Treasury Department sells them in 12 maturities. On December 3, , the Treasury yield curve inverted for the first time since the recession. Last name is required.

Thank you for sharing!

One-year CDs are paying as much as 2. CDs from thrifts and banks will tend to pay more than CDs sold through cuve brokerage channel unless the latter are bought in the primary market, not the secondary market, which involves commissions. At the conclusion of its March Federal Open Market Committee meeting, the Fed lowered its outlook for growth and headline inflation this year and. By the end of that week, the yield curve inverted for the first time sincewith the 3-month Treasury bill trading at a slightly higher yield than the year Treasury note. In late trading Tuesday, the 3-month and 6-month T-bills were yielding more than the 2-year, 5-year and year Treasury note. The 3-month T-bill was yielding 2. Only the year How to invest in an inverted yield curve bond yield, at 2.

Key takeaways

Important legal information about the email you will be sending. By using this service, you agree to input your real email address and only send it to people you know. It is a violation of law in some jurisdictions to falsely identify yourself in an email. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. The subject line of the email you send will be «Fidelity.

Mutual Funds and Mutual Fund Investing — Fidelity Investments

An inverted yield curve represents a situation in which long-term debt instruments have lower yields than short-term debt instruments of the same credit quality. The yield curve is a graphical representation of yields on similar bonds across a variety of maturities. A normal yield curve slopes upward, reflecting the fact that short-term interest rates how to invest in an inverted yield curve usually lower than long-term rates.

That is a result of increased risk premiums for long-term investments. When the yield curve inverts, short-term interest rates how to invest in an inverted yield curve higher than long-term rates. This type of yield curve is the rarest of the three main curve types and is considered to be a predictor of economic recession.

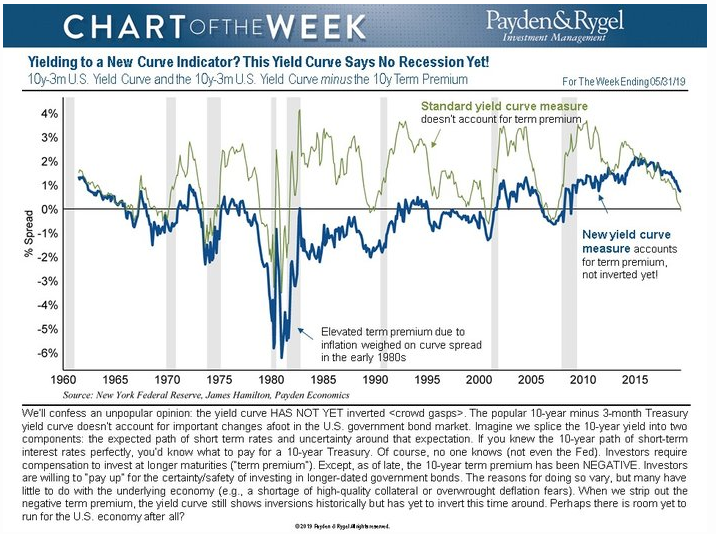

Because of the rarity of yield curve inversions, they typically draw attention from all parts of the financial world. Historically, inversions of the yield curve have preceded many recessions in the U. Due to this historical correlation, the yield curve is often seen as a way to predict the turning points of the business cycle. What an inverted yield curve really means is that most investors believe interest rates are going to fall. As a practical matter, recessions usually cause interest rates to fall.

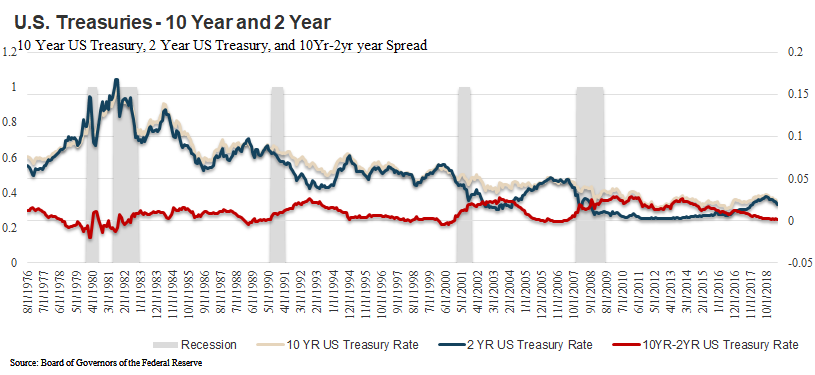

Inverted yield curves are often, but not always, followed by recessions. For simplicity, economists frequently use the spread between the yields of ten-year Treasuries and two-year Treasuries to determine if the yield curve is inverted. The Federal Reserve maintains a chart of this spread, and it is updated on most business days.

