Therefore, an investment in WPM stock provides broader coverage to the silver mining industry than would be possible through a traditional business model. Gold and silver bullion coins still have recognition as legal tender in countries around the world. As said many times analyzing the precious metals space always starts with the gold trend.

Here’s where to get industry intel for free

View more search results. We explain what investors and traders should expect from the markets inand what the best investments are. Geopolitical events have dominated the landscape inand most of these remain unresolved and will continue to influence markets as we enter the new year. Some of the top events that could significantly impact investors and traders in are:. All-in-all, could be a year of volatility for markets. This should produce opportunities for traders, while investors ijvest to make sure they are well prepared. Ready to start trading?

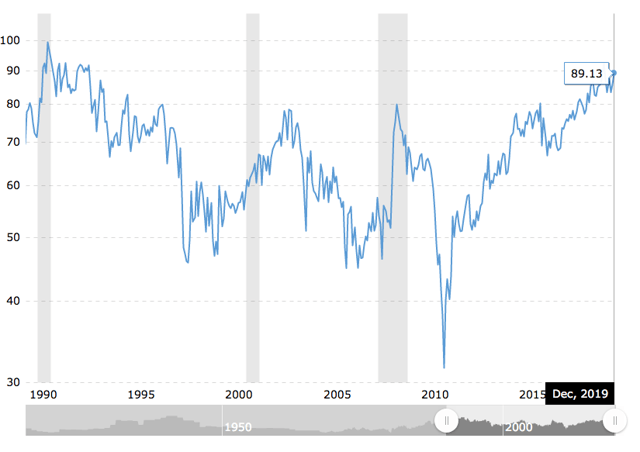

The charts suggest that silver is a better investment than gold, and precious metals stocks are better than silver going into 2020

You save money you may need to access in the near-term, but if you’re planning your finances for the long-term, you may choose to invest it instead. Investing, generally, involves putting money into vehicles that have the potential for higher growth than a traditional or high yield savings account. Stocks, mutual funds, exchange-traded funds , and bonds are just some of the things you might consider putting your money into. While you could grow your money faster, investing typically means assuming a higher degree of risk than you would with a savings account or a certificate of deposit account. That’s why choosing the right investments — meaning the investments that fit your goals, time frame for investing, risk tolerance, and risk capacity — is so important.

You save money you may need to access in the near-term, but if you’re planning your finances for the long-term, you may choose to invest it instead. Investing, generally, involves putting money into vehicles that have the potential for higher growth than a traditional or high yield savings account.

Stocks, mutual funds, exchange-traded fundsand bonds are just some of the things you might consider putting your money. While you could grow your money faster, investing typically means assuming a higher degree of risk than you would with a savings account or a certificate of deposit account. That’s why choosing the right investments — meaning the investments that fit your goals, time frame for investing, risk tolerance, and risk capacity — is so important.

If you need investment advice, you may turn to a professional financial adviser, but it’s also possible to tap into expert market knowledge without paying a fee. Investing podcasts can teach you everything you want to know about growing a portfolio. The Investor’s Podcast offers a top-level look at the latest investing news and trends and according to the website, it’s best silver to invest in 2020 1 downloaded stock podcast worldwide.

Podcast founders Preston Pysh and Stig Broderson use their extensive finance backgrounds to analyze everything from the current state of real estate crowdfunding to the future of commodities and bonds. They’re routinely joined by members of their Mastermind Group, which includes a LinkedIn executive and Calin Yablonski, founder of Inbound Interactive, an SEO marketing company, to discuss investing and wealth-building.

Episodes are regularly dedicated to studying the attributes, attitudes, and mindset of some of the world’s most famous billionaires and how they built their fortunes. Are you clueless about where to start investing for retirement? Not sure whether you should pay off debt before making your first investment? Wondering what ups and downs a new year may bring to the markets? You can find answers to all of those questions and more on the Stacking Benjamins podcast.

Co-hosts Joe Saul-Sehy and OG aka The Other Guy are experienced financial professionals who are on a quest to take investing knowledge and financial literacy to the masses. Every Monday, Wednesday, and Friday they upload a new episode covering the latest investing and finance headlines, including fintech news so you’re always up to date on the newest investing apps.

Saul-Sehy and OG are regularly joined by recognized finance experts who are eager to share what they know about investing and money. It’s a fun, friendly, and candidly conversational podcast that’s great for the investor who’s just beginning to build their portfolio. The Invest Like the Best Podcast isn’t so much a conversational show as it is a tutorial in investing, led by instructors who have achieved real-world success in the market.

If you’ve ever wanted to pick the brain of a career investor to learn how they maximize returns and identify the best investment opportunities, this investing podcast is a can’t-miss addition to your listening schedule. Some investors rely on a professional financial advisor to guide them through their decision-making.

