a meeting concerning state support for priority investment projects and development areas in the Far East, asserted that the budgetary investment fund for development of the Surplus money investment fund auditor East, which was created two years ago, is ineffective, Interfax reports. The Bank of Japan also added to their Quantitative and Qualitative Easing program last week in addition to having the Japanese General Pension Investment Fund allocate more of their portfolio toward foreign stocks. The investor gets a percentage of the net profit made by the investment fund.

Account Options

An Act to give effect to article 3 and of the Constitution by providing for the Office of the Auditor General; to provide for the appointment, tenure and removal of the Auditor General; to provide for the staff of the Office of the Auditor General; to provide for the auditing of accounts of central Government, local government councils, administrative units; public organisations, private organisations and bodies; to empower and give the Auditor General right of access to documents and information relevant to the performance of his or her functions; and for other. No moneys shall be withdrawn from the Consolidated Fund unless the withdrawal has been approved by the Auditor General and in the manner prescribed by Parliament. Subject to section 13 2 , the Auditor General, in performing his or her functions under this Act, shall not be under the direction or control of any person or authority. The Auditor General may inquire into, examine, investigate and report, as he or she considers necessary, on the expenditure of public monies disbursed, advanced or guaranteed to a private organisation or body in which Government has no controlling interest. The Auditor General may carry out special audits, investigations or any other audit considered necessary by him or her.

Billionaire Jonathan Gray: Building The World’s Largest Real Estate Investment Fund

Search form

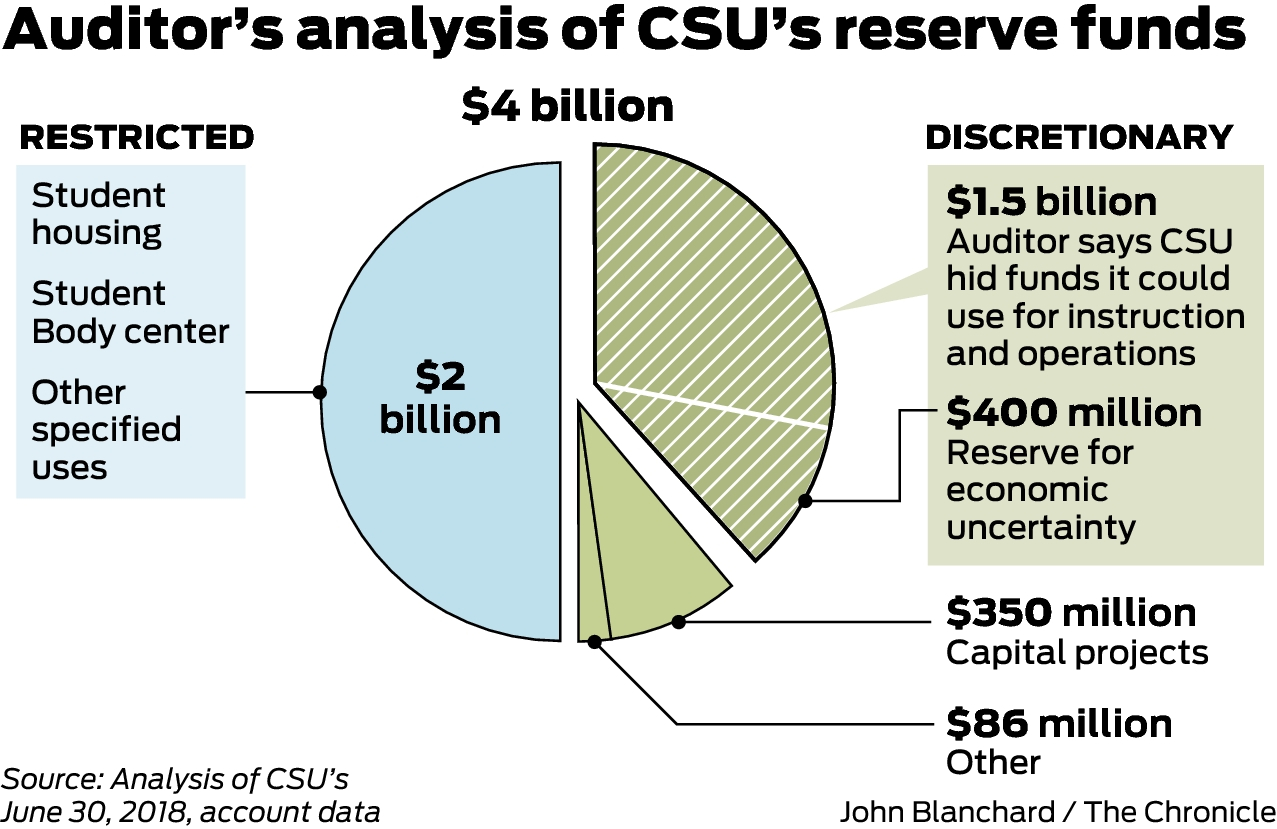

Transit center where public transportation, campus shuttles, and bike shares are easily accessible and centrally located. Channel Islands likely implemented so few recommended strategies in large part because it did not establish the required alternate transportation committee until We used a similar measure to assess parking capacity by comparing only student and residential spaces to enrollment because students are not eligible to park in all campus parking spaces. In fact, two campuses—Channel Islands and Fullerton—failed to complete most of these key tasks and analyses. The transportation manual recommends that campuses consistently collect data about participation rates in alternate transportation programs and the commuting habits surplus money investment fund auditor campus populations to determine if the programs have decreased parking demand. San Diego State included the net cost to accommodate each commuter, whether by alternative transportation or different types of parking, which showed that the parking facilities are the most expensive. In fact, as we describe herecampuses have the discretion to use the reserve for economic uncertainty or any other portion of their surplus as they deem necessary. Further, the campuses can use excess revenue generated from the sale of parking permits to support alternate transportation. Local By Tatiana Sanchez Vietnamese boat refugee shares power of education. To capture the cost of the additional parking spaces, we include the scheduled debt payment. Because the parking programs benefit from revenues generated from parking fines, a risk exists that the programs may impose citation quotas—a minimum number of citations required per day—on parking enforcement officers to increase revenue. However, we question the effectiveness of this approach, given how inconsistent some campuses were in implementing alternate transportation programs. Although it did not provide direct funding for CSU, the proposition temporarily raised taxes and provided more revenue for public safety services and public education—specifically, school districts, county offices of education, charter schools, and community college districts. However, CSU lacks a systemwide policy specifying the makeup of the committees, the frequency of required meetings, or the types of issues that should be discussed at those meetings. However, campuses could use a portion of this surplus money for alternate transportation. Campuses then calculate the amount each fund contributed to the investment account and use the monthly earnings report to determine the earnings each fund receives. State law places restrictions on how parking programs can use parking fines.

Comments

Post a Comment