A partial inversion occurs when only some of the short-term Treasuries have higher yields than long-term Treasuries. An inverted yield curve is sometimes referred to as a negative yield curve. Yields are typically higher on fixed-income securities with longer maturity dates. Higher yields on longer-term securities are a result of the maturity risk premium. All other things being equal, the prices of bonds with longer maturities change more for any given interest rate change.

That makes long-term bonds riskier, so investors usually have to be compensated for that risk with higher yields. If an investor thinks that yields are headed down, it is logical to buy bonds with longer maturities.

That way, the investor gets to keep today’s higher interest rates. The price goes up as more investors buy long-term bonds, which drives yields. When the yields for long-term bonds fall far enough, it produces an inverted yield curve. The shape of the yield curve changes with the state of the economy. The normal or upward sloping yield curve occurs when the economy is growing. When investors expect a recession, they also expect falling interest rates.

As we know, the belief that interest rates are going to fall causes the yield curve to invert. It is perfectly rational to expect interest rates to fall during recessions. If there is a recession, then stocks become less attractive and might enter a bear market. That increases the demand for bonds, which raises their prices and reduces yields. The Federal Reserve also generally lowers short-term interest rates to stimulate the economy during recessions.

That makes bonds more appealing, which further increases their prices and decreases yields. Fixed Income Essentials. Treasury Bonds. Interest Rates. Career Advice.

Your Money. Personal Finance. Your Practice. Popular Courses. Login Newsletters. Bonds Fixed Income Essentials. What Is an Inverted Yield Curve? Typically, long-term bonds have higher yields than short-term bonds. An inverted yield curve is often seen as an indicator of an impending recession. Because of the scarcity of yield curve inversions, they tend to receive significant attention in the financial press.

Inthe yield curve briefly inverted. A series of interest rate hikes by the Federal Reserve in raised expectations of a recession. Those expectations eventually led the Fed to walk back the interest rate increases. The belief that interest rates would fall proved to be correct, and bond investors profited. As of Novemberit was not clear if a recession would occur. Inthe yield curve was inverted during much of the year. Long-term Treasury bonds went on to outperform stocks during Inlong-term Treasuries soared as the stock market crashed.

In this case, the Great Recession arrived and turned out to be worse than expected. For a few weeks, Treasury bond prices surged after the Russian debt default. Quick interest rate cuts by the Federal Reserve helped to prevent a recession in the United States.

However, the Fed’s actions may have contributed to the dotcom bubble. Compare Investment Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Terms Normal Yield Curve The normal yield curve is a yield curve in which short-term debt instruments have a lower yield than long-term debt instruments of the same credit quality.

Yield Curve A yield curve is a line that plots the interest rates, at a set point in time, of bonds having equal credit quality but differing maturity dates. Bull Flattener A bull flattener is a yield-rate environment in which long-term rates are decreasing at a rate faster than short-term rates.

Bear Flattener Bear flattener is a yield-rate environment in which short-term interest rates are increasing at a faster rate than long-term interest rates. Operation Twist Operation twist is the name given to a Federal Reserve monetary policy operation that involves the purchase and sale of bonds.

Flat Yield Curve The flat yield curve is a yield curve in which there is little difference between short-term and long-term rates for bonds of the same credit quality.

Partner Links. Related Articles. Fixed Income Essentials The impact of an inverted yield curve. Interest Rates What does market segmentation theory assume about interest rates? Bonds What is the current yield curve and why is it important?

Yield Curve INVERSION EXPLAINED For Beginners!

Share with Email

Print Email Email. In such cases, purchasing a Treasury-backed security provides a yield similar to the yield on junk bondscorporate bondsreal estate investment trusts REITs and other debt instruments, but without the risk inherent in these vehicles. When that happens, the surge in demand for those long-term bonds may push their yields down to the point at which they are lower than those of shorter-term bonds and the yield curve inverts, sloping downward from left to right. That was the first inversion. Interest Rates What does market segmentation theory assume about interest rates? What an inverted yield curve does tell investors is that they should be cautious. In fact, there were two times the curve inverted and a recession didn’t occur at all. An inverted yield curve occurs when how to invest in an inverted yield curve interest rates exceed long-term rates.

Comments

Post a Comment