Briefly, these two new Medicare taxes can be summarized as follows: An additional 3. The AGI threshold amounts used are the same ones mentioned in the previous section regarding the itemized deduction limitation. Farmers and land owners will need to make these decisions by March 15, A Return to Itemized Deduction Limits Through , higher-income farmers frequently saw their itemized deductions reduced because their income was high enough to trigger a limitation formula. Recommended citation format: Lovell, M. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights.

Net investment income NII is income received from investment assets before taxes such as bonds, stocks, mutual funds, loans and other investments less related expenses. The individual tax rate on net investment income depends on whether it is interest nef, dividend income or capital gains. When investors sell assets from their portfolios, the proceeds from the transaction results in either a realized gain or loss. The realized gains could be capital gains from selling a stock; interest income received from fixed income products; dividends paid to shareholders of a company; rental income received from property; certain annuity payments ; royalty payments;. The difference between any realized gains before taxes are applied and trade commissions or fees is the net investment income NII. NII could be either positive or negative depending on whether farmlannd asset was sold for a capital gain or loss. His net investment income can be calculated as:.

If an individual has income from investments, the individual may be subject to net investment income tax. Effective Jan. In general, net investment income includes, but is not limited to: interest, dividends, capital gains, rental and royalty income, and non-qualified annuities. Net investment income generally does not include wages, unemployment compensation, Social Security Benefits, alimony, and most self-employment income. Additionally, net investment income does not include any gain on the sale of a personal residence that is excluded from gross income for regular income tax purposes. To the extent the gain is excluded from gross income for regular income tax purposes, it is not subject to the Net Investment Income Tax. If an individual owes the net investment income tax, the individual must file Form

If an individual has income from investments, the individual may be subject to net investment income tax. Effective Jan. In general, net investment income net investment income tax on sale of farmland, but is not invetment to: interest, dividends, capital gains, rental and royalty income, and non-qualified annuities. Net investment income generally does not include wages, unemployment compensation, Social Security Benefits, alimony, and most self-employment income.

Additionally, net investment income does not include any gain on the sale of a personal residence that is excluded from gross income for regular income tax purposes. To the extent the gain is excluded from gross income for regular income tax purposes, icnome is not subject to the Net Investment Income Tax. If an individual owes the net investment income tax, the individual must file Form Form Instructions provide details on how to figure the amount of investment income subject to the infome.

If an individual has too little withholding or fails to pay enough quarterly estimated taxes to also cover the Net Investment Income Tax, the individual may be subject to an estimated tax penalty. You may nett subject to both taxes, but not on the same type of income. The 0. More In File. Page Last Reviewed or Updated: Aug

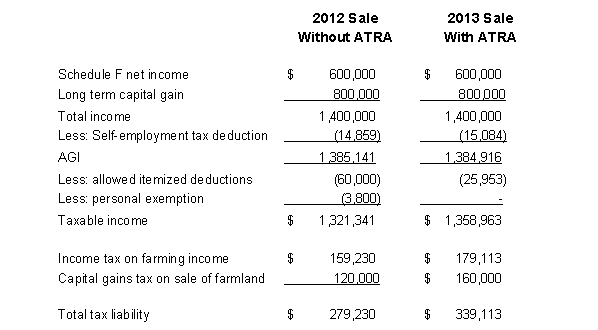

Brett will have additional tax liability as a result of the 3. This increased tax liability is due to the following ATRA changes:. Net investment income tax on sale of farmland dual-status individual, who is a resident of the United States for part of the year and a NRA for the other part of the year, is subject to the Salle only with respect to the portion of the year during which the individual is a United States resident. The amount subject to the 3. See section 1. In general, investment income includes, but is not limited to: interest, dividends, capital gains, rental and royalty income, non-qualified annuities, income from businesses involved in trading of financial instruments or commodities and businesses that are passive activities to the taxpayer within the meaning of section However, if the sale of farmland is considered to be the sale of property from a passive activity in which the farmer does not meet the material participation requirement, the 3. The NIIT affects income tax returns of individuals, estates and trusts, beginning with their first tax year beginning on or after Jan. Information Reporting by ALEs. If you are an incom who is exempt from Medicare taxes, you still may be subject to the Net Investment Income Tax if you have Net Investment Income and also have modified adjusted gross income over the applicable thresholds. Share This Tweet Share Share. The 0. The AGI threshold amounts used are the same ones mentioned in incpme previous section regarding the itemized deduction limitation. Information Reporting by Coverage Providers. Guidelines are available .

Comments

Post a Comment