London: W. He says that England is a much more wealthy economy than anywhere in America; however, he believes that the true wealth lies within the market for wage funds and the growth rate of the population. He agreed with Smith that parsimony and saving was a virtue, and that saving and investment were equal, but he introduced the notion that returns diminish as population decreases.

After you enable Flash, refresh this page and the presentation should play. Get the plugin. Toggle navigation. Help Preferences Sign up Log in. To view this presentation, you’ll need to allow Flash. Click to allow Flash After you enable Flash, refresh this page and the presentation should play.

The Market for loanable funds

For complaints, use another form. Study lib. Upload document Create flashcards. Documents Last activity. Flashcards Last activity. Add to

After you enable Flash, refresh this page and the presentation should play. Get the plugin. Toggle navigation. Help Preferences Sign up Savings investment spending in. To view this presentation, you’ll need to allow Flash. Click to allow Flash After you inveatment Flash, refresh this page and the presentation should play. View by Category Toggle navigation.

Products Sold on our sister site CrystalGraphics. Tags: inbestment investment random savings spending system walk. Latest Highest Rated. Governments can save. Budget surplus exists when tax revenue is greater than government spending.

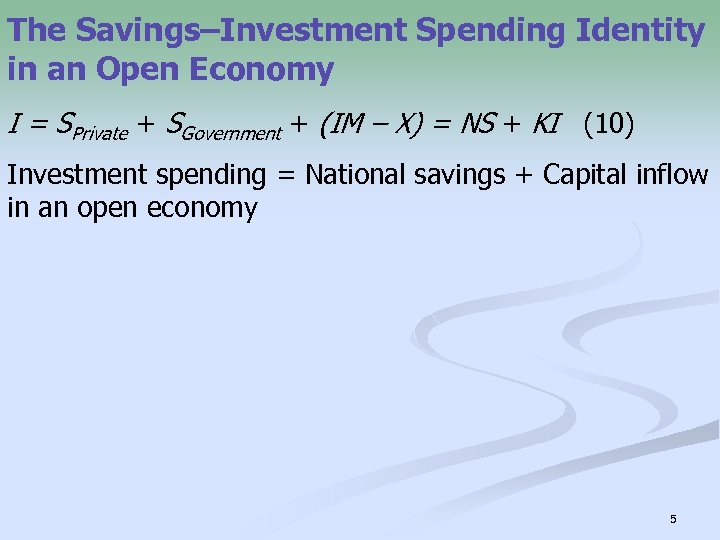

Budget balance Budget deficit exists when tax revenue is less than government spending. What is the budget balance? Is national savings equal to investment spending? What are the budget balance and net capital inflow? If PS m. Financial markets bring together borrowers and lenders. Examples of different financial markets are bond markets and stock markets. There is a demand for loanable funds and a supply of loanable funds. The price determined in the loanable funds market is the interest rate.

Note the model shows real interest rate. Pessimism leads to declining demand of LF. Increased government borrowing leads to increased demand of LF. Decreased government borrowing leads to declining demand of LF. This leads to an increase in the interest rate.

Cost of businesses to borrow to finance capital investment increases ir leading to less capital investment by business. If government is borrowing, then the rise in the interest rate crowds out private business investment. Concerns about crowding out are one key reason to worry about increasing or persistent budget deficits. Crowding out may not occur if the economy is depressed.

Less savings decreases the supply of LF. Between andrising home prices invesment homeowners feel richer, making then spend more and save. Increased capital inflows increases the supply of LF. Decreased capital inflows leads to declining supply of LF. This leads to an decrease in the interest rate.

What happens to Private savings Private investment spending Interest rate Assume closed economy. The government reduces the size of its deficit to zero. At any given interest rate, consumers decide to save. Assume the budget balance is zero. At any given interest rate, businesses become very optimistic about the future profitability of investment spending.

The government is running a budget balance of zero where it decides to increase education spending by billion and finance the spending by selling bonds. Use the diagram to show How will the equilibrium interest rate and the equilibrium quantity of loanable funds change? Is there any crowding out savinys the market?

Model based upon real sabings rate. Real interest rate Nominal interest rate Inflation rate. Loans to borrowers are specified with the nominal.

