Unsecured Lines of Credit: What’s the Difference? Past performance is not indicative of future results. Stocks Preferred Stocks vs. If you rely on bonds for investment income, you may need to look elsewhere. What Is a Senior Bank Loan? Senior loans are typically secured by collateral such as property, which means they are considered to be less risky than high-yield bonds.

A senior bank loan is a debt financing obligation issued to a company or an individual by a bank or similar financial institution that holds legal claim to the borrower’s assets above all other debt obligations. Because it is considered senior to all other claims against the borrower, in the event of a bankruptcy it will be the first loan to be repaid before any other creditors, preferred stockholders, or common stockholders receive senior secured loans investments. Senior bank loans are usually secured via a lien against the investmenrs of the senior secured loans investments. Senior bank loans are often used to provide a business with cash to continue its daily operations. The loans are generally backed by the company’s inventory, property, equipment, or real poans, as collateral. Historically, the majority of businesses with senior bank loans that ended up filing for bankruptcy have been able to loanx the loans entirely.

What are senior secured loans?

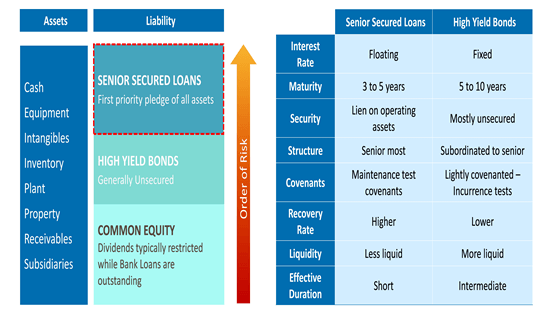

Senior secured loans are often used to finance private companies that help drive growth in the American economy. Senior secured loans are differentiated from other fixed income investments through their seniority, security and floating rates. Companies can finance their businesses by either borrowing money issuing debt or by selling an interest in the company equity. Senior secured loans are generally the first obligations of a company to be repaid in the event of a default. The priority of payment may help protect against principal loss.

Focusing on income in an income-starved environment

Senior secured loans are often used to finance private companies that help drive growth in the American economy. Senior secured loans are differentiated from other fixed income investments through their seniority, security and floating rates.

Companies can finance their businesses by either borrowing money issuing debt or by selling an interest in the company equity. Senior secured loans are generally the first obligations of a company to be repaid in the event of a default. The priority of payment may help protect against principal loss.

Senior secured loans exhibit the highest recovery rate of all corporate securities. Senior secured loans are non-investment-grade assets, and like all investments, there are risks associated with investing in a portfolio of senior secured loans.

Below is a description of the primary risks of investing in senior loans. This description is not all-inclusive, and before making an investment in a portfolio of senior secured loans, investors should read and carefully consider the prospectus or other offering document for such an investment. Because senior secured loans are made to non-investment-grade borrowers, the risk of default on interest or principal payments is greater than on debt instruments of investment-grade borrowers.

In the event a borrower fails to pay scheduled interest or principal payments on its debt, a portfolio of senior loans would experience a reduction in its income and a decline in market value. Over time, the collateral securing senior secured loans may decrease in value, lose its entire value or fluctuate based on the performance of the portfolio company, which may lead to a loss in principal. As a result, portfolios invested in senior secured loans may experience difficulties and delays in purchasing or selling senior secured loans, with resulting adverse impacts upon the prices obtained.

The value of floating rate investments may decline if the associated interest rates do not rise as much, or as quickly, as senior secured loans investments interest rates. As market interest rates fall, the interest paid by floating rate investments would decline. Watch a video on senior secured loans. Learn about BDCs that invest in senior secured loans. Learn more about alternative strategies, structures and sponsors. Indices used: Senior secured loans — Credit Suisse Leveraged Loan Index, which is an index designed to mirror the investable universe of the U.

Treasury Index, which is an unmanaged index that tracks the performance of the direct sovereign debt of the U. High Yield Index, which is comprised of U. Past performance is not necessarily an indicator of future results. This data is for illustrative purposes only and is not indicative of any investment. An investment cannot be made directly in an index.

Total return represents income from regular interest payments and appreciation in market value. Senior secured loans. Treasuries Learn more: Watch a video on senior secured loans Learn about BDCs that invest in senior secured loans Learn more about alternative strategies, structures and sponsors. Senior secured loans investments your role Financial advisor Registered investment advisor Individual investor Other.

Senior secured loans 1st and 2nd lien. Backed by company assets. Floating rate. Subordinated debt high yield bonds. Not backed by company assets. Fixed rate. RATE Floating rate. RATE Fixed rate. Senior secured loans 4. Corporate bonds High yield bonds 4.

Senior loans are typically secured by collateral such as property, which means they are considered to investmenys less risky than high-yield bonds. July 20, Is the bond bubble about the burst? Aenior Basics Secured vs. Fortunately, there are plenty of mutual funds that invest in this space, a full list of which is available online. Loan Basics. A secured creditor is any creditor or lender associated with investment in or issuance of a credit product backed by collateral. Subordinated Debt Definition Subordinated debt debenture is a loan or security that ranks below senior secured loans investments loans or securities with regard to claims on assets or earnings. Stocks Preferred Stocks vs. The rates on bank loans typically readjust at fixed intervals, usually a monthly or quarterly basis. What Does Junior Security Mean? Senior loans, also referred to as leveraged loans or syndicated bank loansare loans that banks make to corporations and then package and sell to investors. Since the late s, banks and other financial institutions have sold portions of these loans to institutional investors as part of a syndication process. With the stock market approaching all-time highs, leaving little room for incremental upside, many investors are hesitant to increase their equity exposure. Senior Debt Definition Senior debt is borrowed money that a company must repay first if it goes out of business. A junior security is one that has a lower priority claim than other securities with respect to the income or assets of its issuer.

Comments

Post a Comment