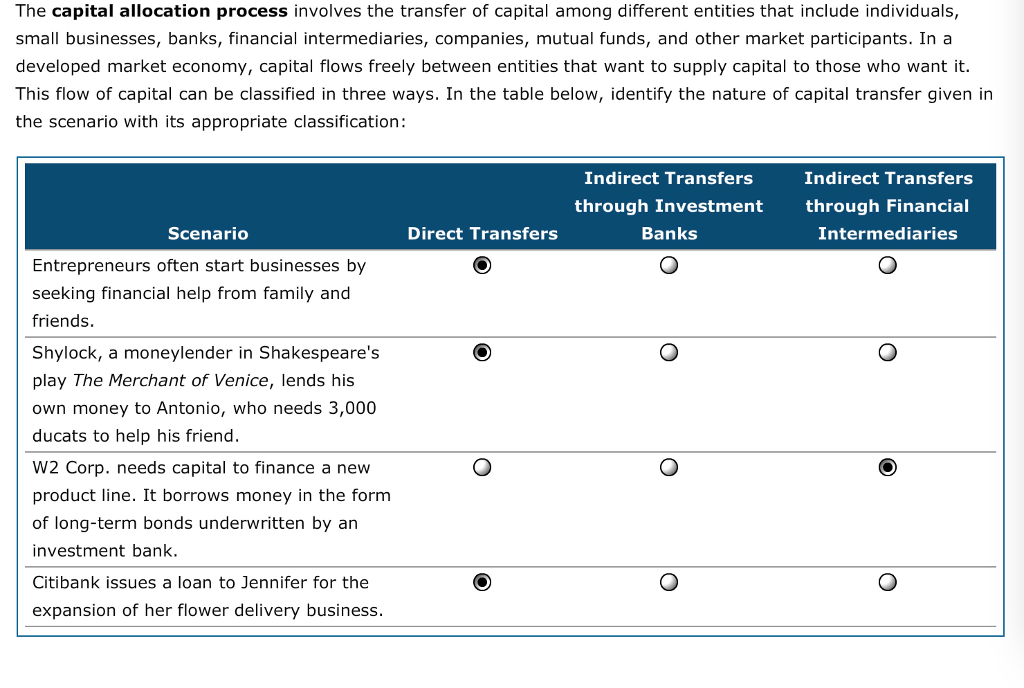

Size is an asset in the investment banking business, where bigger banks have a greater opportunity to profit by matching buyers and sellers. An investment bank IB is a financial intermediary that performs a variety of services. If you had to sought out your own saving, you might have to spend a lot of time and effort to investigate best ways to save and borrow.

From Wikipedia, the free encyclopedia

Banks are financial institutions that accept money deposits and make loans. They are a source of the financial intdrmediaries that is expanding the ways in which we can invest our savings. Banks loans create checking account deposits, a large component of the money supply. Banks are financial intermediaries that the average person interacts with most frequently. A person who needs a loan ss buy a house or a car usually obtains it from a ivestment bank. Most Americans keep a large proportion of their financial wealth in banks in the form of checking accounts, saving accounts, or other types of bank deposits. As a client of this bank I: make deposits, take investment banks as financial intermediaries, take out cash from cash dispensers, make utility payments, make money transfers, use consulting services on different issues, use assistance with issuing shares, arrange mergers and acquisitions, open different accounts.

Examples of Financial Intermediaries

.jpg)

A financial intermediary is an institution or individual that serves as a middleman among diverse parties in order to facilitate financial transactions. Common types include commercial banks, investment banks, stockbrokers, pooled investment funds, and stock exchanges. Financial intermediaries reallocate otherwise uninvested capital to productive enterprises through a variety of debt, equity, or hybrid stakeholding structures. Through the process of financial intermediation, certain assets or liabilities are transformed into different assets or liabilities. A financial intermediary is typically an institution that facilitates the channeling of funds between lenders and borrowers indirectly. This may be in the form of loans or mortgages.

Banks are financial institutions that accept money deposits and make loans. They are a source of the financial innovation that is expanding the ways in which we can invest our savings. Banks loans create checking account deposits, a large component of the money supply. Banks are financial intermediaries that the average person interacts with most frequently. A person who needs a loan to buy a house or a car usually obtains it from a local bank.

Most Americans keep a large proportion of their financial wealth in banks in the form of checking accounts, saving accounts, or other types of bank deposits. As a client of this bank I: make deposits, take loans, take out cash from cash dispensers, make utility payments, make money transfers, use consulting services on different issues, use assistance with issuing shares, arrange mergers and acquisitions, open different accounts.

The account manager spent lots of time in the office and never made mistakes in a balance sheet. Education is becoming a investment banks as financial intermediaries of general interest and many managers organize additional training for their staff.

Specialists of our research and development department have been designing the new model of this portable computer for a half of the year. He has been offered an interesting new job and now he is being paid a competitive salary for it. Coaching is the kind of additional training, which started in the mid-nineties and is still spreading. Scientists throughout the world study the problem of the future of human civilization on the Earth.

Banks are important for several reasons: 1. They provide a channel for linking people who want to save with those who want to invest. They play an important role in determining the money supply.

What are the functions of banks? How can an average person interact with banks as financial intermediaries?

What is FINANCIAL INTERMEDIARY? What does FINANCIAL INTERMEDIARY mean?

Popular Courses. These pool the small savings of individual investors and enable a bigger investment fund. A financial intermediary is an institution or individual that serves as a middleman among diverse parties in order to facilitate financial transactions. Brokers Stock Brokers. Wright and Vincenzo Quadrini. Most Investment banks specialize in large and complex financial transactions, such as underwriting, acting as an intermediary between a securities issuer and the investing public, facilitating mergers and other corporate reorganizations and acting as a broker or financial adviser for institutional clients. The largest investment banks have clients around the globe. A financial intermediary helps to facilitate the different needs of lenders and borrowers. Common types include commercial banks, investment banks, stockbrokers, pooled investment funds, and stock exchanges. Niche Banks Niche banks target a specific market or type of customer and tailor a bank’s advertising, product mix, and operations to this target market’s needs. If you have a risky investment.

Comments

Post a Comment