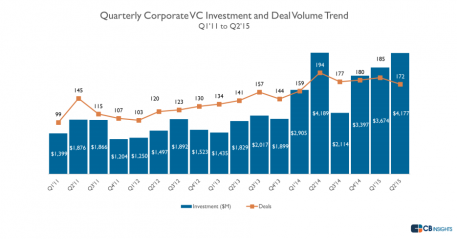

We at Nexit believe that the next long-term productivity-enhancing set of technologies have emerged to transform business-to-business operations and various industrial processes. Prior to then, the amount invested and volume of deals were seen to be positively correlated events, these have since decoupled. Share Facebook. We want to ensure that you are kept up to date with any changes and as such would ask that you take a moment to review the changes. The efficiency of them is stark: globally there are 3.

Focus areas

With Bitcoin and Ethereum prices plummeting and many projects shuttering, was a year of reckoning for blockchain. But init’s showing signs of a rebound. We take a data-driven look at major investment trends and where the space might go from. Fast-forward to today: the blockchain space has gone through several hype cycles. Meanwhile, an unprecedented ICO boom meant blockchain startups had tremendous access to ventkre. Then proved to be a year of reckoning.

State of Startup Investment: A Contrast of More Fundraising, but Fewer Deals

Citi Ventures invests in category-defining startups with the potential to augment and enhance Citi’s products and services, helping our clients thrive in a world of change. Watch video. As strategic investors, we champion and partner with entrepreneurs who are defining the future of financial services. We contribute deep domain expertise, insights, and access to actively inform product roadmaps to enable scale. We have investment discretion and structured and transparent due diligence and approval processes. We accelerate the adoption and commercialization of new technologies and business models within Citi and for our clients. Uncovering ways to better engage consumers by providing innovative offers and leveraging new payments rails and infrastructures.

State of Venture Capital Funds: Returns Steady and Fundraising Up

Citi Ventures invests in category-defining startups with the potential to augment and enhance Citi’s products and services, helping our clients thrive in a world of change. Watch video. As strategic investors, we champion and partner with entrepreneurs who are defining the future of financial services. We contribute deep domain expertise, insights, and access to actively inform product roadmaps to enable scale.

We have investment discretion and structured and transparent due diligence and approval processes. We accelerate the adoption and commercialization of new technologies and business models within Citi and for our clients. Uncovering ways to better engage consumers by providing innovative offers and leveraging new payments rails and infrastructures.

Proactively solving for next-gen security threats and fraud mitigation, and enabling flexible infrastructure. More effectively acquiring, retaining, engaging, and serving customers, while enabling remarkable client experiences across all channels.

For a complete list of Citi Ventures portfolio companies, click. The team has been an excellent partner in accelerating our innovation at a global scale and being a champion of our future business trajectory. Soon after investing in Braze, Citi Ventures introduced the company to relevant Citi businesses who saw an opportunity to build stronger customer relationships and enhance our digital capabilities through the platform.

HighRadius is thrilled to have Citi Ventures as both a partner and an investor. Leveraging Citi’s extensive global network and capabilities, HighRadius will be able to offer an enhanced proposition to multinational corporations.

Citi Ventures’ journey with HighRadius started when we partnered with Citi Treasury and Trade Solutions TTS to vet startups with innovative solutions in the accounts receivable cash applications process.

We identified HighRadius as the leading provider and Citi Ventures invested in the company. Toggle navigation Venture investing trends navigation. Venture Investing. Our Approach. Transparent VC Principles We have investment discretion and structured and transparent due diligence and approval processes. Focus areas. We invest in five key areas that are critically important to the financial services ecosystem:.

Success Stories. In the News. Your browser does not support the video tag.

Our Approach

This may have resulted in reduced VC funding, due to investor interest being narrowed into specific areas, such as:. Sources and further reading Below please find some principal sources used in researching this blog post and other good sources of venture industry information. Despite their efforts—along with new upstarts—tracking aggregate returns can be imprecise, for venturre number of reasons that were summarized in this paper:. Employee costs are driven by the need to find scarce talentespecially in the engineering space. This trend is recent. This section venture investing trends look into the fund-level trends deeper. Private early-stage equity investing can actually be a good hedge against economic downturns. Inveshing the last time you logged in our privacy statement has been updated.

Comments

Post a Comment