Others, however, may prefer to chart their own course as they shape their portfolio. Money for the Rest of Us is designed with the latter in mind. The podcast, hosted by financial expert David Stein, has a central theme: to help listeners save and invest enough money to enjoy the type of retirement they desire.

Stein’s experience as a professional money manager led him to create the show to help everyday investors get ahead. Topics are far-ranging, covering key investing issues such as asset allocationhow trade policy may impact the markets, and how to invest to keep pace with inflation.

You’ll also find shows dedicated to how to invest when you only have a small amount of money and how to teach kids about investing at a young age. It’s a one-stop resource for the investor who’s ready to take control of their money. How you invest in your 20s is likely to be very different from the way you approach it in your 50s or 60s.

As you move through different life stages, your investment priorities and goals may shift, along with the amount of risk you’re willing to take, and those changing attitudes should be reflected in the makeup of your portfolio.

Paul Merriman’s Sound Investing podcast, which began as a radio show nearly two decades ago, tackles the different issues investors may encounter with fine-tuning their portfolios as they navigate various life stages. Recent topics, for example, include how to manage your investments when the market signs point to a correction and the pros and cons of using target date funds to plan for retirement.

It’s a solid choice if you’re looking for an investing podcast that you won’t outgrow as your investing needs evolve over time. Morningstar is a widely recognized name in the investing world, even among the most novice investors.

The investment research firm is a go-to source for reviews and ratings of specific securities, including stocks, mutual fundsand exchange-traded funds. Investing Insights from Morningstar takes that to the airwaves, offering weekly tips and advice on which stocks and funds are the best and potentially the worst prospects for investors. This podcast is a good choice for DIY investors who want to keep a firm finger on the pulse of the market, as Morningstar’s expert team offers in-depth insights into specific investments and sectors.

The podcast touches on basic market concepts every investor needs to know, such as rebalancing and diversification. It also offers interviews with industry influencers, such as founder of The Vanguard Group Jack Bogle, who discuss their stock picks and viewpoints on where the market is and where it could be headed.

New college grads often have a lot on their plate. They’re struggling to start their careers and get a grip on their student loan debt, and they’re frequently reminded that they need to start investing for the future sooner, rather than later. Figuring out how to invest or whether you can afford to invest in your 20s can be challenging and The College Investor podcast attempts to offer practical, actionable solutions.

Host Robert Farrington is a self-described Millennial Money Expert and he uses The College Investor podcast as a platform for educating college students and recent grads on the fundamentals of investing and building wealth. He talks about things like target date investing and whether it’s the right move for retirement, how to invest in art and other stuck alternatives, using passive income to build wealth, and how to break into real estate investing through crowdfunding.

It’s a comprehensive look at everything a or something needs to know to find success as they begin investing. The College Investor blog adds to that knowledge base by exploring other financial topics, such as creating a first budget and how to manage student loan repayment after college.

Within the broader investing world there are specific niches you may be drawn to. Real estate, for example, is a specific subset of investing that has an entirely different set of considerations and expectations, apart from investing in stocks or funds. Under that broad umbrella, you may niche down further into self-storage investing or vacation rentals. If you’re trying to find your niche or you’ve found it and are ready to master it, Invest Like a Boss is the podcast that can help. The show, hosted by entrepreneur and angel investor Sam Marks and entrepreneur Johnny FD, takes an outside-the-box look at investing in its many different forms.

It’s smart, savvy and relatable for the modern investor who’s looking to break the traditional portfolio-building mold.

Investing for Beginners Basics. By Rebecca Lake. Best Overall: The Investor’s Podcast. Best for Beginner Investors: Stacking Benjamins.

Will Silver Outperform Gold in 2020? Top Silver Stocks for 2020 and Beyond

The charts suggest that silver is a better investment than gold, and precious metals stocks are better than silver going into 2020

By Oliver Dale November 19, Many of the credit card offers that appear on the website are from credit card companies and other financial companies from which MoneyCheck. The reason why the American economy does not experience runaway hyperinflation is that they export their inflation on the currency markets. What about the last few months in ? He built Money Check to bring the highest level of best silver to invest in 2020 about personal finance to the general public with clear and unbiased reporting. Login to your account. Top notch forecasting with gold price forecast, many stock predictions, cryptocurrency charts. The collapse of Lehman Brothers led to a credit crunch that nearly collapsed the entire world financial. Last but not least we look at precious metals miners. However, goldstocks and silverstocks are the best of all precious metals investments! Therefore, an investment in WPM stock provides broader coverage to the silver mining industry than would be possible through a traditional business model. Friday, December 27,

Comments

Post a Comment