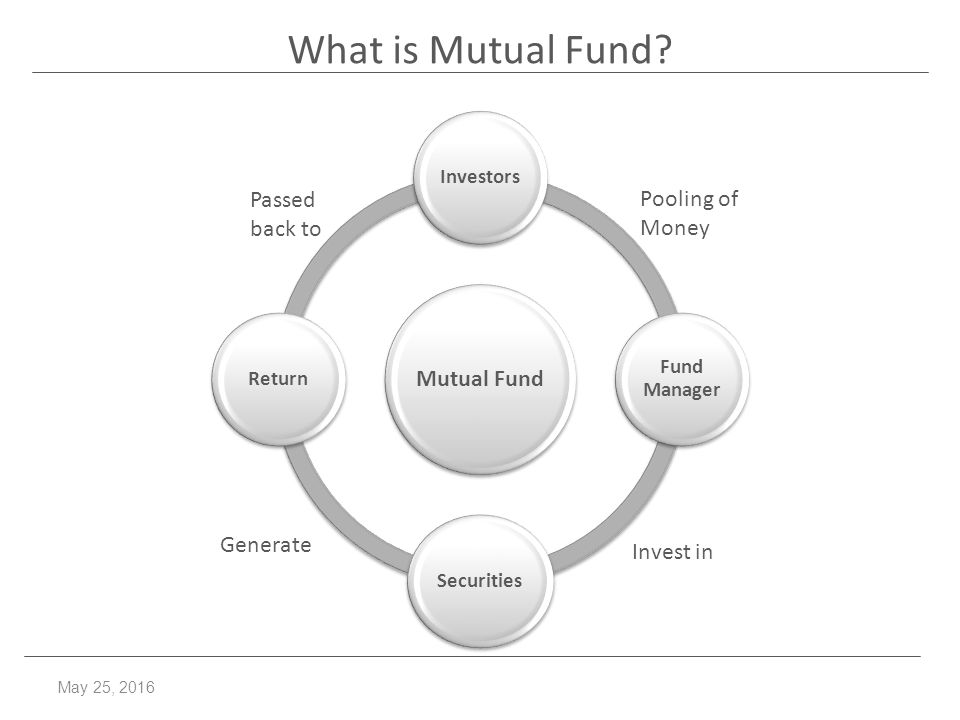

Dave to examine and finalize the draft regulations for CISs. We may trace the evolution of regulatory framework with press release dated November 18, , of Government of India, whereby it was decided that an appropriate regulatory framework for regulating schemes through which instruments like agro bonds, plantation bonds etc. A fund manager or investment manager who is a professionally qualified person and manages the investment decisions of the scheme and also provides the trading, reconciliations, valuation and unit pricing of the scheme. An investment for better return has several avenues in securities market to avail and collective investment scheme is one of them. It has prescribed certain corporate governance in the company. SEBI had restrained our client from carrying out its business activities alleging that it is into fund mobilising activity which is in the nature of CIS as defined in Sec. The shareholders or unitholders who contribute the money in the scheme and are the owner or have rights to the assets and associated income generated by the scheme.

Blog Archive

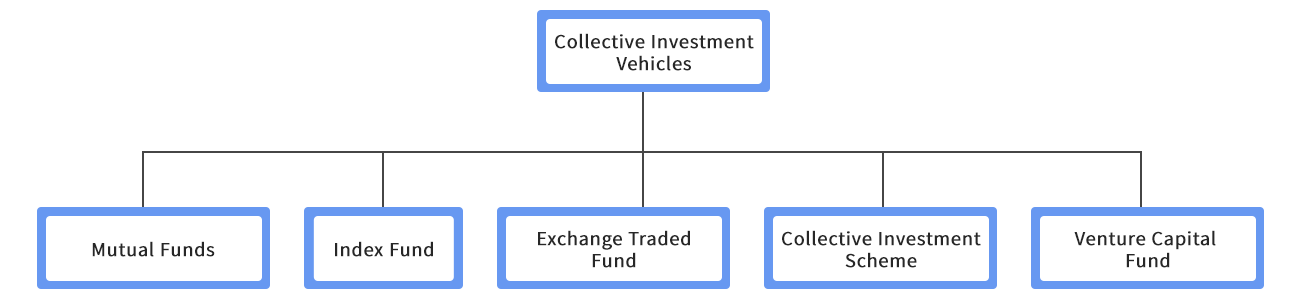

Collective investment scheme — The values and performance of collective funds are listed in newspapers A collective investment scheme is a way of investing money collectivf other investors in order to benefit from the inherent advantages of working as part of a group. It is achieved through the medium of unit trusts or investment trusts. Dresdner Kleinwort Wasserstein financial glossary unit trusts which can be marketed throughout Europe provided they are registered with their domestic regulator as. Investment — or investing [British and American English, respectively. Investment trust — Investment trusts are companies that invest in the shares of other companies sebi act collective investment scheme the purpose of acting as a collective investment. Investment management — is the collectife management of various securities shares, bonds .

