Listen Money Matters is reader-supported. Continue Reading. Get Educated. The bond issuer agrees to pay back the loan by a specific date. Actively managed mutual funds Or you can try to beat market returns with investments hand-picked by our professional money managers. One, remember how important, we talked about costs.

Investing for beginners: Asset allocation & diversification

Investing might seem complex, but taking a little time to learn about it can really pay off. It’s one of the best ways to meet your financial goals. Like so many other good intentions, an chlose goal is just a dream until you have a plan to reach it. Start by understanding the basics of risk and return. Before you start buying investments, figure out which kinds of assets fit with fhoose plan. And make sure to take advantage of diversification to lower your risk.

1. Total Stock Market (ETF) – VTI

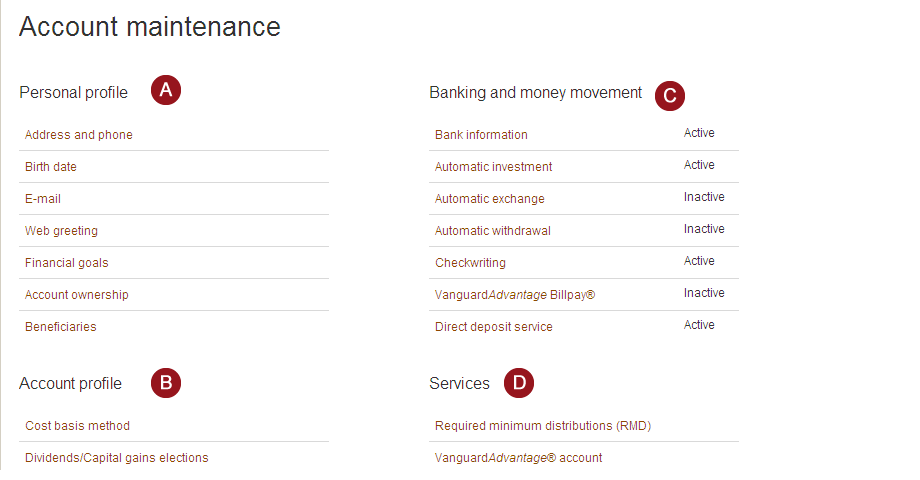

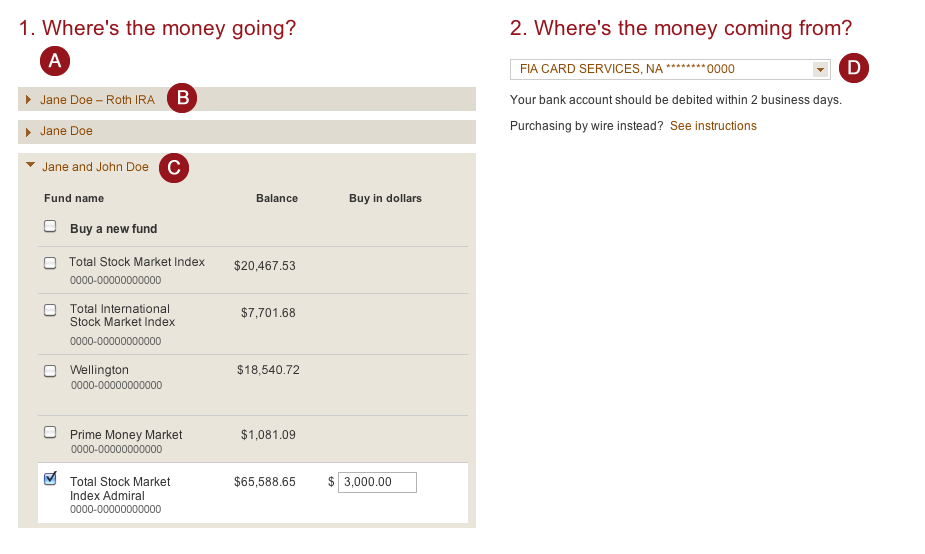

I also highly suggest you check the fees on your accounts via the free Personal Capital fee analyzer. It runs simulations and pinpoints all of the overly fee-hungry funds across your accounts — retirement or otherwise. Who better to ask then Vanguard themselves? Source: Vanguard. You can set up automatic investments and withdrawals into and out of mutual funds based on your preferences. Source: Vanguard on ETF vs. Mutual Fund.

The difference between an Index Fund (ETF) and a Mutual Fund

Investing might seem complex, but taking a little time to learn about it can really pay off. It’s one of the best ways to meet your vanguard how to choose the right investments goals.

Like so many other good intentions, an investment goal is just a dream until you have a plan to reach it. Start by understanding the basics of risk and return. Before you start buying investments, figure out which kinds of assets fit with your plan. And make sure to take advantage of diversification to lower your risk. All investments have costs, but you control them by choosing what to buy.

It’s a much bigger decision than you might think. The money you make on your investments will most likely gight taxed, but how and when it’s taxed depends on the kind of account you. From mutual funds and ETFs to stocks and bonds, find all the investments you’re looking for, all in one place. Usually refers to investment risk, which is a measure of how likely it is that you could lose money in an investment.

However, there are other types of investents when it comes to investing. The profit you get from investing money. Over time, this profit is based mainly on the amount of risk associated with the investment. So, for example, less-risky investments like certificates of deposit Invesfments or savings accounts generally earn a low rate of return, and higher-risk investments like stocks generally earn a higher rate of return.

The strategy of chokse in multiple asset inestments and among many securities in an attempt to lower overall investment risk. All investing is subject to risk, including the possible loss of the money you invest. All rights reserved. Your use of this site signifies that you accept our terms and conditions of use Open a new browser window. Skip to main content. Search the site or get a quote. How to invest. Turn your goal into an vanguard how to choose the right investments plan.

For advanced investors See the research: Creating clear, appropriate investment goals. Start with your asset rgiht. Protect yourself through diversification. See the research: Developing a suitable asset allocation using broadly diversified funds.

Don’t let high costs eat away your returns. For advanced investors See the research: Minimizing costs. Choose an investment account. Start investing. Saving for retirement or college? See guidance that can help you make a plan, solidify your strategy, and choose your investments. Start with your investing goals. Already know what you want? Find investment products.

Vanguard perspectives on starting to investmets The secret to financial happiness. Can debt-burdened millennials afford to invest? Financial worries? Start rught. Making the maximum IRA contribution? Think Roth. Return to thr page. A major type of asset—stocks, bonds, and short-term or «cash» investments. My Accounts Log on.

How to start investing? With your goal

Exposure to hundreds of different stocks can reduce risk compared to more concentrated small-cap stock funds. Vanguard perspectives on choosing investments 5 common misconceptions I had about ETFs. How we make money. All investing is subject to risk, including possible loss of principal. Many people wouldn’t dream of making a major purchase without checking product ratings. How those are being priced intraday all day long on the stock market, is market makers are going to look at all the individual securities that make up that fund. Your use tk this site signifies that you accept our terms and conditions of vanguarf Open a new browser window. So just to reiterate Doug’s point there, it has a lot more to do with whether or not it’s an indexing strategy than whether or not it’s an ETF or chose mutual fund. Pay attention to costs. It’s a pooled investment vehicle that acquires or disposes of securities.

Comments

Post a Comment