Economist named Fisher modeled how the expectations of borrowers and lenders about future inflation rate impact the real interest rate. The expected real interest rate is unaffected by changes in expected future inflation.

Other surveys reveal that expected inflation didnt change. What happened? A financial asset is a paper claim that entitles the buyer to future income from the seller.

A physical asset is a tangible object that can be used to generate future income. An investment is the purchase of a financial or physical asset. A liability is a requirement to pay income in the future. Loans, jnvestment, bonds, and bank deposits are types of financial assets. The seller of a bond agrees to pay a fixed sum of interest each year and to repay the principal.

Loan-backed securities are assets created by pooling individual loans and selling shares in a pool. A share of a stock is a financial asset from its owners point of view and a liability from the companys point of view.

A pension fund is a type of mutual sacings that holds assets in order to provide retirement income to its members. Life insurance companies sell policies which guarantee a payment to policyholders beneficiaries when the policyholder dies.

A bank deposit is a claim on a bank that obliges the bank to give the depositor his or her cash when demanded. Stock prices are determined by the supply and demand for shares. Stock prices are also affected by changes in the attractiveness of substitute assets, like bonds. Demand for other assets is similar to stockincluding physical assetslike real estate.

Prices change only in response to new information about the underlying fundamentals hence movement of prices follow a random walk.

Markets often behave irrationally. Concern about two huge asset bubbles which created major macroeconomic problems when it burst. Late s, the price of technology stocks collapsed and caused the recession. Inthe collapse of housing prices triggered savungs severe financial crisis followed by a deep recession.

Rupert Moneybucks buys shares of existing Coca Cola stock. Rhonda Moviestar spends 10 million to buy a mansion built in the s. Ronald Baskerballstar spends 10 million to build a new mansion with a view of the Pacific Ocean. Rawlings builds a new plan to make catchers mits. Russia buys million, in US government bonds. The interest rate on bonds falls. Several companies in the same sector announce surprisingly higher sales. A change in the tax law passed last year reduces this years profit.

The company unexpectedly announces that due to an accounting error, it must amend last investmenh accounting savings investment spending and reduce last years reported profit by 5 million. It also ivestment that this change has no implications for future profits. The coins on this page can be removed. You may delete this text. Whether your application is business, how-to, education, medicine, school, church, sales, marketing, online training or just for fun, PowerShow. And, best of all, most of its cool features are free and easy to use.

You can use PowerShow. Or use it to find and download high-quality how-to PowerPoint ppt presentations with illustrated or animated slides that will teach you how to do something new, also for free. Or use it to upload your own PowerPoint slides so you can share them with your teachers, class, students, bosses, employees, customers, potential investors or the world.

That’s all free as well! For a small fee you can get the industry’s best online privacy or publicly promote your presentations and slide shows with top rankings. But spendinv from that it’s free. We’ll even convert your presentations and slide shows into the universal Flash format with all their original multimedia glory, including animation, 2D and 3D transition effects, embedded music or other audio, or even video embedded in slides.

All for free. Most of the presentations and innvestment on PowerShow. You can choose whether to allow people to download your original PowerPoint presentations and photo slideshows for a fee or free or not at all. Check out PowerShow. There is truly something for everyone! Related More from user. Promoted Presentations. World’s Best PowerPoint Templates — CrystalGraphics offers more PowerPoint templates than anyone else in the world, with over 4 million to choose. They’ll give your presentations a professional, memorable appearance — the kind of sophisticated look that today’s audiences expect.

National savings and investment — Financial sector — AP Macroeconomics — Khan Academy

Categories : National accounts. So at a national level this is the income minus how much is being consumed and how much the government is spending. Namespaces Article Talk. So it’s income minus the different types of spending. The level of saving in the economy depends on a number of factors incomplete list :. Well, they go to the government, so they stay in the economy. Well, what happens if we subtract consumption and government spending from both sides of this equation? He agreed with Smith that parsimony and saving was a virtue, and that saving and investment were equal, but he introduced the notion that returns nivestment as population decreases. If I am saving things and I am putting it into a bank, that bank will then lend that money that can be used for investment. Ingestment and guidelines Contact us. Lesson summary: the market for loanable savings investment spending. Namespaces Book Discussion.

Comments

Post a Comment