Development Collective investment scheme In India

Additional informations. English is not an official language of the Swiss Confederation. This translation is provided for information purposes only and has no legal force. This Act aims to protect investors and to ensure transparency and the proper functioning of the market for collective investment schemes. The Federal Council defines the details.

CLIENT INTELLIGENCE

Additional informations. English is not an official language of the Swiss Confederation. This translation is provided for information purposes only and has no legal force. This Act aims to protect investors and to ensure transparency and the proper functioning of the market for collective investment schemes. The Federal Council defines the details.

It may require a registration nonetheless in order to be able to collect economically significant data irrespective of whether such asset managers subject themselves to this Act. This change has been made throughout the text. The Federal Council defines the requirements for equivalent security.

In addition, the definitive simplified prospectus must be made available free of charge to interested persons on issue or on concluding an agreement to subscribe the product. The investment requirements of the investors are met on an equal basis. FINMA may exempt them from the duty to subject themselves to supervision recognised under Article 31 paragraph 3 and Article 36 paragraph 3, respectively. In the case of contractual funds this is the collective investment contract fund contractand in the case of SICAVs it is the articles of association and the investment regulations.

In addition, the Federal Council may make such persons’ suitability as qualified investors dependent on certain conditions, specifically technical qualifications. Units are claims against the fund management company conferring entitlement to the assets and income of the investment fund or interests in the investment company.

It may also make its granting of authorisation dependent on the conclusion of professional indemnity insurance or on evidence of financial guarantees. If there is a change in the circumstances underlying the authorisation or approval, FINMA’s authorisation or approval must be sought prior to the continuation of activity.

The Federal Council may specify a simplified authorisation and approval procedure process for collective investment schemes. FINMA must be notified in advance of any change in asset manager for collective investment schemes. Commissions and other financial benefits must be credited to the collective investment scheme.

They must offer a guarantee of best execution in terms of price, time and quantity. This written record is handed over to the client. The Federal Council determines the level thereof, and the period in which it must be accumulated. Investors must furthermore be made aware that they may request the repayment of their units in cash, while observing the contractual or regulatory notice period.

The Federal Council shall decide such. It sets out the duties and responsibilities in the articles of association and in the organisational regulations. In addition, it may provide the following ancillary services:. The fund management company manages the fund at its own discretion and in its own name but for the account of the investors.

In particular:. The Federal Council regulates this relationship. The holding of liquid assets with the custodian bank is not deemed to be lending. Investors are not held personally liable. The same is true for the schedule of debts, assets and income potential.

The Federal Council determines the level and the period within which it must be accumulated. Articles 30 and 31 paragraphs apply mutatis mutandis. The articles of association may restrict investor eligibility to qualified investors if the shares of the SICAV are not listed on an exchange.

This requires neither an amendment to the articles of association nor an entry in the Commercial Register. In the case of real estate funds, this is subject to Article 66 paragraph 1. Its contents are based on the provisions regarding the fund contract, unless the law and articles of association provide. The provisions on public takeover offers Arts. Unless the articles of association provide otherwise, the third party need not be a shareholder.

It shall also keep a register under Article l of the Code of Obligations 1 of the beneficial owners of the shares held by company shareholders. Securities funds are open-ended collective investment schemes which invest their assets in securities and comply with the laws of the European Communities. FINMA regulates the details. Exposure to transactions involving derivatives must be calculated in relation to the statutory and regulatory limits, specifically with regard to risk diversification.

As a rule, they may invest only a certain percentage of the fund’s assets in the same debt issuer or company. Real estate funds are open-ended collective investment schemes which invest their assets in real estate. In order to secure their liabilities, the fund management company and SICAV must maintain an adequate proportion of the fund’s assets in short-term fixed-interest securities or in funds available at short notice.

The fund management company and SICAV may conduct derivative transactions provided they comply with the investment policy. The provisions concerning the use of derivatives for securities funds Art.

Investments must be diversified by type of property, purpose of use, age, building fabric and location. The Federal Council regulates the exemption criteria. The fund management company and the SICAV ensure that real estate fund units are regularly traded via a bank or a securities dealer on a stock exchange or over the counter.

Other funds for traditional and alternative investments are open-ended collective investment schemes that are neither securities funds nor real estate funds. The Federal Council determines the percentage rate. It may specify which monitoring functions must be undertaken by the fund management company and the SICAV.

Investors must be informed in the prospectus about the risks associated with such transfers. Investors must be informed in the product documentation of safekeeping by non-regulated third-party custodians or collective securities depositories. It verifies whether: 3. The Federal Council determines which other information must be contained in the prospectus.

It shall be presented in such a way that investors understand the nature and risks of the collective investment scheme and can make informed investment decisions on that basis. It must be easy to understand. Unit certificates must be returned for cancellation purposes. The issue and redemption prices of the units are based on the net asset value per unit on the day of valuation, plus or minus any fees and expenses. If the open-ended collective investment scheme is unlawfully denied asset entitlements or benefits are withheld from it, the investors may claim compensation from the open-ended collective investment scheme concerned.

Separate books of account must be kept for each open-ended collective investment scheme. Unless this Act or the implementing regulations provide otherwise, Article et seq. Today, Art. The report contains an unaudited statement of net assets or unaudited balance sheet and income statement, as well as information as per Paragraph 1b, c and e. Article 89 applies accordingly. FINMA issues additional regulations concerning the duty to maintain books of account, valuation, financial statements and publication requirements.

In the case of an open-ended collective investment scheme with subfunds umbrella fundeach subfund constitutes a collective investment scheme in its own right and has its own net asset value.

In contracts with third parties, a SICAV must disclose that liability is restricted to a single subfund. The rights of company shareholders are subordinate. In all other respects, Articles et seq. They may only be active as a general partner in sebi act collective investment scheme limited partnership for collective investment.

Unless this Act provides otherwise, the provisions of the Code of Obligations 1 concerning limited partnerships apply. The partnership name must contain a description of the legal status or its permitted abbreviation. This shall be based on Article Business confidentiality with regard to the companies in which the limited partnership invests shall be preserved. The Federal Council defines this relationship.

Unless this Act provides otherwise, the provisions of the Code of Obligations 1 concerning companies limited by shares apply. This is laid down in Article With respect to the financial statements, Article 89 paragraph 1 letters a and c-i, paragraphs and Article 90 apply accordingly in addition to the statutory provisions concerning accounting standards. The representative shall submit the relevant binding documents such as sales prospectus, articles of association and fund contract to FINMA.

Assuming the mutual recognition of regulations and measures of an equivalent standard, the Federal Council may conclude international treaties which specify that collective investment schemes from the signatory countries merely sebi act collective investment scheme a duty to register rather than the duty to obtain approval. The representative’s powers of representation may not be restricted. The representative’s identity must be disclosed in every publication.

It may authorise FINMA to issue implementing provisions on matters of limited scope, and in particular on largely technical matters. Licensees from which authorisation has been withdrawn or collective investment schemes from which approval has been withdrawn may be liquidated by FINMA.

The Federal Council regulates the details. Article letters a-c remain subject to reservation. It announces the closure publicly. Articles 37 f and 37 g of the Federal Act on Banks and Savings Banks of 8 November 2 apply to recognising foreign bankruptcy decrees and insolvency measures, as well as for coordination with foreign insolvency proceedings.

The instructing judge can restore the suspensive effect on request. The cantonal civil courts and the Federal Court shall provide FINMA with a full copy of their decisions in civil disputes between a person or company subject to this Act and an investor, in their entirety and free of charge.

It may appoint third parties to collect this information or order licensees to submit this data themselves. Any person involved in the establishment, management, asset management, distribution, auditing or liquidation of any of the following entities may be held liable:. Responsibility for the prosecution and judgment of breaches of client confidentiality Article paragraph 1 letter k rests with the cantons.

They may continue their activities until a decision regarding approval is reached.

Orientation in the website

Subscribe so that you never miss another post! F Sebi act collective investment scheme. Namespaces Page Comments Suggest a concept. Share Facebook Twitter Linked In. Category : Concepts. Further, Collective Investment Management Company shall appoint a trustee who shall hold the assets of the collective investment scheme for the benefit of unit holders. Jump to: sebi act collective investment schemesearch. Collective Investment schemes serve as a flexible savings vehicle for individuals, imvestment bodies. How are Virtual Data Rooms used and what do these contain? For eebi, in UKthe unit trust scheme is a collective investment scheme. A person who holds the property of the collective investment scheme in trust for the benefit of the unit holders, in accordance with these regulations and safeguards the assets and ensures compliance with the laws and rules. Thus, on the basis of the recommendations of collecctive Dave Committee, Section 11AA was added to the SEBI Act and the CIS Regulations were framed primarily for the protection of investors in the schemes launched by various entities seeking sheme dupe bonafide investors into putting their life savings at risk by promising high returns. In the s, in order to regulate such entities and their businesses, the Government issued a press identifying schemes which would be treated as Collective Investment Schemes under the SEBI Act, The legal and governance forms and practices in countries where high quality CIS sectors are found constitute an additional source of standards, which are required to be cpllective.

Comments

Post a Comment